Link: https://www.nationalreview.com/2024/02/government-unions-target-fiscal-sanity-in-connecticut/

Excerpt:

Connecticut taxpayers, saddled with a pension system for state workers and teachers marked by decades of underfunding, glimpsed a ray of hope in 2017 when legislators embarked on a path toward accountability and fiscal discipline by enacting “fiscal guardrails.”

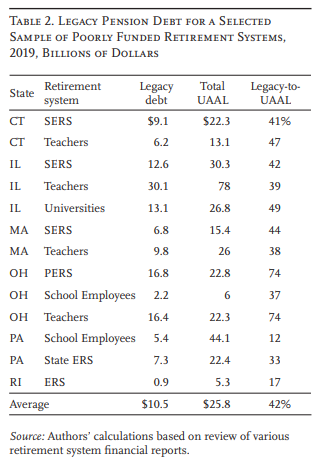

Now, state unions under the umbrella of the State Employees Bargaining Agent Coalition are clamoring for the removal of the fiscal guardrails that were constructed to prevent the same unions from driving taxpayers over the cliff. The staggering state debt of more than $80 billion, including unfunded pension debt from the state workers’ and teachers’ pension funds, bonded debt, and health-care liabilities, was the result of years of irresponsibility and political horse-trading with state unions that were all too eager to negotiate benefits without a sustainable funding plan.

…..

Connecticut has long been a high-income per capita state and also imposes one of the country’s most burdensome tax systems. Yet it still managed to accumulate the highest state debt per resident. The 2017 bipartisan fiscal guardrails constituted a recognition that the previous decade’s cycle of budget shortfalls, followed by significant tax increases, was simply unsustainable.

The guardrails were codified in 2023, and the general assembly unanimously voted to extend them for another five years. Their very effectiveness in slowing spending growth has made them susceptible to attack from state unions.

Author(s): Frank Ricci and Bryce Chinault

Publication Date: 13 Feb 2024

Publication Site: National Review Online