Graphic:

Excerpt:

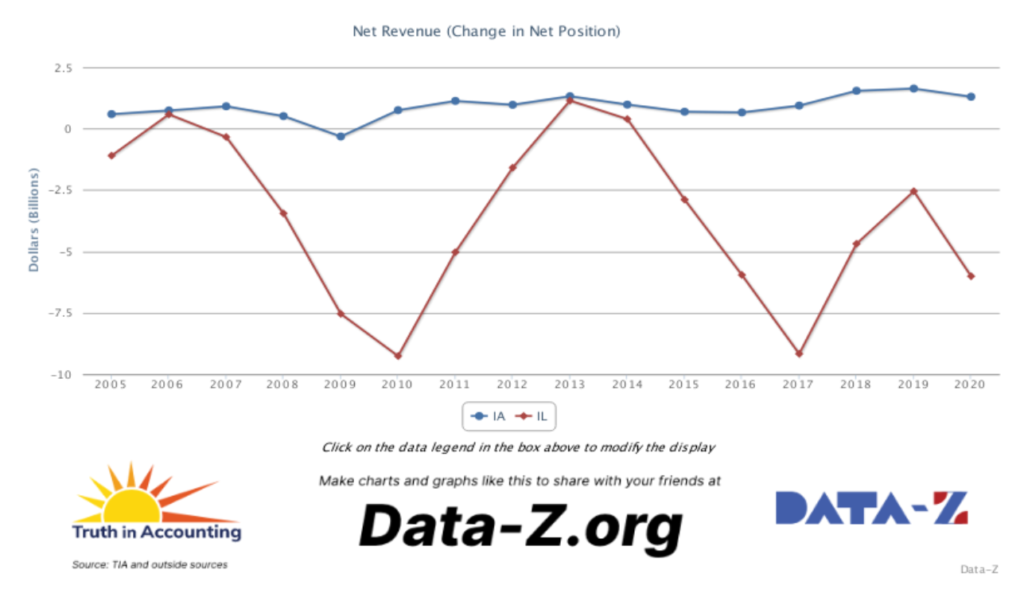

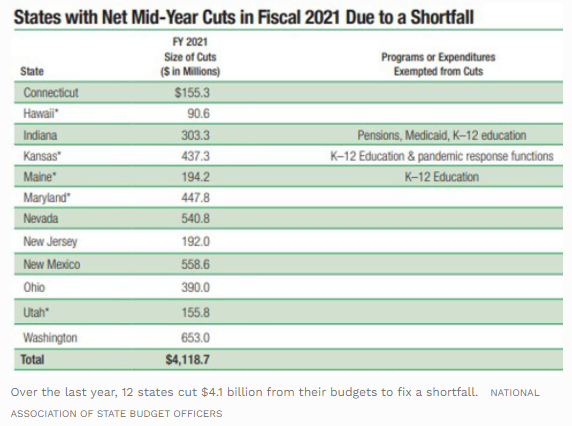

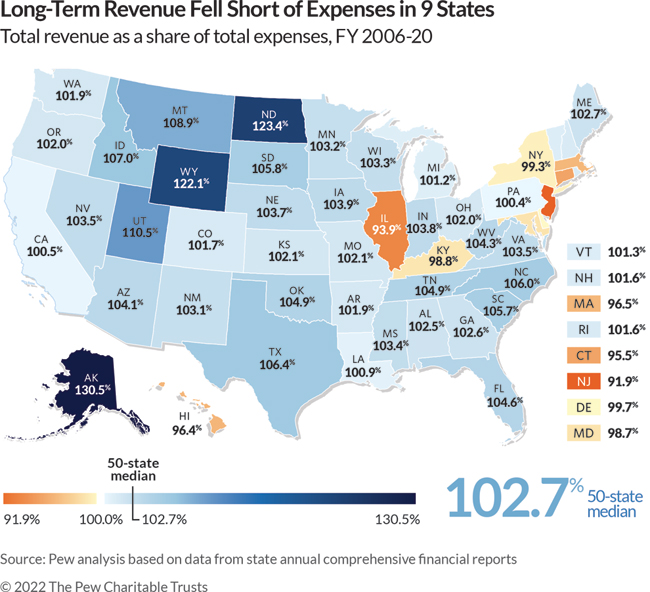

Twenty states recorded annual shortfalls in fiscal year 2020, when the coronavirus pandemic triggered a public health crisis, a two-month recession, and substantial volatility in states’ balance sheets. States can withstand periodic deficits, but long-running imbalances—such as those carried by nine states—can create an unsustainable fiscal situation by pushing off some past costs for operating government and providing services onto future taxpayers.

States are expected to balance their budgets every year. But that’s only part of the picture of how well revenue—composed predominantly of tax dollars and federal funds—matches spending across all state activities. A look beyond states’ budgets at their own financial reports provides a more comprehensive view of how public dollars are managed. In fiscal 2020, a historic plunge in tax revenue collections and a spike in spending demands were met with an initial influx of federal aid to combat the pandemic. The typical state’s total expenses and revenues grew faster than at any time since at least fiscal 2002, largely thanks to the unprecedented federal aid. But spending growth outpaced revenue growth in all but five states (Idaho, Maryland, Missouri, South Dakota, and Virginia). And 20 states recorded annual shortfalls—the most since 2010 and four times more than in fiscal 2019.

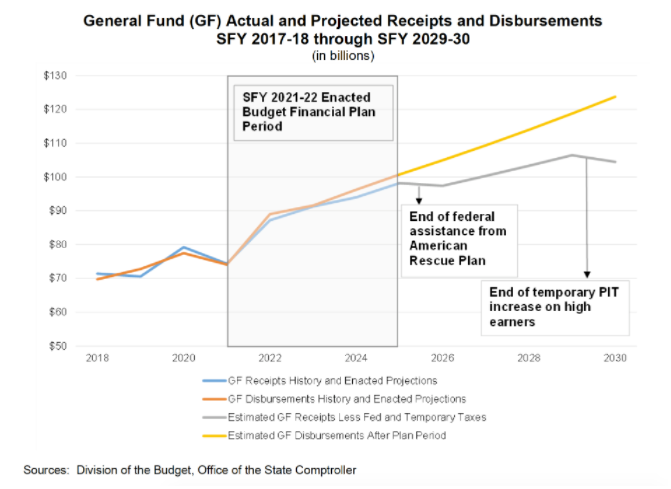

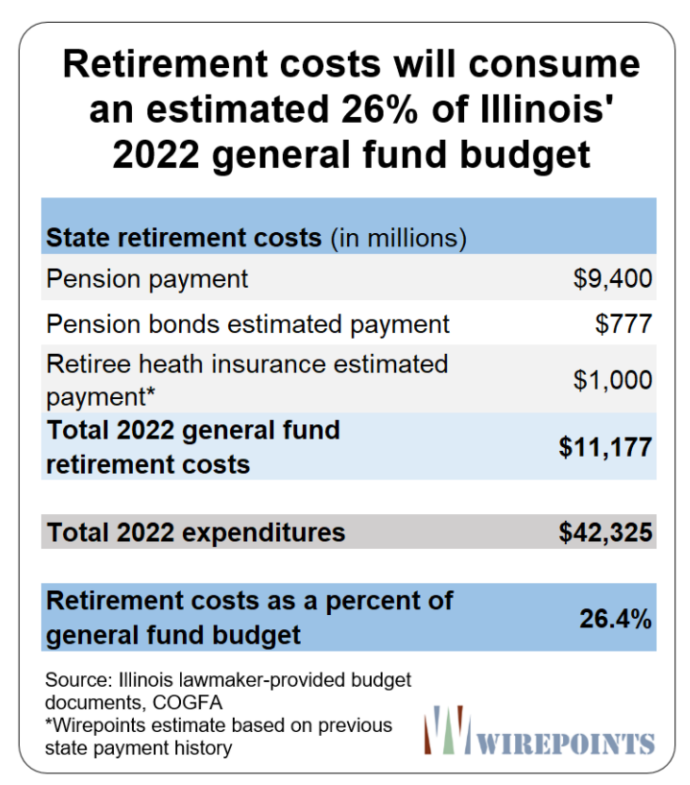

Despite the sudden increase in annual deficits, most states collected more than enough aggregate revenue to cover aggregate expenses over the long-term. But the nine states that had a 15-year deficit (New Jersey, Illinois, Connecticut, Hawaii, Massachusetts, Maryland, Kentucky, New York, and Delaware) —or a negative fiscal balance—carried forward deferred costs of past services, including debt and unfunded public employee retirement liabilities. Between 2006 and 2020, New Jersey accumulated the largest gap between its revenue and annual bills, taking in enough to cover just 91.9% of its expenses—the smallest percentage of any state. Meanwhile, Alaska collected 130.5%, yielding the largest surplus. The typical state’s revenue totaled 102.7% of its annual bills over the past 15 years.

Zooming out from a narrow focus on annual or biennial budgets—which may mask deficits as they allow for shifting the timing of when states receive cash or pay off bills to reach a balance—offers a big-picture look at whether state governments have lived within their means, or whether higher revenue or lower expenses may be necessary to bring a state into fiscal balance.

Author(s): Joanna Biernacka-Lievestro, Alexandre Fall

Publication Date: 16 Dec 2022

Publication Site: Pew