Link: https://www.soa.org/resources/research-reports/2021/retirement-risk-survey/

Full report: https://www.soa.org/48fd8a/globalassets/assets/files/resources/research-report/2021/risks-retirement-findings.pdf

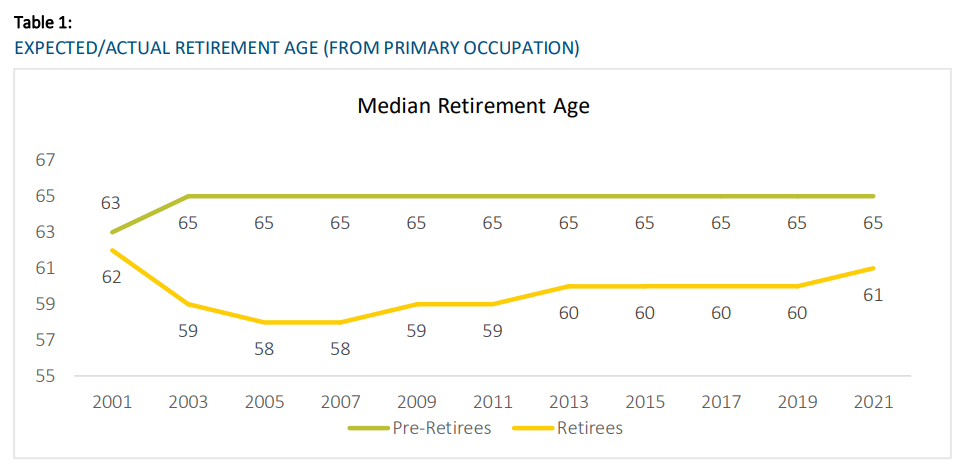

Graphic:

Excerpt:

CHAPTER HIGHLIGHTS:

• Despite the COVID-19 pandemic, level of concern about various risks remains historically low this year for both pre-retirees and retirees. Compared to 2019, level of concern dropped on some issues for retirees. As a result of this drop, retiree concerns are lower than those of pre-retirees by a larger gap than ever before.

• The one exception to this trend was concern about fraud. In 2021, both retirees and pre-retirees were

more concerned about fraud, and it is the highest concern among retirees, particularly Black/African

American retirees. As in prior studies, those with lower income tend to show much higher levels of

concern.

• The biggest concerns for pre-retirees are their savings and investments not keeping up with inflation, not being able to afford long-term care, not being able to afford health care costs, not being able to maintain a reasonable standard of living throughout retirement, and potentially depleting all their savings.

• While half of pre-retirees plan to retire gradually rather than all at once, retiree respondents indicate this

seldom actually happens. Higher-income pre-retirees are more likely to plan to go straight from full time

employment to retirement.

• The COVID-19 pandemic has not affected plans that pre-retirees have for work, living arrangements, and

lifestyle in retirement, although over a quarter report changing their lifestyle.

• Despite the financial challenges that retirement poses, most do not have financial advisors, especially preretirees, lower-income respondents, and Black/African American respondents.

Author(s): Greenwald Research

Publication Date: February 2022

Publication Site: Society of Actuaries