Excerpt:

Twitter’s ban on “COVID-19 misinformation,” which Elon Musk rescinded after taking over the platform in late October, mirrored the Biden administration’s broad definition of that category in two important respects: It disfavored perspectives that dissented from official advice, and it encompassed not just demonstrably false statements but also speech that was deemed “misleading” even when it was arguably or verifiably true. In a recent Free Press article, science writer David Zweig shows what that meant in practice, citing several striking examples of government-encouraged speech suppression gleaned from the internal communications that Musk has been disclosing to handpicked journalists.

Twitter’s moderation of pandemic-related content was intertwined with government policy from the beginning. Even before Joe Biden was elected president and his administration began publicly and privately demanding that social media companies suppress speech it viewed as a threat to public health, the company’s guidelines deferred to the positions taken by government agencies such as the Centers for Disease Control and Prevention (CDC). And those rules explicitly covered “misleading information” as well as “demonstrably false” statements.

….

That July, Twitter sought to clarify “our rules against potentially misleading information about COVID-19″ (emphasis added). “For a Tweet to qualify as a misleading claim,” the company said, “it must be an assertion of fact (not an opinion), expressed definitively, and intended to influence others’ behavior.” Possible topics included “the origin, nature, and characteristics of the virus”; “preventative measures, treatments/cures, and other precautions”; “the prevalence of viral spread, or the current state of the crisis”; and “official health advisories, restrictions, regulations, and public-service announcements.”

That was a very wide net, potentially encompassing anyone who questioned the CDC’s ever-shifting guidance or criticized government policies, such as lockdowns and mask mandates, aimed at reducing virus transmission. While the intent requirement ostensibly allowed dissent as long as it was not aimed at influencing behavior, that limitation did not mean much in practice, since moderators were apt to infer the requisite intent when they encountered tweets that implicitly or explicitly deviated from the recommendations of “public health authorities and governments.”

….

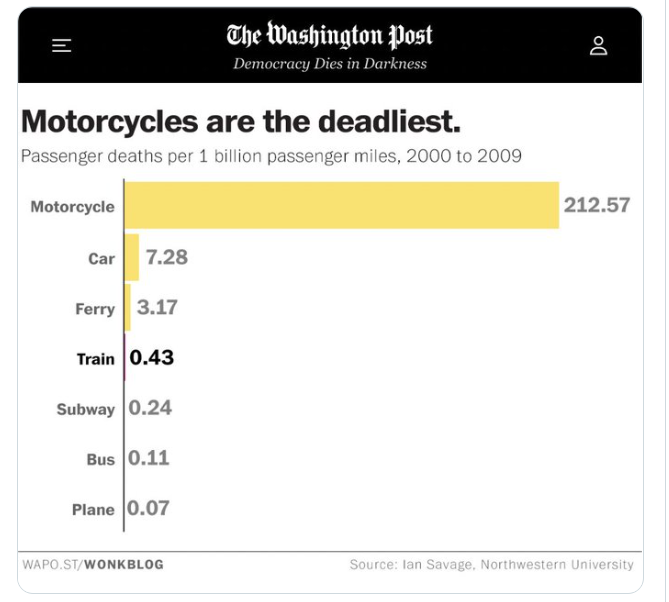

Another example that Zweig cites: Last August, @KelleyKga, a self-described “public health fact checker,” responded to another Twitter user’s claim that “COVID has been the leading cause of death from disease in children” since December 2021. “What an excellent example of cherry picking!” @KelleyKga wrote. “If you narrow it down to only the specific months you specify, which include the largest Covid wave (seen across the world), AND you ignore all non-disease deaths, AND you ignore cancer, heart disease, SIDS, then COVID is ‘leading.'”

Author(s): Jacob Sullum

Publication Date: 2 Jan 2023

Publication Site: Reason