Link: https://www.ncpers.org/files/ncpers-pension-metrics-2022.pdf

Webinar slides: https://www.nirsonline.org/wp-content/uploads/2022/03/FINAL-Pension-Health-Webinar-September-2022.pdf

Webinar video:

Graphic:

Excerpt:

This report describes a “scorecard”, a standardized summary of pension valuation results (shown on next page), as well as three new metrics, of varying degrees of novelty, to appear on it:

The Scaled Liability is a measurement of pension liabilities against the size of the economy that supports these liabilities.

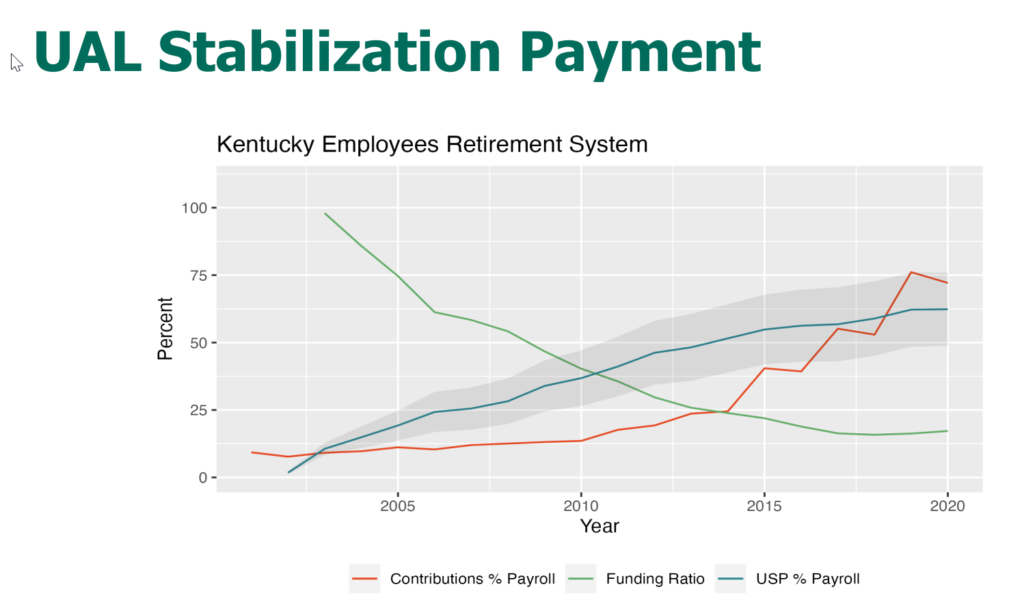

The UAL Stabilization Payment (USP) is an objectively defined cash flow policy standard comparable to

the funding ratio, an objectively defined balance sheet policy standard.

Risk-Weighting Assets is a proposed method to assess the value of a plan’s assets, taking into account

its capacity to endure the downside risk it has taken on through its allocation of investments.

Author(s): Tom Sgouros

Publication Date: September 2022

Publication Site: NCPERS