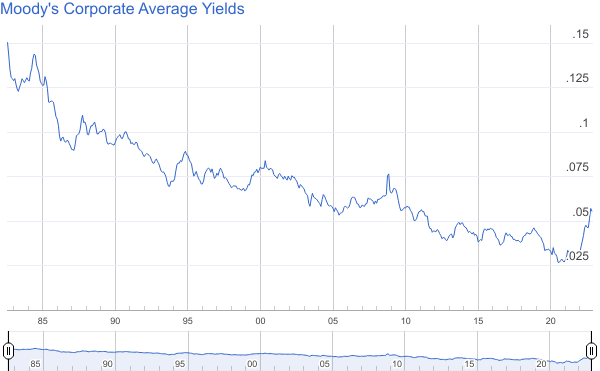

Link: https://content.naic.org/research_moody.htm

Historical record: https://docs.google.com/spreadsheets/d/1Sgi6XVzK0_sCtAWuCnUD02eObOTC3S4xlQgMep32OeU/edit?usp=sharing

Graphic:

Publication Date: accessed 9 Dec 2022

Publication Site: NAIC

All about risk

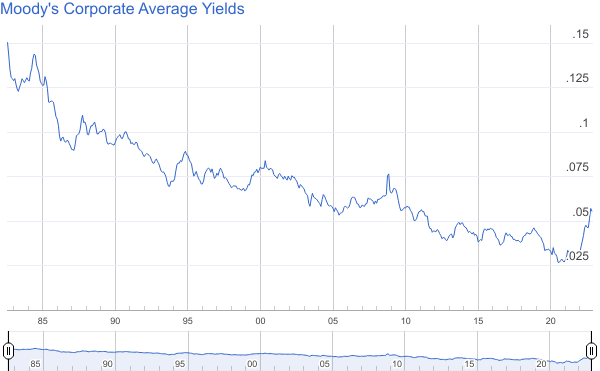

Link: https://content.naic.org/research_moody.htm

Historical record: https://docs.google.com/spreadsheets/d/1Sgi6XVzK0_sCtAWuCnUD02eObOTC3S4xlQgMep32OeU/edit?usp=sharing

Graphic:

Publication Date: accessed 9 Dec 2022

Publication Site: NAIC

Link: https://www.ai-cio.com/news/new-report-measures-public-pension-health/

Excerpt:

The National Conference on Public Employee Retirement Systems recently released a report entitled “Measuring Public Pension Health: New Metrics, New Approaches” that introduces new mechanisms to account and judge the sustainability of pension plans.

To create these, the report’s author, Tom Sgouros, fellow and co-chair at The Policy Lab at Brown University, formed and hosted the Pension Accounting Working Group, a group made up of actuaries and public pension experts. The group assembled to measure the health of plans, and create new metrics to generate greater insights into a pension’s sustainability, so that trustees and policymakers could make better and more informed decisions.

The working group came up with three new metrics. The first is “scaled liability,” a measurement of pension liabilities against the size of the underlying supporting economy. The second is “unfunded actuarial liability (UAL) stabilization payment,” an objectively defined cash-flow policy standard comparable to the funding ratio. And last is “risk-weighting asset values,” a method to assess the value of a plan’s assets that accounts for a plan’s capacity to endure the downside risk it has taken through the allocation of its assets.

The scaled liability measurement uses economic strength as a proxy for tax capacity. This measurement helps decisionmakers get a read on a plan’s sustainability by providing a comparison between a pension plan and the economic strength of its sponsor. The Federal Reserve includes a comparison of net pension liability with measures of GDP and state revenues in the “Enhanced Financial Accounts” component of its “Financial Accounts of the United States” report.

Author(s): Dusty Hagedorn

Publication Date: 23 Sept 2022

Publication Site: ai-CIO

Excerpt:

In the PBRAR, VM-31 3.D.2.e.(iv) requires the actuary to discuss “which risks, if any, are not included in the model” and 3.D.2.e.(v) requires a discussion of “any limitations of the model that could materially impact the NPR [net premium reserve], DR [deterministic reserve] or SR [stochastic reserve].” ASOP No. 56 Section 3.2 states that, when expressing an opinion on or communicating results of the model, the actuary should understand: (a) important aspects of the model being used, including its basic operations, dependencies, and sensitivities; (b) known weaknesses in assumptions used as input and known weaknesses in methods or other known limitations of the model that have material implications; and (c) limitations of data or information, time constraints, or other practical considerations that could materially impact the model’s ability to meet its intended purpose.

Together, both VM-31 and ASOP No. 56 require the actuary (i.e., any actuary working with or responsible for the model and its output) to not only know and understand but communicate these limitations to stakeholders. An example of this may be reinsurance modeling. A common technique in modeling the many treaties of yearly renewable term (YRT) reinsurance of a given cohort of policies is to use a simplification, where YRT premium rates are blended according to a weighted average of net amounts at risk. That is to say, the treaties are not modeled seriatim but as an aggregate or blended treaty applicable to amounts in excess of retention. This approach assumes each third-party reinsurer is as solvent as the next. The actuary must ask, “Is there a risk that is ignored by the model because of the approach to modeling YRT reinsurance?” and “Does this simplification present a limitation that could materially impact the net premium reserve, deterministic reserve or stochastic reserve?”

Understanding limitations of a model requires understanding the end-to-end process that moves from data and assumptions to results and analysis. The extract-transform-load (ETL) process actually fits well with the ASOP No. 56 definition of a model, which is: “A model consists of three components: an information input component, which delivers data and assumptions to the model; a processing component, which transforms input into output; and a results component, which translates the output into useful business information.” Many actuaries work with models on a daily basis, yet it helps to revisit this important definition. Many would not recognize the routine step of accessing the policy level data necessary to create an in-force file as part of the model itself. The actuary should ask, “Are there risks introduced by the frontend or backend processing in the ETL routine?” and “What mitigations has the company established over time to address these risks?”

Author(s): Karen K. Rudolph

Publication Date: July 2022

Publication Site: SOA Financial Reporter

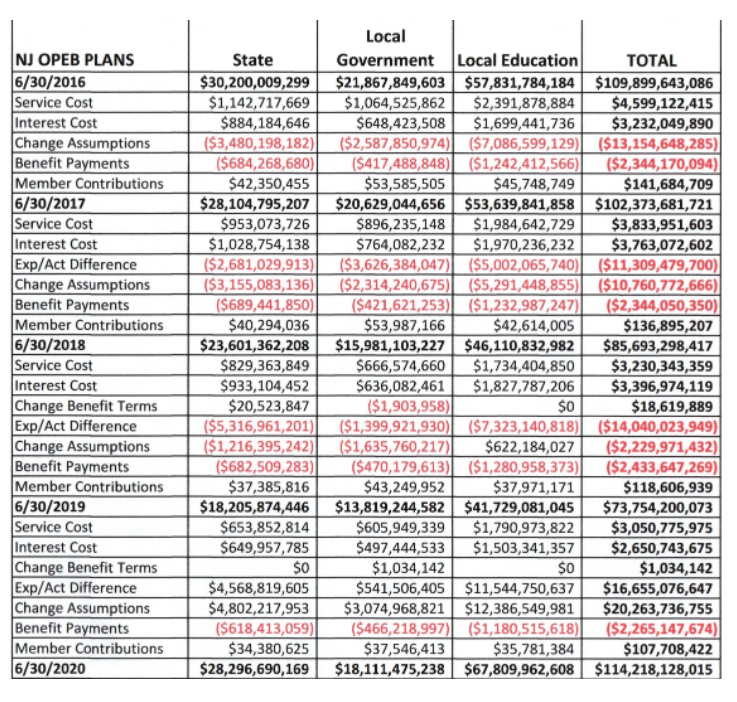

Link: https://burypensions.wordpress.com/2022/04/26/nj-opeb-update-2020/

Graphic:

Excerpt:

There are three separate reports for state, local government, and local education which throw a lot of distracting numbers at you but, when added up, show that after an amazing 1/3rd reduction in the total OPEB Liability (from $110 billion as of 6/30/16 to under $74 billion as of 6/30/19) the state actuaries sharply reversed course.

Author(s): John Bury

Publication Date: 26 Apr 2022

Publication Site: Burypensions

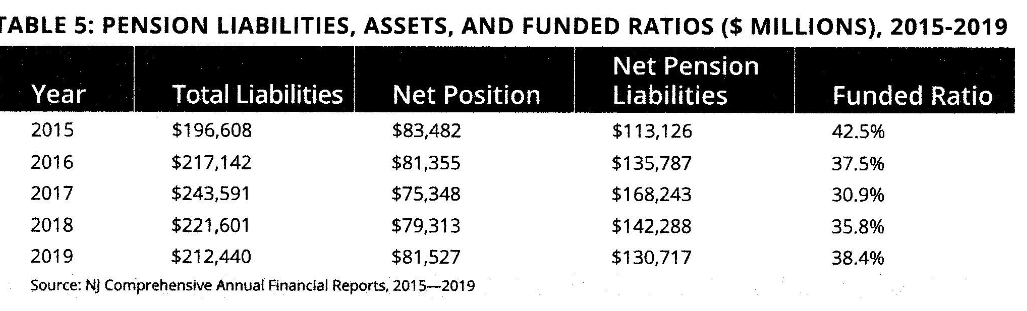

Graphic:

Excerpt:

The Garden State Initiative released a report on the state of New Jersey finances. You have heard it all before but what keeps being left out of these ivory tower pronouncements is the systemic corruption at all levels and in all corners of officialdom here that makes even the slightest improvement in our general fiscal situation a pipe dream.

Here are some excerpts along with a few charts on the pension system, the last of which makes my point.

…..

Focus on that last chart. Liabilities actually decreased over the last two years. Significantly decreased against all logic and reason. Did everybody take a pay cut? Did 30% of plan participants disappear? No. The actuaries just got told to lower liability values and like dutiful apparatchiks they complied.

Author(s): John Bury

Publication Date: 22 Sept 2021

Publication Site: Burypensions

Excerpt:

DiNapoli announced today that he’s approved a recommendation by the State Retirement System Actuary to reduce, from 6.8 percent to 5.9 percent, the assumed rate of return (RoR) on investments by the $268 billion Common Retirement Fund, which underwrites the New York State and Local Employee Retirement System (NYSLERS) and Police and Fire Retirement System (PFRS), of which the comptroller is the sole trustee.

To be sure, even at 5.9 percent, the RoR that the pension fund literally counts on to pay constitutionally guaranteed benefits will remain considerably higher than the yields from commensurate low-risk U.S. Treasury or high-quality corporate bonds, which currently range from 2.3 percent to 3.3 percent. Nonetheless, in isolation, cutting the RoR assumption is an unequivocally good and prudent thing for the comptroller to do.

Assuming lower earnings also tends to result in higher required contributions by employers—which is why politically sensitive public pension fund administrators across the country have tended to set their RoRs at much higher levels than those required for private corporate plans. To guard against volatility in investment returns, which has been especially pronounced over the past 25 years, DiNapoli and other pension fund administrators also resort to “asset smoothing” — i.e., counting average market returns over several years—as a basis for estimating the assets available to pay retirement benefits. In New York’s case, the smoothing period is five years.

Author(s): E.J. McMahon

Publication Date: 25 August 2021

Publication Site: Empire Center for Public Policy

Link: http://www.actuarialstandardsboard.org/email/2021/ActuarialStandardsBoard-aug-9-2021.html

Excerpt:

The Actuarial Standards Board of the American Academy of Actuaries recently approved a third exposure draft of a proposed revision of Actuarial Standard of Practice (ASOP) No. 4, Measuring Pension Obligations and Determining Pension Plan Costs or Contributions. The standard provides guidance to actuaries when performing actuarial services with respect to measuring obligations under a defined benefit pension plan and determining periodic costs or actuarially determined contributions for such plans. The standard addresses broader measurement issues, including cost allocation procedures and contribution allocation procedures. The standard also provides guidance for coordinating and integrating all of the elements of an actuarial valuation of a pension plan.

The comment deadline for the third exposure draft is Oct. 15, 2021. Information on how to submit comments can be found in the exposure draft.

Publication Date: 9 August 2021

Publication Site: Actuarial Standards Board

Link: https://www.mackinac.org/lawmakers-want-to-be-more-careful-with-pension-funds

Excerpt:

One of the most important assumptions built into pensions is the guess at how much investments will grow over time. If investments provide high returns, then lawmakers don’t need to set aside as much money today to pay for pensions to be paid out in the future. If investments do not return as much as assumed, a gap develops between what has been promised and what has been saved. The bills cap the rate at which administrators can assume their investments will grow, allowing them to be no more risky than current policy allows. They also let administrators use less risky assumptions if they think it is prudent.

This is a smart approach. Much of the current pension debt exists because administrators overestimated investment returns. Taxpayers now owe more to the pensioners than they do to the lenders and bondholders who willingly lent the state money. Putting a cap on the assumptions administrators make can prevent future pension debt.

Author(s): James M. Hohman

Publication Date: 1 March 2021

Publication Site: Mackinac Center for Public Policy