Excerpt:

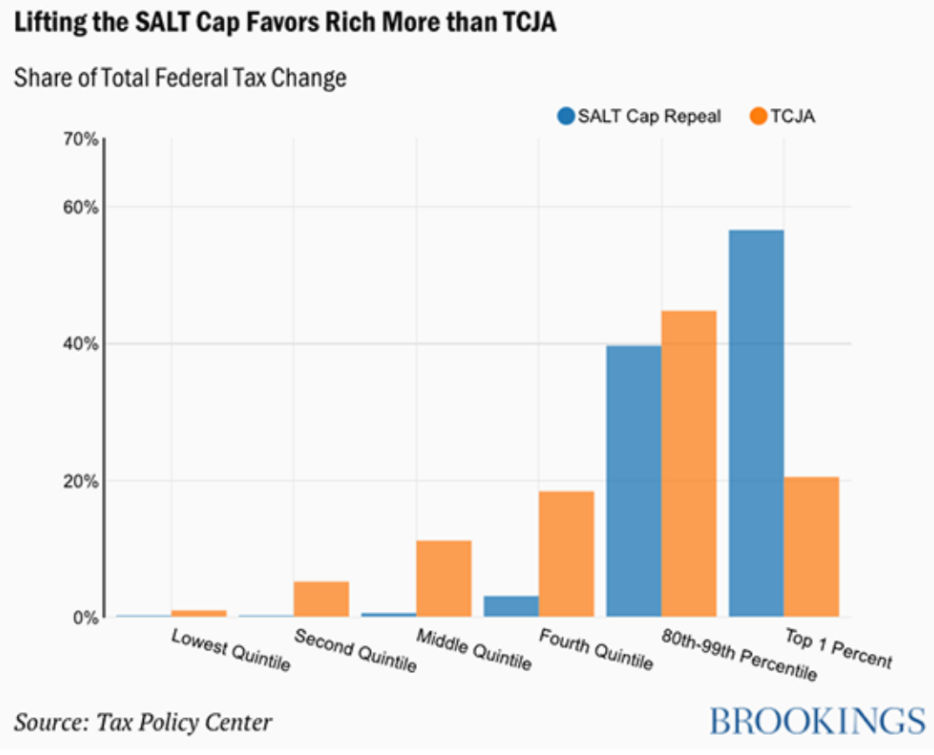

House Democrats continue to search for a way to satisfy lawmakers who want to scrap the deduction limit on state and local taxes without losing progressives wary of a tax cut that would overwhelmingly benefit the wealthy.

The budget blueprint Democrats passed this summer instructs lawmakers to include some form of SALT cap relief in a tax-and-spend plan of up to $3.5 trillion.

A full repeal would be costly and politically difficult to pass with razor-thin margins in both chambers. But a coalition of lawmakers from New York, New Jersey, and other states with high tax rates continue to insist that is what it will take for them to back the legislation.

…..

Suozzi is one of the leaders of the “SALT Caucus”, an alliance of more than 30 lawmakers who want to roll back the $10,000 deduction limit established in the Republican-led 2017 tax law. While they argue that the cap unfairly targets Democrat-dominated states and encourages people to move to Florida and other low-tax states, progressives counter that expanding the deduction shouldn’t be a priority in a social spending bill because the lion’s share of the benefit would go to the wealthy.

…..

That [2019] bill passed the House, but 16 Democrats voted against it, including New York Representative Alexandria Ocasio-Cortez, who has described a full repeal as a “gift to billionaires.” Democratic leadership is dealing with a much narrower majority this Congress and can’t afford to lose that many votes with no Republicans expected to support the reconciliation package.

Author(s): Kaustuv Basu

Publication Date: 9 September 2021

Publication Site: Bloomberg