Excerpt:

In May, the United Kingdom’s version of the Securities and Exchange Commission will begin enforcing its pledge to crack down on so-called greenwashing by companies wishing to trade on the label of being green-friendly.

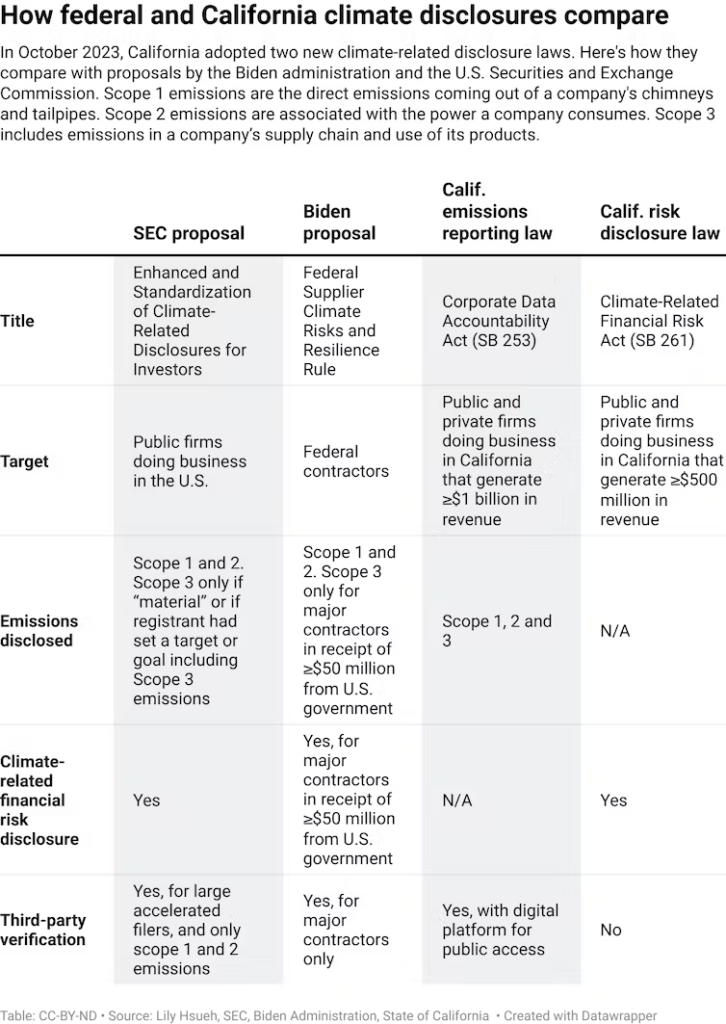

The Financial Conduct Authority’s rules, announced in late November, come as U.S. traders await stronger regulations from the SEC. That body moved in September to curb misleading marketing practices by requiring 80 percent of funds that claim to be “sustainable,” “green,” or “socially responsible” to actually be so.

The sustainability disclosure requirements are now deemed a necessity after regulators found “environmental, social, and corporate governance” analysts at Goldman Sachs and Germany’s DWS Group were promoting investments that were not as ESG-friendly as they claimed.

“The portfolio managers weren’t necessarily doing all of the work that they said they were doing,” the associate director of sustainability research for Morningstar Research Services LLC, Alyssa Stankiewicz, said. “They didn’t have documentation or data maybe related to the ESG-ness of these investments.”

At the same time as ESG-friendly firms are facing accusations of insincerity, they’re also coming under pressure from state pension funds in states with Republican-controlled governments that don’t want their employees’ retirement funds affected by what they view as politicized, left-leaning investing strategies.

Author(s): SHARON KEHNEMUI

Publication Date: 16 Jan 2024

Publication Site: NY Sun