Link: https://marypatcampbell.substack.com/p/mortality-with-meep-cause-of-death-76e

Video:

Graphic:

Excerpt:

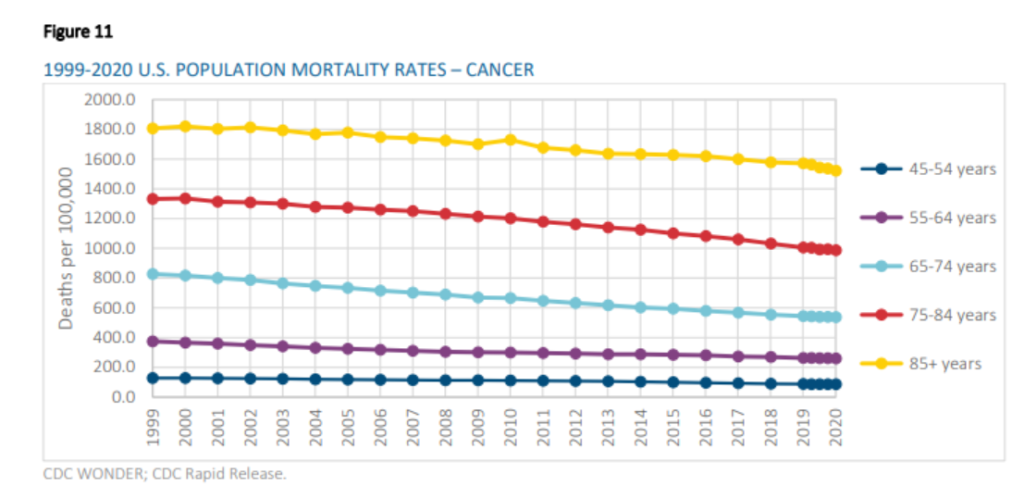

As with heart disease, we see improvement at all ages, but the percentage improvement is not as high with cancer as it was with heart disease.

One of the biggest things, though, is how death rates go up by age group. I will use 2020Q1 cause of death rates to make comparisons, as these are in the SOA report, and the COVID impact didn’t come fully until 2020Q2.

Heart disease death rate for those aged 85+ was 3766 per 100K, and those aged 75-84 was 986. That’s a ratio of 3.8.

Cancer deaths for those aged 85+ was 1562 per 100K, and those aged 75-84 was 1004. That’s a ratio of 1.6.

Two things to note:

Cancer death rate for those age 75-84 was higher than the heart disease death rate for the same group

Heart disease death rates climb much more rapidly than cancer death rates by age

Author(s): Mary Pat Campbell

Publication Date: 4 August 2021

Publication Site: STUMP at substack