Link: https://www.ai-cio.com/news/how-pension-plans-evolved-out-of-the-great-financial-crisis/

Excerpt:

A recent webinar held by the National Institute on Retirement Security, in conjunction with consulting firm Segal and Lazard Asset Management, reviewed the report “Examining the Experience of Public Pension Plans Since the Great Recession,” which examines how public retirement plans weathered the period’s market and made subsequent changes to public pension funds to ensure their long-term sustainability.

Most plans recovered their losses between 2011 and 2014, three to six years after the market bottom. Despite the recession and subsequent loss of value, plans continued to pay out over a trillion dollars in benefits to subscribers during the period.

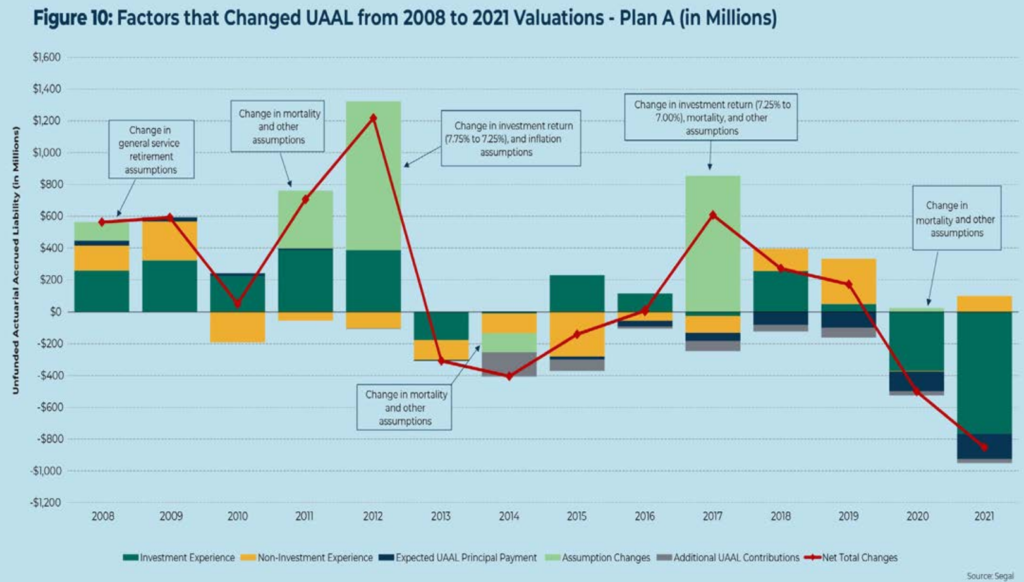

Todd Tauzer, vice president at Segal, says that since 2008, the models and risk assessment strategies of public plans have evolved greatly. Tauzer says, “funding status alone does not indicate health of a public pension, after all, one cannot see the underlying assumptions used. A plan’s funding status can be measured in many different ways, and the ways we measure can change over time.”

“Plans today are on a much stronger measurement of liability than they were 15 years ago,” according to Tauzer. Adjustments to the assumption of the models in mortality, the assumed rate of return, general population counts, and the assumed rate of inflation are a few of the assumptions modified which give greater clarity into pension health post-GFC.

Author(s): Dusty Hagedorn

Publication Date: 17 Oct 2022

Publication Site: ai-CIO