Excerpt:

Robinhood is a broker. It is a FINRA-regulated broker-dealer. It relies on a clearing house to clear its transactions. The clearing house it uses is the National Securities Clearing Corporation (NSCC), which is a subsidiary of the Depository Trust & Clearing Corporation (DTCC). Thus, Robinhood is a “member” of NSCC. The NSCC is a “designated financial market utility” as defined in the 2010 Dodd-Frank Act. Thus, it is “a financial market utility that the Council has designated as a systemically important.” (“The Council” is a regulatory body created by Dodd-Frank. Its ten voting members include the Treasury Secretary, the Fed chair, and the comptroller of the currency.) NSCC is a provider of “financial market infrastructure” (FMI). As such, it must publicly promulgate rules for the computation of the “Clearing Fund” every “member” must maintain with it. While the FMI is responsible for designing its own rules for determining the clearing fund, they are subject to approval or rejection by the regulatory authorities. In particular, the SEC may prohibit any changes NSCC wants to make in its formula for computing the clearing fund of each member. The Bank for International Settlements (BIS) has promulgated a set of “principles” that member states should adhere to in regulating payment and settlement systems. These include, “An FMI should maintain sufficient financial resources to cover its credit exposure to each participant fully with a high degree of confidence.”

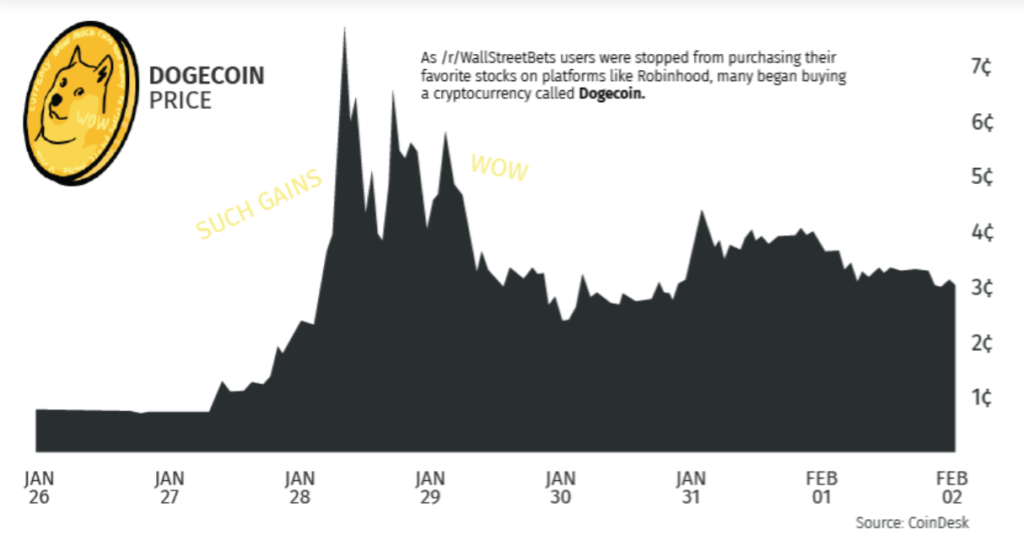

Thus, the regulatory authorities require clearing houses to require members to keep a risk-adjusted balance with them as a guard against credit risk. In the case of Robinhood, the short squeeze drove this formulaic value up sharply. Robinhood didn’t really have much of a choice about how to respond. It had to both pony up more money for the clearing fund and act to hold off (to the extent possible) further increases in it. Robinhood had to borrow a lot of money to maintain its clearing fund.

Author(s): Roger Koppl

Publication Date: 2 February 2021

Publication Site: EconLib