Link: https://siepr.stanford.edu/publications/working-paper/impacts-covid-19-illnesses-workers

Graphic:

Excerpt:

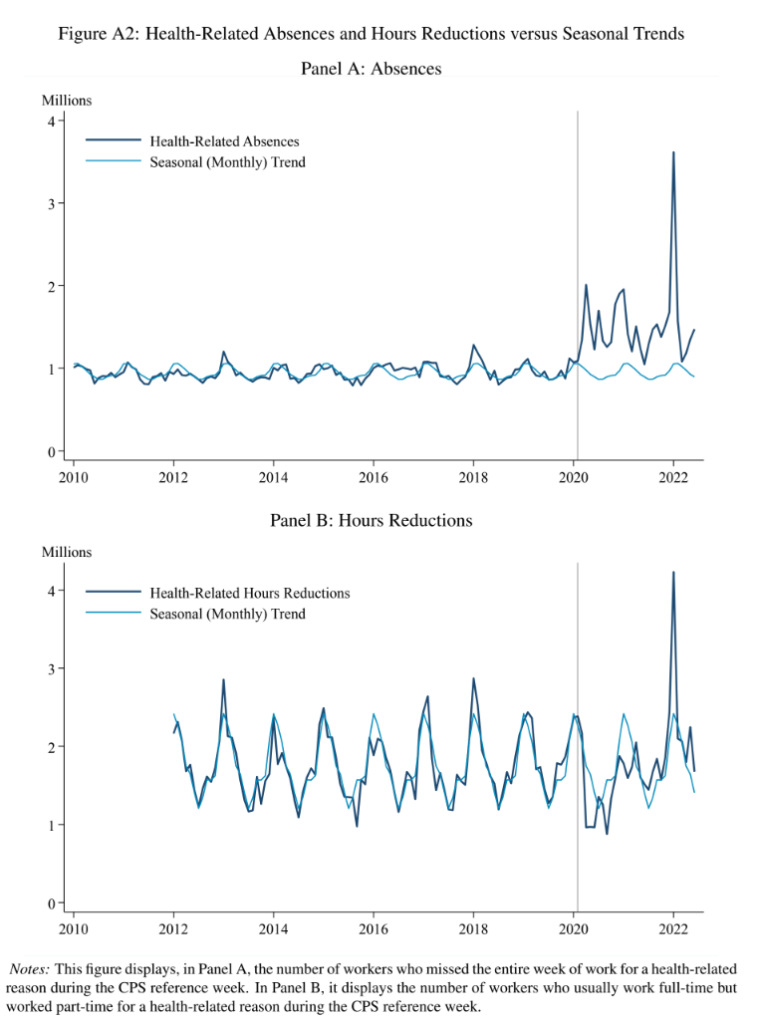

We show that Covid-19 illnesses persistently reduce labor supply. Using an event study, we estimate that workers with week-long Covid-19 work absences are 7 percentage points less likely to be in the labor force one year later compared to otherwise-similar workers who do not miss a week of work for health reasons. Our estimates suggest Covid-19 illnesses have reduced the U.S. labor force by approximately 500,000 people (0.2 percent of adults) and imply an average forgone earnings per Covid-19 absence of at least $9,000, about 90 percent of which reflects lost labor supply beyond the initial absence week.

Author(s):

Gopi Shah Goda

Evan J. Soltas

Publication Date: Sept 2022

Publication Site: Stanford University, Stanford Institute for Economic Policy Research (SIEPR)