Excerpt:

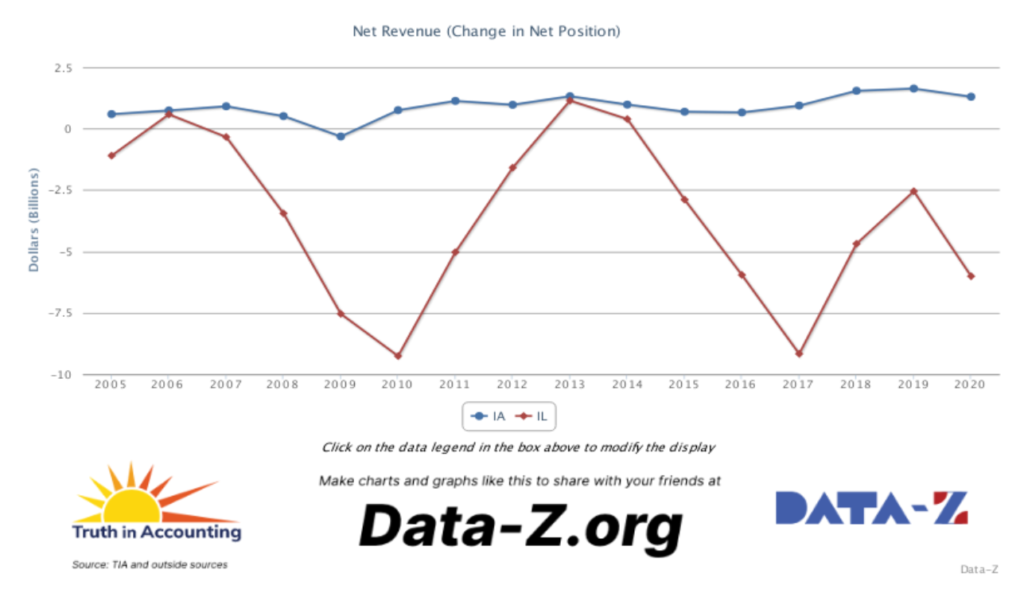

An example of questionable disclosure practices is found in the Illinois budgeting and financial reporting process, specifically regarding pension contributions. In 1994, then-Gov. Jim Edgar led an effort to pass a bipartisan bill to solve the state’s $15 billion pension deficit. The plan would resolve the deficit within 50 years. The plan was structured to pay down the debt very slowly in the first 15 years and accelerate at the end. This ensured that sitting politicians in the early days of the plan would not be required to make the necessary tax increases or budget cuts to pay down the debt in a meaningful way.

This program is shown in charts to look like a skateboard ramp, appropriately named the “Edgar Ramp.” The problem is, the plan doesn’t work.

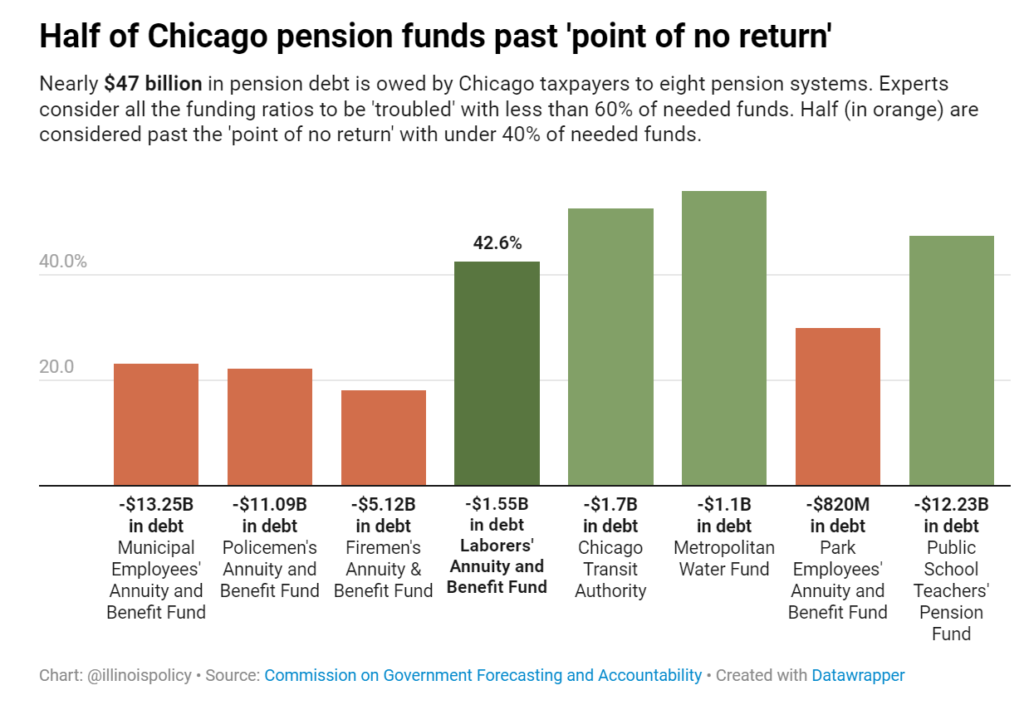

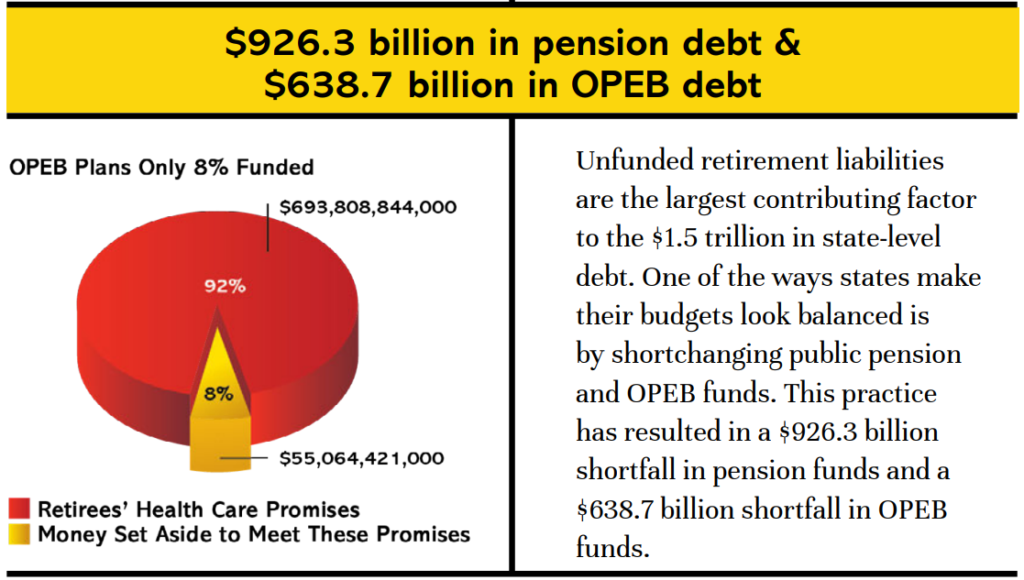

It is so unsuccessful that the Illinois pension deficit has grown from $15 billion to $317 billion as of June 30, 2020, according to Moody’s Investors Service. The state’s latest bond offering document emphasizes, “The state’s contributions to the retirement systems, while in conformity with state law, have been less than the contributions necessary to fully fund the retirement systems as calculated by the actuaries of the retirement systems.”

The latest Illinois Annual Comprehensive Financial Report discloses cash-flow problems, significantly underfunded pension obligations, other post-retirement benefit deficits and multiple references to debt-obligation bonds.

Author(s): Shiela Weinberg

Publication Date: 7 Aug 2022

Publication Site: News Gazette