Graphic:

Excerpt:

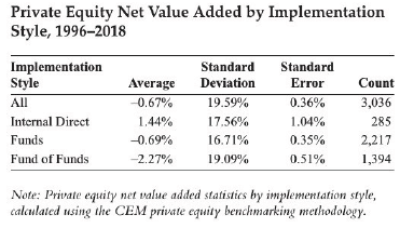

CEM, using a simple mix of small-cap indexes, found that even though private equity funds deliver what looks to be outsized raw returns, they fall short of CEM’s benchmark since 1996. However, as we’ve also said for some time, the big exception is investing in house, which CEM calls “internal direct”. And the worst, natch, is fund of funds, which have an extra layer of fees.

There are two additional reasons the CEM findings are deadly. First, the time period they look at, going back to 1996, includes a substantial portion of the 1994-1999 “glory years” where private equity firms were coming back from a period of disfavor after the late 1980s leveraged buyout crash. Less competition for deals meant better buying prices and better returns. Alan Greenspan dropping interest rates for a full nine quarters after the dot-com collapse was the first episode of the Fed driving money into high risk investment strategies by creating negative real returns for a sustained period, and the rush of money into private equity elevated deal prices.

Author(s): Yves Smith

Publication Date: 1 April 2021

Publication Site: naked capitalism