Graphic:

Excerpt:

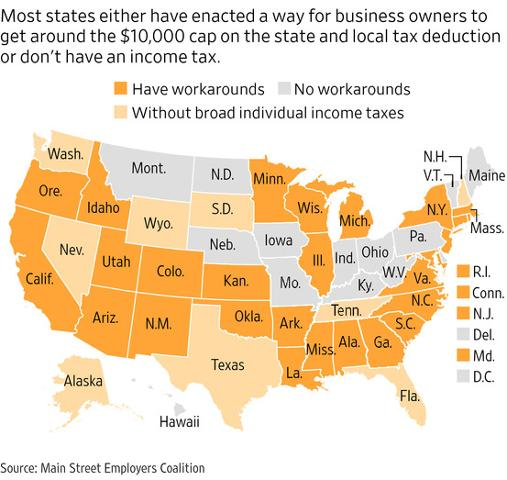

Business owners are likely saving more than $10 billion annually in federal taxes through state laws that circumvent the $10,000 cap on state and local tax deductions, according to a Wall Street Journal analysis of state data.

The state laws blunt the cap’s effect on owners of closely held businesses such as law firms, hedge funds, manufacturers and car dealerships, while workers earning wages generally can’t take advantage. The strategy, now available in 27 states, converts business owners’ personal income taxes into deductible business taxes that escape what is known as the SALT cap on state and local tax deductions.

Much of the money flows to high-income people in California, New York and New Jersey, while those in Illinois, Massachusetts, Minnesota and Connecticut are likely saving hundreds of millions of dollars as well. It isn’t just a phenomenon in high-tax Democratic states. The proliferating workarounds mark a rare case where a state-tax policy trend has been swift, national and bipartisan, and Utah, Georgia, Arizona, South Carolina and Kansas now have similar laws.

For states, approving the workarounds has been easy, because their residents benefit and state tax collections are barely altered. For business owners, the chance to lower federal tax bills is attractive, and industry groups are lobbying in the states that haven’t yet enacted workarounds.

Author(s): Richard Rubin

Publication Date: 31 May 2022

Publication Site: WSJ