Link: https://roaring20s.substack.com/p/november-14-1921

Graphic:

Excerpt:

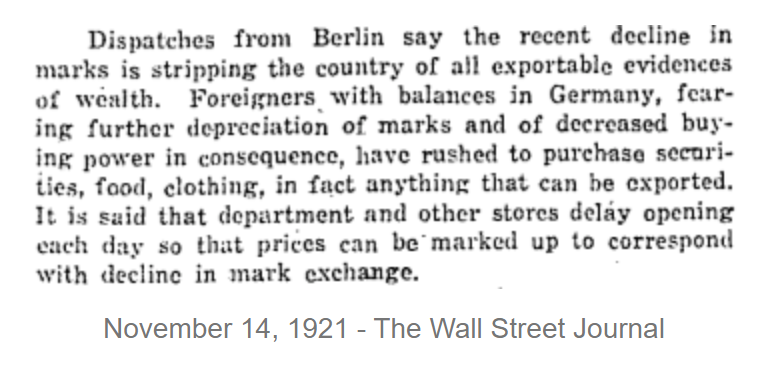

Historical Fact: Some readers may have a pressing question: What happens to debt, including mortgages, under hyperinflation? In finance, there is a popular quote, “there is no free lunch.” By 1924, Weimar Germany will redenominate and reinstate debt into the brand new Rentenmark after bailing out Deutsche Bank and Commerzbank. It’s a messy process and beyond the scope of this publication you’re reading.

Author(s): Tate

Publication Date: 14 Nov 2021

Publication Site: Roaring 20s at substack