Graphic:

Excerpt:

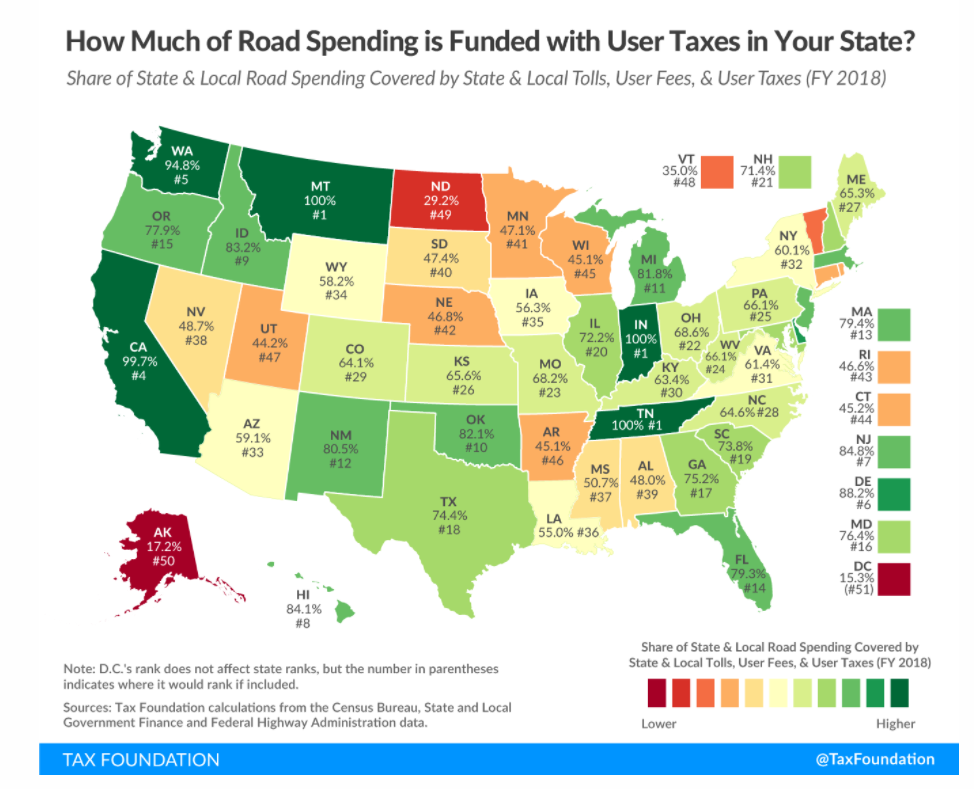

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades. Between developments in vehicles’ fuel economy, increased sales of electric vehicles, and inflation, taxes on motor fuel generally raise less revenue per vehicle miles traveled (VMT) than they did in the past. As a result, most states contribute revenue from other sources to make up differences between infrastructure revenue and expenditures.

The amount of revenue states raise through taxes on infrastructure and transportation vary to a significant degree—as do the sources. Four states (California, Indiana, Montana, and Tennessee) raise enough revenue to cover their highway spending, but 46 states and the District of Columbia must cover the difference with tax revenue from other levies. Alaska (17 percent) and North Dakota (29 percent), which both rely heavily on revenue from severance taxes, raise the lowest proportion of highway funds from transportation taxes and fees.

Author(s): Ulrik Boesen

Publication Date: 21 April 2021

Publication Site: Tax Foundation