Link: https://www.scribd.com/document/645874607/First-We-Get-the-Money-FINAL-v3#

Graphic:

Excerpt:

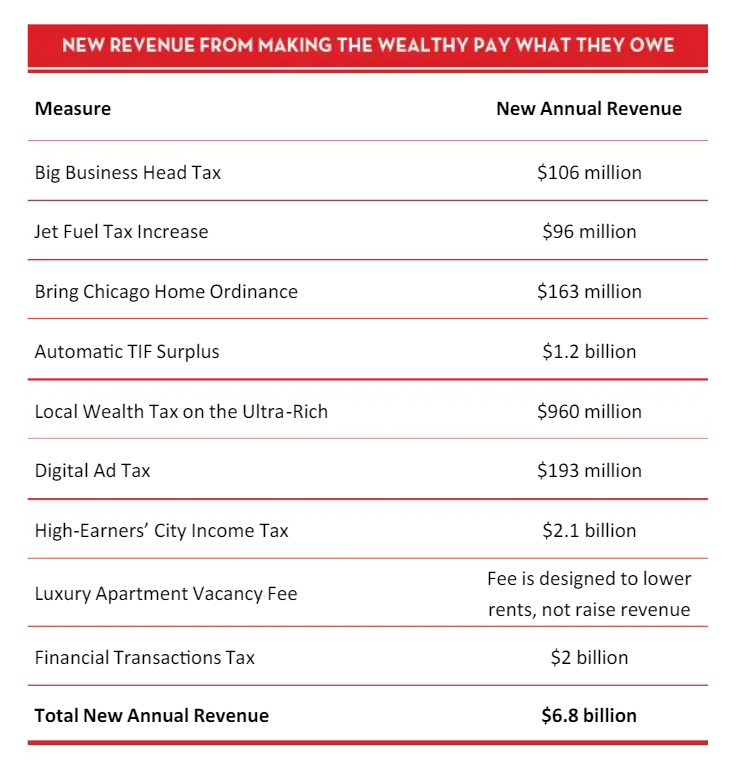

Reinstitute the big business head tax: Mayor Johnson should reinstitute the big business head tax to make large corporations pay what they owe for benefiting from the city’s public infrastructure. The head tax existed previously in Chicago, until Mayor Rahm Emanuel eliminated it as a handout to corporations.3 Reinstating the head tax at a level of $33 per employee per year would generate $106 million a year in new revenue.4

….

Institute a city income tax on high earners: Mayor Johnson should lobby Springfield to give the city the authority to institute a municipal income tax on high earners who live or work in the city. A 3.5% tax on household income above $100,000 would bring in an estimated $2.1 billion a year in new revenue, of which $1.6 billion would be from high-earning Chicagoans and $490 million from high-earning commuters.16 By way of comparison, New York and Philadelphia both have municipal income taxes with top rates above 3.7%.17 By exempting the first $100,000 of income from the tax, the city could ensure the tax is progressive without a change in the state constitution.

Institute a luxury apartment vacancy fee: Mayor Johnson should work withstate officials to implement a vacancy fee on large, luxury apartment buildings with units that sit vacant for more than 12 months at a time. Landlords who own more than 20 units and are asking for a monthly rental price that exceeds the 75th percentile in the city (based on the number of bedrooms) must pay a fee equal to the median rental price in the city on each unit that sits vacant for more than 12 consecutive months, if more than three units in the building sit vacant for more than 12 consecutive months. This would encourage luxury developers to charge more affordable rents that can maintain higher occupancy rates. This policy is designed to encourage landlords to lower rents to avoid having to pay the fee; thus, if it works as intended, we hope that it would eventually not produce any revenue for the city but that it would increase affordable housing options.

Author(s): Saqib Bhatti, Gabriela Noa Betancourt

Publication Date: May 2023

Publication Site: Scribd