Link: https://www.washingtonpost.com/opinions/interactive/2023/irs-enforcement-costs-congress-funding/

Graphic:

Excerpt:

The White House and Congress recently agreed to claw back more than $20 billion earmarked for the Internal Revenue Service. This deal was, ostensibly, part of a grand bargain to reduce budget deficits.

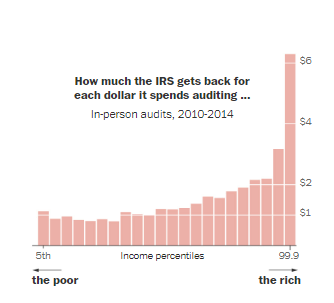

Unfortunately, it’s likely tohave the opposite effect. Every dollar available for auditing taxpayers generates many times that amount for government coffers — and the rate of return is especially astonishing for audits of the wealthiest Americans, according to new research shared exclusively with The Post.

A team of researchers at Harvard University, the University of Sydney and the Treasury Department examined internal IRS data for approximately 710,000 in-person audits from 2010 to 2014. Here’s what they found:

Wealthy people generally have more complex tax returns, so auditing them costs more. Internal government records show that the IRS employees auditing the rich earn higher wages and spend much more time per audit; overhead costs add up, too.

Now here’s the revenue collected per audit, from additional taxes, penalties and interest. The differential for low- vs. high-income taxpayers is even bigger.

This means that while the upfront costs of auditing the wealthy are usually higher — perhaps suggesting these taxpayers aren’t worth going after — the average return on investment is much better.

Author(s):

Opinion by Catherine Rampell and graphics by

Youyou Zhou

Publication Date: 14 Jun 2023

Publication Site: Washington Post