Graphic:

Excerpt:

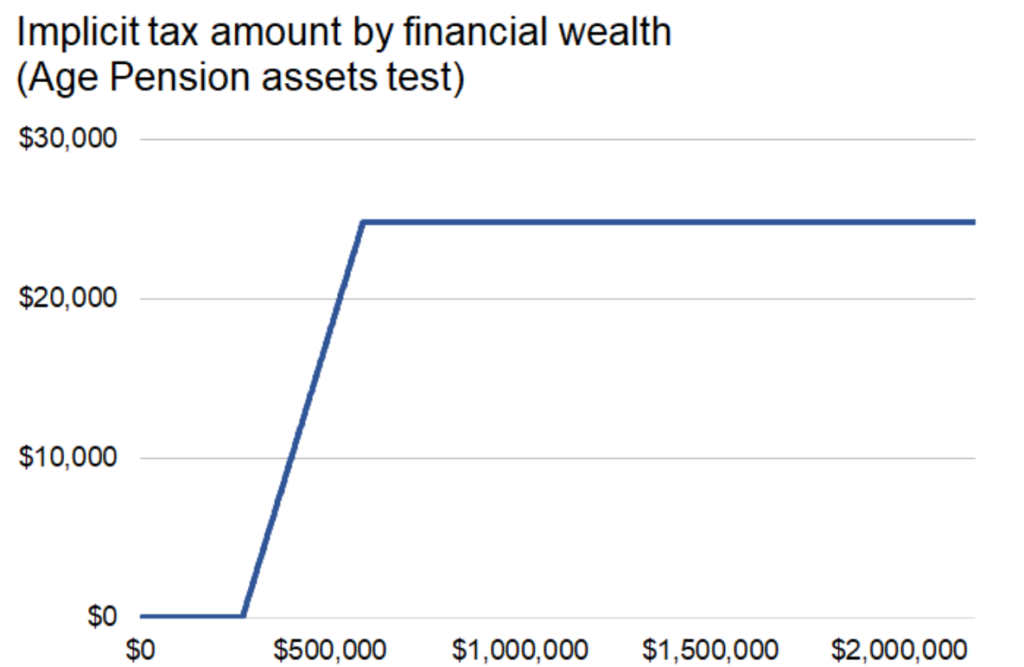

Means tests must always turn regressive at some point in the income or wealth distribution. Because the means test withdrawal cannot exceed the benefit amount, the implicit tax can only rise with income or wealth so far. From there, it turns into a fixed sum tax, like the notorious Thatcher poll tax albeit phased-in at the lower end.

Consider the Australian Government’s Age Pension assets test, which functions as an implicit wealth tax targeted at the middle class. The single Age Pension benefit is approximately $953 a fortnight. The maximum implicit tax amount can then only be $953 per fortnight – whether you’re worth $600,000 or $600 million. The implicit tax amount payable by wealth (excluding the family home) for a single person is shown below.

Author(s): David Sligar

Publication Date: 5 June 2021

Publication Site: Western Sydney Wonk