Link:https://www.wsj.com/amp/articles/iowas-bold-tax-reform-kim-reynolds-11642614230

Excerpt:

Gov. Reynolds is proposing a bold tax reform that would increase the incentives to work and invest in the Hawkeye State. Her proposal unveiled last week would reshape the state income tax, gradually consolidating brackets en route to a flat 4% rate by 2026. “When the bill’s fully implemented,” she said, “an average Iowa family will pay more than $1,300 less in taxes.”

The flat 4% levy would drop the state’s top rate by more than a third. Under current law Iowans are set to pay 6.5% on earnings above about $80,000, a threshold that catches much of the middle class. That and three other income-tax brackets would be swept away by Gov. Reynolds’s reform.

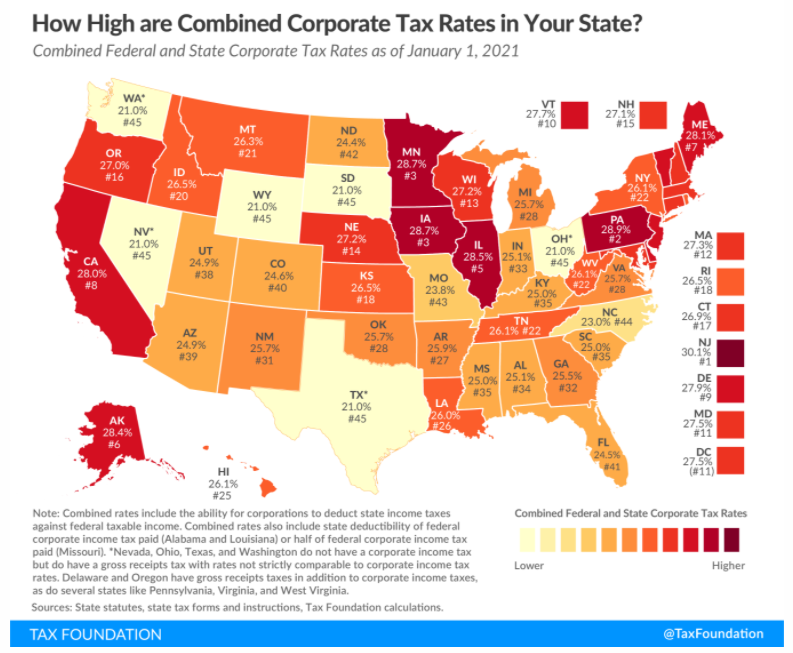

The plan would also slash the state’s corporate tax, which is even more punishing. Iowa-based companies pay 9.8% of their earnings above $250,000 in state tax. Ms. Reynolds’s reform would gradually reduce the top rate to 5.5%, capping corporate-tax revenue at $700 million a year and using excess revenue to offset annual rate cuts. An immediate rate cut would be better economically, providing more clarity for corporate investment decisions. But the revenue target should be met if the economy continues to grow.

Author(s): WSJ Editorial Board

Publication Date: 19 Jan 2022

Publication Site: WSJ