Link: https://www.realclearpolicy.com/articles/2021/03/01/memo_to_dems_dont_lift_salt_cap_to_help_the_rich_help_states_directly_instead_685729.html

Excerpt:

But at a national level, it is much less clear that the SALT deduction makes for good politics. Most of the key swing states, including Georgia, Pennsylvania, North Carolina, New Hampshire, and Arizona were below the national average in the value of the SALT deduction as a percent of adjusted gross income before the new cap. Florida and Nevada were in the bottom seven states.

Of course, states and local governments do need help from the Federal government. In fact, more help is needed now more than ever. The pandemic is hurting state and local government revenues, to the tune of around $350 billion over the next three years. Now is the time to enact a better federal support system for states and localities, and to replace the SALT deduction, rather than revert to the previous system.

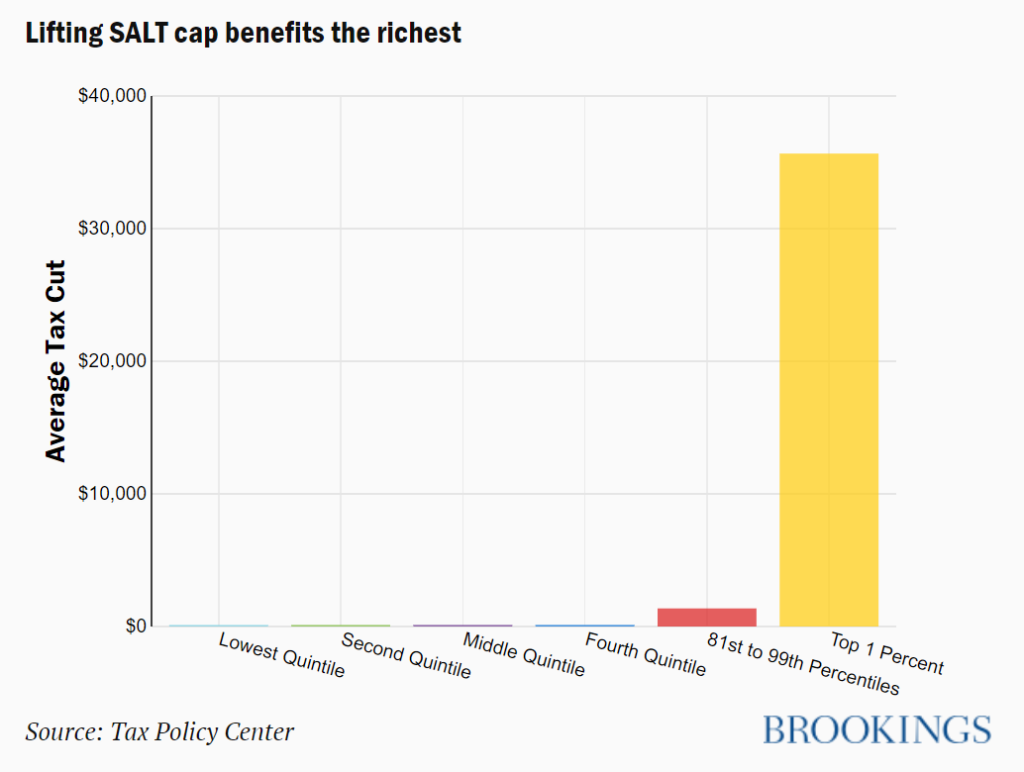

The good news is that there are a number of good policy options available to legislators, many of which were outlined at a recent Brookings event on this subject, and any of which would be much fairer and more effective than lifting the SALT deduction cap. The key point is that Congress should help states directly, rather than through the long, roundabout route of a regressive tax break to individuals.

Author(s): Richard V. Reeves, Christopher Pulliam

Publication Date: 1 March 2021

Publication Site: Real Clear Policy