Link: https://finance.yahoo.com/news/blackrock-t-compete-free-advil-000000028.html

Graphic:

Excerpt:

China launched private pension plans for the first time last year and Beijing has ensured that domestic banks and fund managers win the vast majority of the new business in a market that may eventually grow to $1.7 trillion. Global companies including BlackRock and Fidelity International Ltd have been off to a slow start.

Given their tiny asset bases in China, most foreign money managers have so far been excluded from pilot trials in 36 cities, allowing banks like Industrial & Commercial Bank of China Ltd. and China Merchants Bank Co. to grab all the inflows. To cement their lead, the banks are offering everything from cash incentives to free ibuprofen for each new account.

“The first bite at the cake here won’t be easy” for foreign companies, said Zhou Yiqin, president of GuanShao Information Consulting Center, a financial regulations specialist.

While it’s still early days for the new pension scheme, the head start for domestic companies illustrates the daunting challenges for global firms eyeing a piece of China’s $60 trillion financial services sector. From mergers advice to stock sales and trading, Wall Street is struggling in a market that combines endless potential with stiff local competition and regulatory roadblocks.

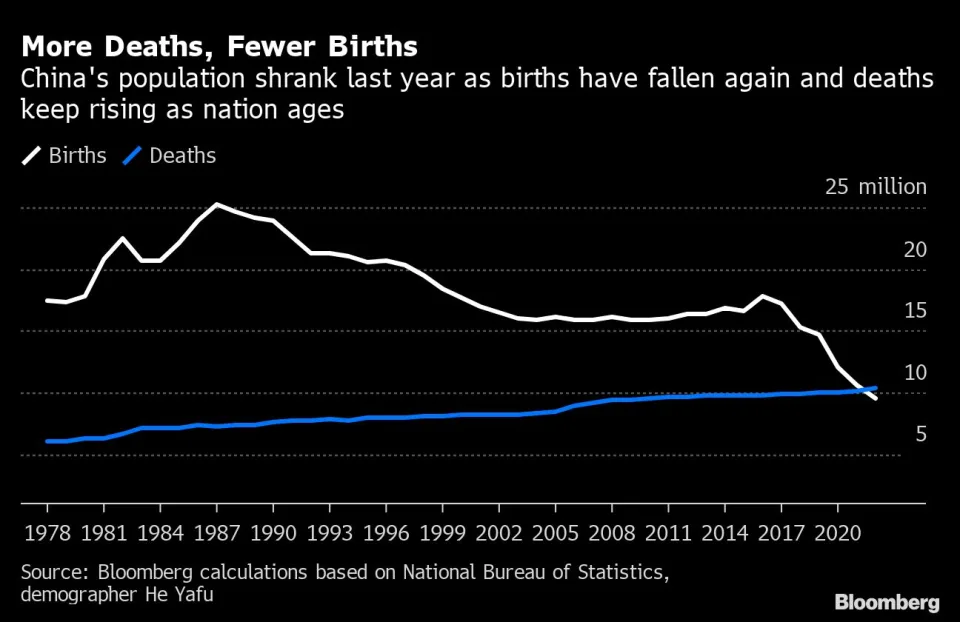

China’s fledging private pension system is loaded with promise, as Beijing desperately tries to entice retirement savings to support an aging population. The number of people over 60 is expected to jump more than 50% by 2040, according to the World Health Organization. China’s population shrank last year for the first time in six decades.

To address the problem, China has launched three pension pillars. The first two — a compulsory state-backed plan and a voluntary corporate matching option — don’t come close to meeting the future needs of most pensioners. Savings in the government-led program covering urban employees may run out by 2032 and face a shortfall of more than 7 trillion yuan by 2035, according to Citic Securities Co. estimates.

Author(s): Bloomberg News

Publication Date: 28 Mar 2023

Publication Site: Yahoo Finance