Graphic:

Excerpt:

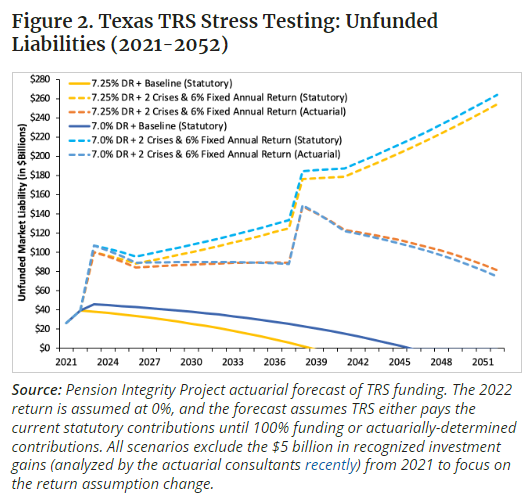

An adjustment of the assumed rate of return down to 7.0% means the plan will recalculate pension debt upwards in 2023, but will also be better positioned to avoid future debt growth over the longer run. The forecast in Figure 2 compares the growth of TRS’ unfunded liabilities under three scenarios:

- Returns meet TRS assumptions;

- TRS experiences two major recessions over the next 30 years;

- And, TRS makes actuarially determined contributions (also using the two-recession scenario).

With this actuarial modeling of the system, it is clear that statutorily limited contributions will continue to pose funding risks for TRS that will be borne by Texas taxpayers. A proposed 7.0% assumed return will readjust 2023 unfunded liabilities upwards by $6.5 billion, but the plan will suffer fewer investment losses over the next 30 years when the plan inevitably experiences returns that diverge from expectations. TRS’ unfunded liabilities will remain elevated under the rigid statutorily-set contributions. If, however, TRS was to transition to Actuarially Determined Employer Contributions (ADEC) each year, then even by recognizing higher 2023 debt (under a 7.0% assumption) TRS could shave billions off its unfunded liabilities by 2052 ($74.7 billion down from $81.3 billion with current 7.25% assumption).

Author(s): Anil Niraula, Zachary Christensen

Publication Date: 15 Jun 2022

Publication Site: Reason