Link: https://finance.yahoo.com/news/debt-ceiling-fears-push-cost-184617316.html

Excerpt:

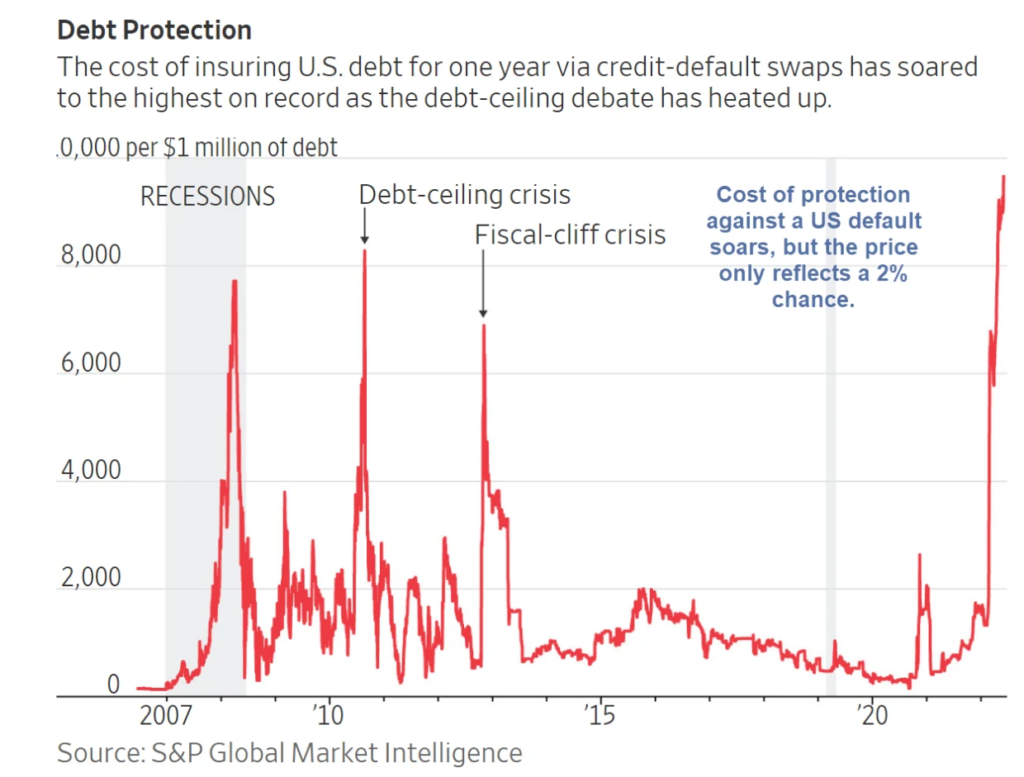

The cost of insurance against the US failing to repay its debts rose to its highest level since the financial crisis last week, as traders worried that political deadlock in Washington might lead to a default.

One-year government credit default swaps traded at 106 basis points Saturday – the most expensive they’ve been since 2008, according to a Financial Times report that cited Bloomberg data.

Credit default swaps – or CDSs – are a form of insurance against a borrower not making scheduled payments on their debt.

The price of one-year government CDSs has spiked 15 basis points in 2023 with traders spooked by the looming threat of a debt-ceiling crisis, the FT reported.

The debt ceiling is a limit on how much the government can borrow, set by Congress. The US hit its $31.4 trillion debt limit in January – and that means it could run out of money to pay its bills as soon as July if lawmakers don’t vote to raise the ceiling, according to the Congressional Budget Office.

Author(s): George Glover

Publication Date: 24 Apr 2023

Publication Site: Yahoo Finance