Graphic:

Excerpt:

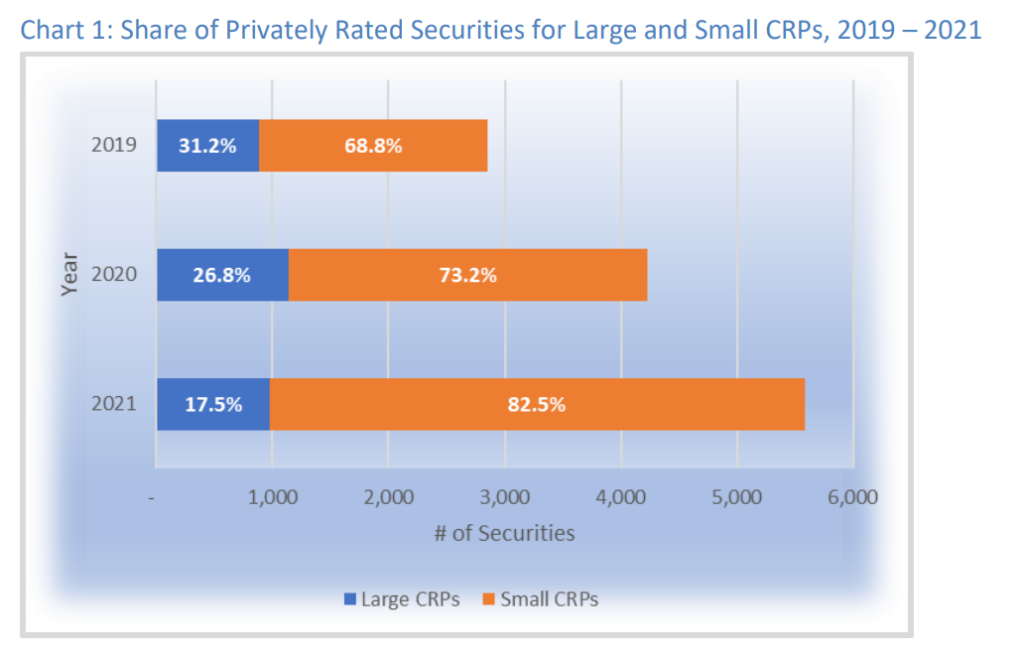

The number of privately rated securities reported by U.S. insurance companies totaled 5,580 at

year-end 2021, an increase from 4,231 in 2020 and 2,850 in 2019.

• Small credit rating providers (CRPs) to the NAIC, such as Egan-Jones, DBRS Morningstar, and the

Kroll Bond Rating Agency LLC (KBRA), produced a dominant share of the private letter ratings

(PLRs), accounting for almost 83% of U.S. insurers’ privately rated securities as of Dec. 31, 2021.

• Designations based on PLRs averaged 2.375 notches higher than designations assigned by the

NAIC Securities Valuation Office (SVO) according to data from 2019 through Q3 2021.

• Based on the credit rating analysis conducted by the SVO, the use of PLRs can result in lower

risk-based capital (RBC) charges and potentially lead to the undercapitalization of insurance

companies.

• Regulatory oversight of nationally recognized statistical rating organizations (NRSROs) does not

result in uniform ratings across the NAIC’s CRPs.

• Ten U.S. insurer groups accounted for 55% of the industry’s exposure to privately rated

securities at year-end 2020.

• No significant issuer concentrations of privately rated securities were noted.

Author(s): Jennifer Johnson, Michele Wong, and Linda Phelps

Publication Date:21 Jan 2022

Publication Site: NAIC Capital Markets Special Bureau