Link: https://www.city-journal.org/update-on-americas-homicide-surge

Graphic:

Excerpt:

Last year, Christos Makridis and I used homicide data from the Centers for Disease Control to break down the 2020 homicide spike by geography and demographics. With another year’s worth of numbers now finalized—plus “provisional” numbers stretching into 2022—it’s time for a brief update. The CDC’s data, compiled from death certificates, are especially crucial in a year when the FBI completely failed to collect murder data from many of the nation’s police departments.

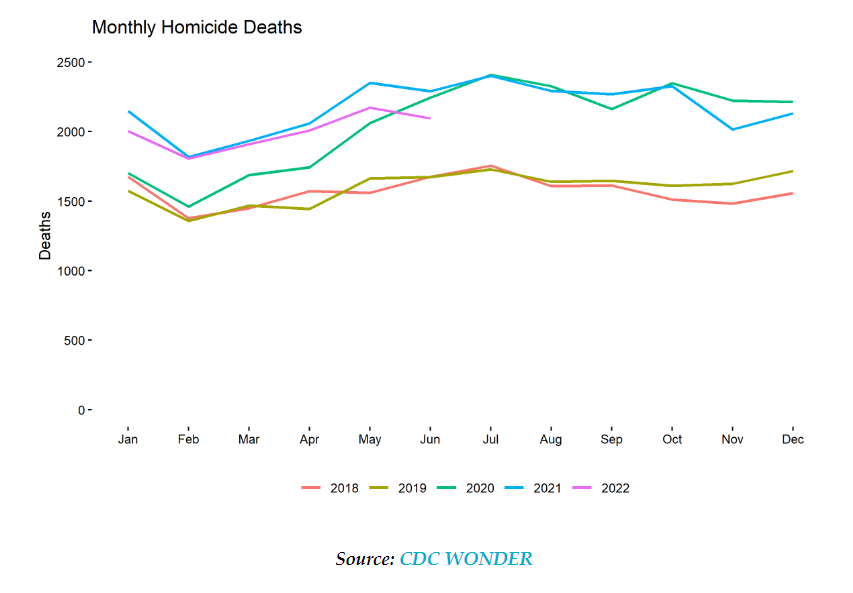

The good news is that, after spiking in 2020 and rising a little further in 2021, homicides seem to be falling again. The bad news is that this has been an extremely slow process, with recent numbers still well above pre-2020 levels, even if violence remains far from the sky-high levels of the early 1990s.

The CDC puts the national homicide rate at 7.8 per 100,000 for 2021, versus 7.5 for 2020 and 5.8 for 2019. Here are the month-by-month totals since 2018, including provisional data for the first half of 2022:

Author(s): Robert VerBruggen

Publication Date: 25 Jan 2023

Publication Site: City Journal