Link to full report: https://www.nirsonline.org/wp-content/uploads/2021/08/Stark-Inequality-F2.pdf

Graphic:

Excerpt:

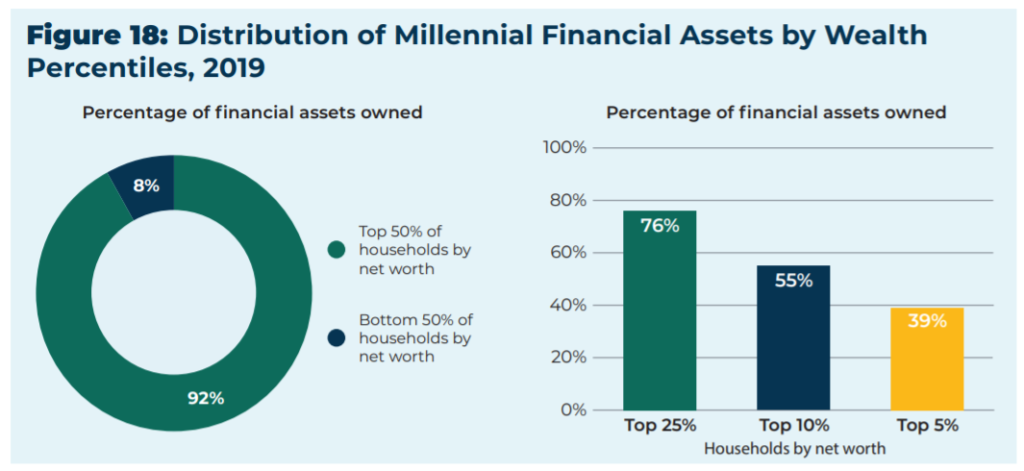

Inequality in the ownership of financial assets both persists and deepens over time. The top five percent of Baby Boomers by net worth owned a greater percentage of that generation’s financial assets in 2019 (58 percent) than in 2004 (52 percent).

Inequality in the ownership of financial assets is consistent across generations. In 2019, the top 25 percent by net worth of Millennials, Generation X, and Baby Boomers owned three-quarters or more of their generation’s financial assets.

Financial asset ownership is highly concentrated among white households. In 2019, white households in all three generations owned three-quarters or more of their generation’s financial assets. Ownership is especially concentrated among white households in the top 25 percent of net worth.

Both mean and median financial assets were significantly higher for white households in 2019 than Black or Hispanic households.

A range of potential solutions exists to address this stark inequality including strengthening and expanding Social Security, protecting pensions, increasing access to savings-based plans for low-income workers, and reforming retirement tax incentives.

Author(s): Tyler Bond

Publication Date: September 2021

Publication Site: National Institute on Retirement Security