Link: https://juliaactuary.org/tutorials/yield-curve-fitting/

Graphic:

Excerpt:

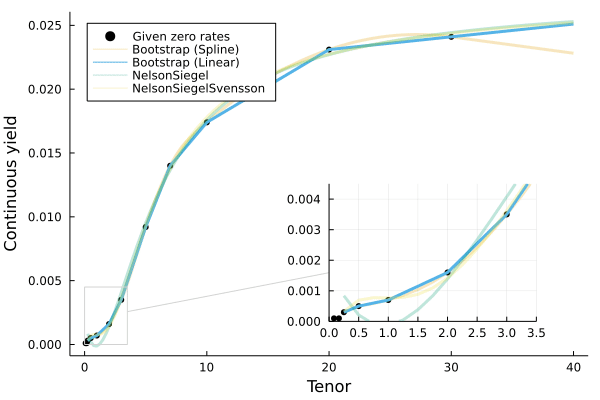

Given rates and maturities, we can fit the yield curves with different techniques in Yields.jl.

Below, we specify that the rates should be interpreted as Continuously compounded zero rates:

using Yields

rates = Continuous.([0.01, 0.01, 0.03, 0.05, 0.07, 0.16, 0.35, 0.92, 1.40, 1.74, 2.31, 2.41] ./ 100)

mats = [1/12, 2/12, 3/12, 6/12, 1, 2, 3, 5, 7, 10, 20, 30]Then fit the rates under four methods:

- Nelson-Siegel

- Nelson-Siegel-Svennson

- Boostrapping with splines (the default

Bootstrapoption) - Bootstrapping with linear splines

ns = Yields.Zero(NelsonSiegel(), rates,mats)

nss = Yields.Zero(NelsonSiegelSvensson(), rates,mats)

b = Yields.Zero(Bootstrap(), rates,mats)

bl = Yields.Zero(Bootstrap(Yields.LinearSpline()), rates,mats)That’s it! We’ve fit the rates using four different techniques. These can now be used in a variety of ways, such as calculating the present_value, duration, or convexity of different cashflows if you imported ActuaryUtilities.jl

Publication Date: 19 Jun 2022, accessed 22 Jun 2022

Publication Site: JuliaActuary