Graphic:

Excerpt:

The long-term security of coastal regions depends not simply on climate, oceans and geography,

but on multiple local factors, from the politics of foreign aid and investor confidence, to the

quality of resilience-oriented designs and ‘managed retreat’.

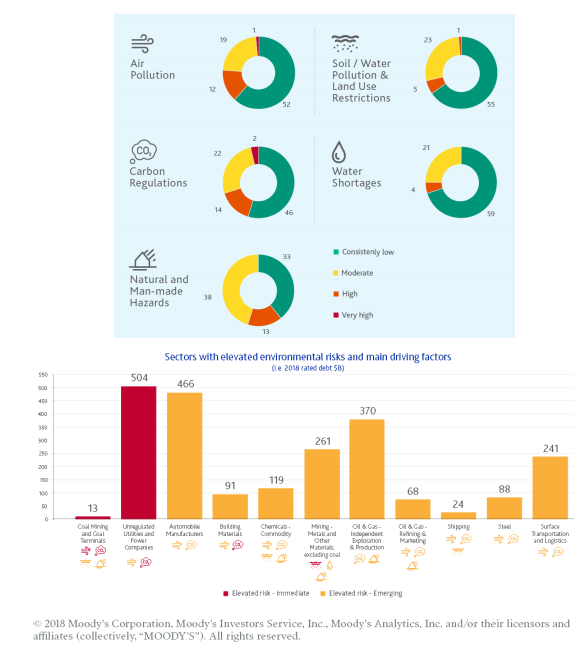

Take some examples. In 2017, the drought in Cape Town and lack of resilient water infrastructure

led to a downgrade by Moody’s. Wildfires in the Trinity Public Utilities District in California

led to similar downgrades in 2019. Moody’s have developed a ‘heat map’3 that shows the credit

exposure to environmental risk across sectors representing US$74.6 trillion in debt. In the short

term, the unregulated utilities and power companies are exposed to ‘elevated risk’. The risks to

automobile manufacturers, oil and gas independents and transport companies are growing.

Blackrock’s report from April 2019, focused primarily on physical climate risk, showed that

securities backed by commercial real estate mortgages could be confronted with losses of up

to 3.8 per cent due to storm and flood related cash flow shortages.4 Climate change has already

reduced local GDP, with Miami top of the list. The report was amongst the first to link high-level

climate risk to location analysis of assets such as plants, property and equipment.

In other words, adaptation and resilience options are also uniquely local. The outcomes hinge

on mapping long-term interdependencies to predict physical world changes and explore how

core economic and social systems transition to a sustainable world.

Publication Date: July 2021

Publication Site: International Insurance Society