Link: https://www.ai-cio.com/news/providence-voters-approve-of-515-million-in-pension-obligation-bonds/

Excerpt:

The city of Providence’s pension fund, which is among the most underfunded in the country, just got one step closer to approving $515 million in pension obligation bonds. A majority of voters cast ballots in favor of the mayor’s proposal to issue $515 million in bonds in a non-binding referendum. While the results do not give Mayor Jorge Elorza the authority to issue the bonds, they do help build his case to the state, whose approval he needs to issue the bonds.

…..

Pension obligation bonds are essentially loans that the pension takes out with a fixed interest rate. The hope is that investment returns exceed the interest rate on the bonds, thus allowing the pension fund to increase its funded ratio. However, a recession or investment downturn could lead to the pension losing money on the bonds. Such was the case in Puerto Rico when it issued pension obligation bonds in 2008. While a total collapse like what occurred in Puerto Rico is unlikely to happen in Providence, according to experts,

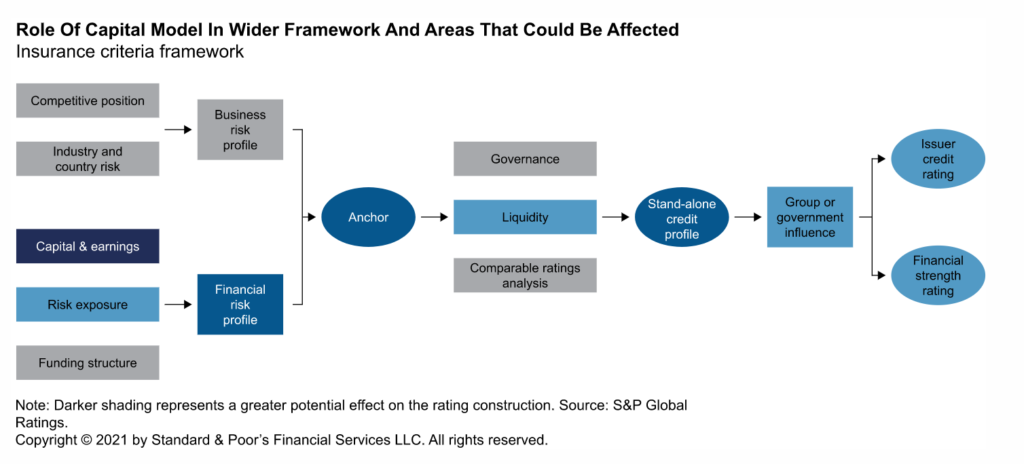

Public pensions have more than doubled their borrowing this past year, according to S&P Global. In 2020, the S&P rated $3 billion in public pension bond issuances. In contrast, the S&P rated $6.3 billion in public pension bond issuances between January 1 and September 15, 2021. However, as interest rates begin to rise again, bond issuances will likely decrease again.

Author(s): Anna Gordon

Publication Date: 9 June 2022

Publication Site: ai-CIO