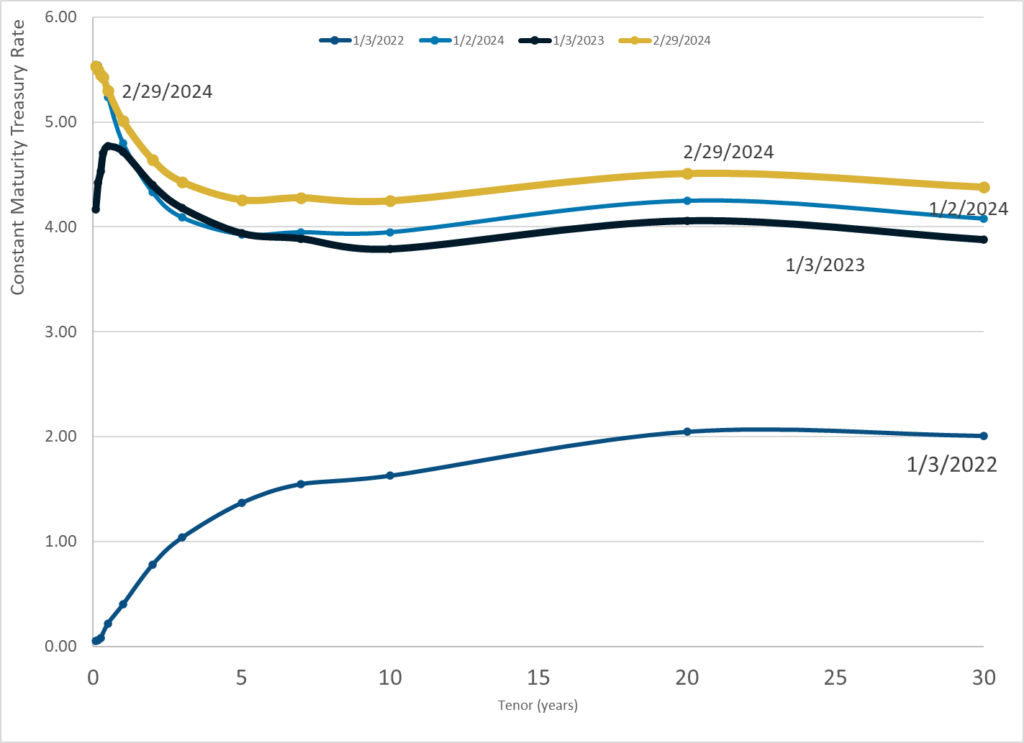

Graphic:

Publication Date: 29 Feb 2024

Publication Site: Treasury Dept

All about risk

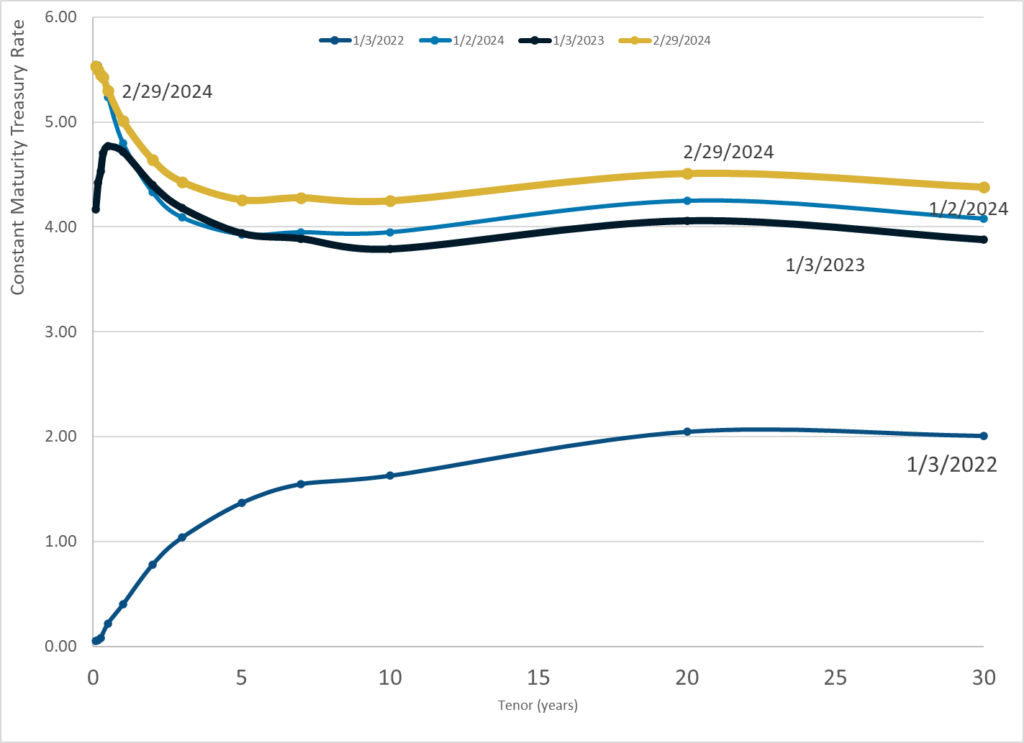

Graphic:

Publication Date: 29 Feb 2024

Publication Site: Treasury Dept

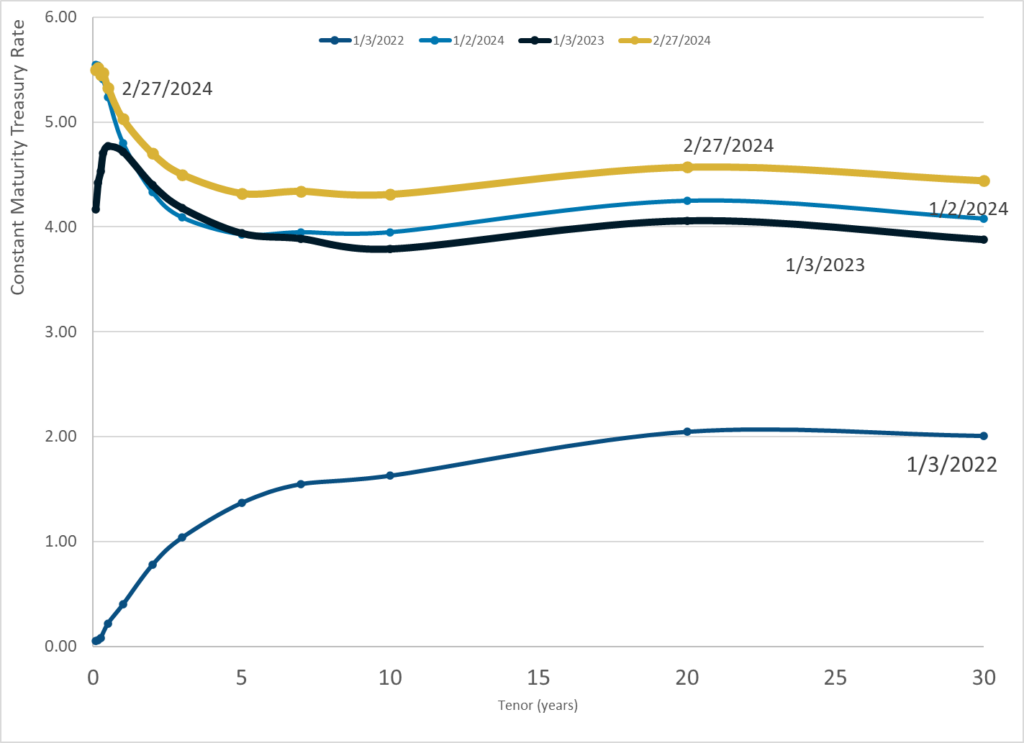

Graphic:

Publication Date: 27 Feb 2024

Publication Site: Treasury Dept

Link: https://www.wsj.com/lifestyle/careers/college-degree-jobs-unused-440b2abd

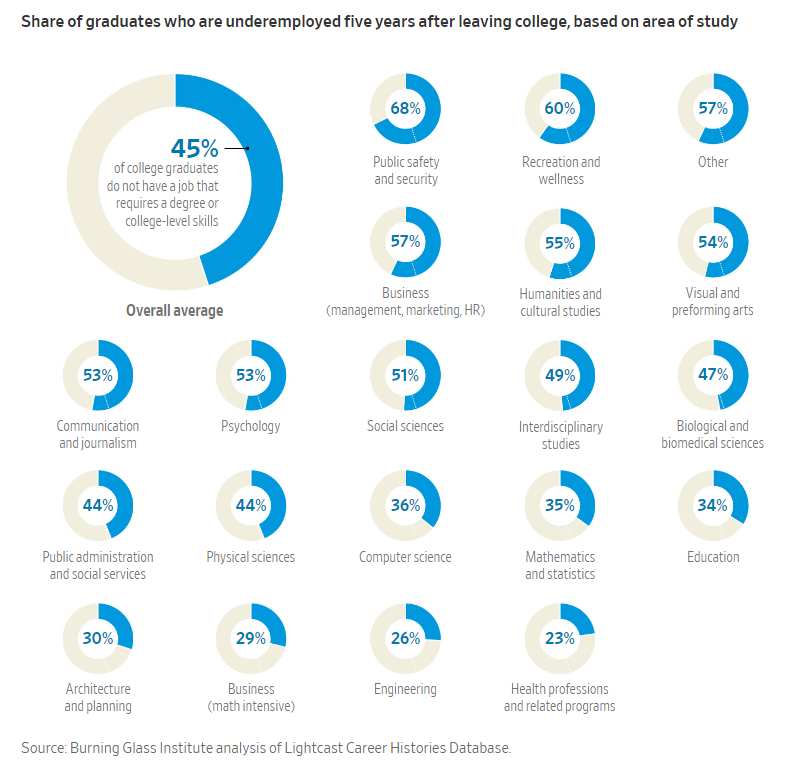

Graphic:

Excerpt:

Of the graduates in non-college-level jobs a year after leaving college, the vast majority remained underemployed a decade later, according to researchers at labor analytics firm Burning Glass Institute and nonprofit Strada Education Foundation, which analyzed the résumés of workers who graduated between 2012 and 2021.

More than any other factor analyzed—including race, gender and choice of university—what a person studies determines their odds of getting on a college-level career track. Internships are also critical.

….

Bachelor’s degree holders in college-level jobs earn nearly 90% more than people with just a high-school diploma in their 20s, according to a Burning Glass analysis of 2022 U.S. Census Bureau data.

By comparison, underemployed college graduates earn 25% more than high-school graduates.

….

Contrary to conventional wisdom, not all degrees in science, technology, engineering and math, or STEM, disciplines are a sure bet to landing a job that reflects a college education, the study found.

Nearly half of people who majored in biology and biomedical sciences—47%—remained underemployed five years after graduating. Likewise, business majors less focused on quantitative skills, such as marketing and human resources, were twice as likely to be underemployed than those with math-intensive business degrees, such as accounting or finance. The data cover graduates who didn’t get master’s or other advanced degrees after college.

Author(s): Vanessa Fuhrmans and Lindsay Ellis

Publication Date: 22 Feb 2024

Publication Site: WSJ

Graphic:

Excerpt:

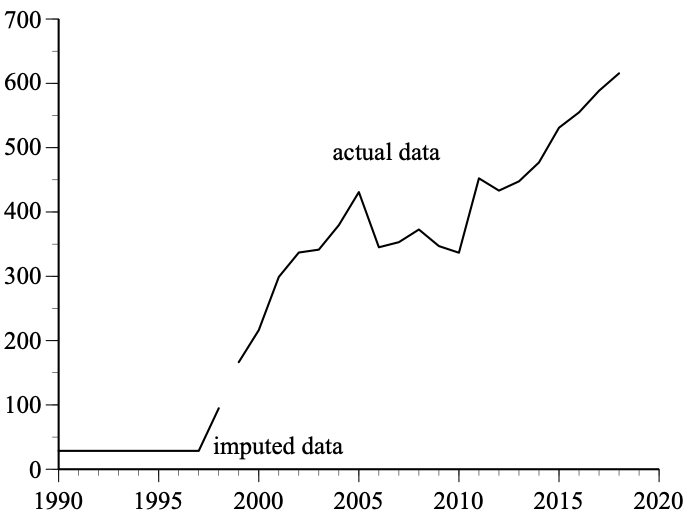

I was reminded of this student’s clever ploy when Frederik Joelving, a journalist with Retraction Watch, recently contacted me about a published paper written by two prominent economists, Almas Heshmati and Mike Tsionas, on green innovations in 27 countries during the years 1990 through 2018. Joelving had been contacted by a PhD student who had been working with the same data used by Heshmati and Tsionas. The student knew the data in the article had large gaps and was “dumbstruck” by the paper’s assertion these data came from a “balanced panel.” Panel data are cross-sectional data for, say, individuals, businesses, or countries at different points in time. A “balanced panel” has complete cross-section data at every point in time; an unbalanced panel has missing observations. This student knew firsthand there were lots of missing observations in these data.

The student contacted Heshmati and eventually obtained spreadsheets of the data he had used in the paper. Heshmati acknowledged that, although he and his coauthor had not mentioned this fact in the paper, the data had gaps. He revealed in an email that these gaps had been filled by using Excel’s autofill function: “We used (forward and) backward trend imputations to replace the few missing unit values….using 2, 3, or 4 observed units before or after the missing units.”

That statement is striking for two reasons. First, far from being a “few” missing values, nearly 2,000 observations for the 19 variables that appear in their paper are missing (13% of the data set). Second, the flexibility of using two, three, or four adjacent values is concerning. Joelving played around with Excel’s autofill function and found that changing the number of adjacent units had a large effect on the estimates of missing values.

Joelving also found that Excel’s autofill function sometimes generated negative values, which were, in theory, impossible for some data. For example, Korea is missing R&Dinv (green R&D investments) data for 1990-1998. Heshmati and Tsionas used Excel’s autofill with three years of data (1999, 2000, and 2001) to create data for the nine missing years. The imputed values for 1990-1996 were negative, so the authors set these equal to the positive 1997 value.

Author(s): Gary Smith

Publication Date: 21 Feb 2024

Publication Site: Retraction Watch

Graphic:

Publication Date: 26 Feb 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 23 Feb 2024

Publication Site: Treasury Dept

Link:https://manhattan.institute/article/the-limits-of-taxing-the-rich

Graphic:

Excerpt:

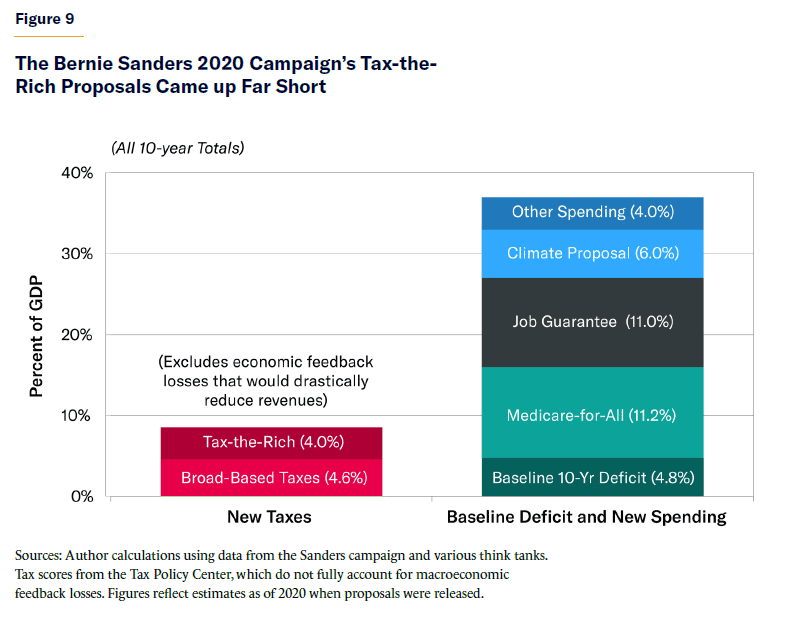

Sanders’s agenda is not limited to taxes on corporations and wealthy families. The campaign also proposed to partially finance Medicare-for-All through 4.6% of GDP in new tax revenues from broad-based payroll taxes and tax-preference eliminations (within health care). However, even if one uses the inflated revenue figure of 8.6% of GDP (4.0% from the wealthy and 4.6% from broad-based taxes), it still falls far short of financing Sanders’s spending promises. Sanders proposed $23 trillion in new taxes over the 2021–30 period, yet also proposed a $30 trillion Medicare-for-All plan, $30 trillion government job guarantee, $16 trillion climate initiative, and $11 trillion for free public college tuition, full student-loan forgiveness, Social Security expansion, housing, infrastructure, paid family leave, and K–12 education. That is $87 trillion in spending promises, on top of a baseline budget deficit that, at the time, was forecast at $13 trillion over the decade.[104] Even the rosiest revenue estimates of Sanders’s tax policies would cover only a small fraction of his spending promises (see Figure 9).

At the same time, Sanders has obfuscated the funding shortfall by: 1) regularly claiming that his tax policies can cover all his spending promises, even as official scores show otherwise; and 2) proposing most spending increases separately, in order to make each one appear individually affordable within his broader tax agenda.

Summary: Some progressives suggest that Bernie Sanders has identified extraordinary potential revenues from taxing the rich. However, his proposed tax increases on corporations and wealthy individuals show revenues of 4% of GDP—and that is before accounting for constitutional challenges and unrealistic tax rates that far exceed the consensus of revenue-maximizing rates. Given behavioral and economic responses, the total potential tax revenues are (at most) 2% of GDP, and possibly far less. Indeed, leading progressive tax officials assume plausible tax rates and revenues far below those of Sanders’s proposals. Even assuming Sanders’s full static revenue estimate and including his steep middle-class tax proposals would not come close to paying for his spending agenda. The contention that Sanders has unlocked an enormous tax-the-rich revenue source is false.

Author(s): Brian Riedl

Publication Date: 21 Sept 2023

Publication Site: Manhattan Institute

Graphic:

Excerpt:

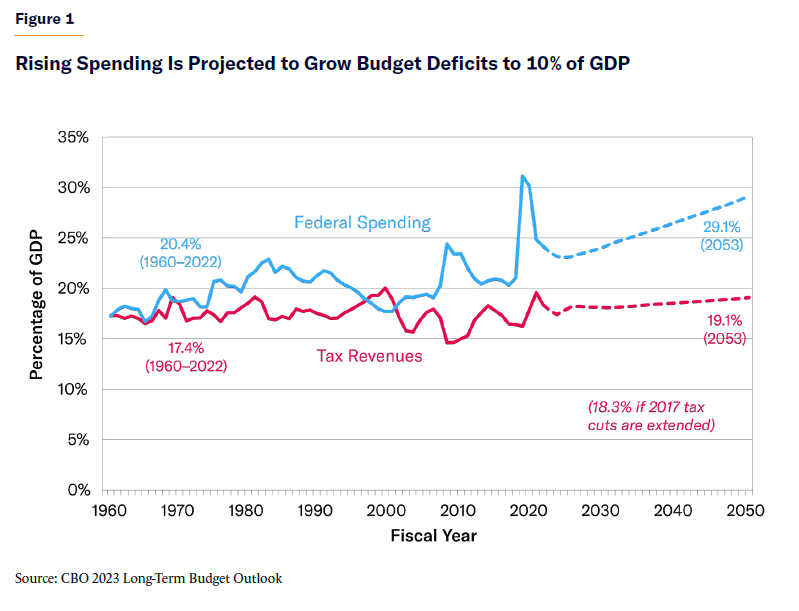

As budget deficits surge toward the stratosphere, Congress will soon have to get serious about savings proposals. Yet reforming Social Security and Medicare—the leading drivers of long-term deficits—remains a political nonstarter. Neither party is willing to raise middle-class taxes. And cutting defense and social spending would save at most $200 billion annually from deficits that are projected to approach $3 trillion by 2034.

That leaves one option: Tax the rich. It won’t be nearly enough.

There are a few excessive tax loopholes and undertaxed corporations that lawmakers could address. It’s farcical, however, to suggest that the tax-the-rich pot of gold is large enough to rein in our deficits and finance new spending programs. Seizing every dollar of income earned over $500,000 wouldn’t balance the budget. Liquidating every dollar of billionaire wealth would fund the federal government for only nine months.

In a study for the Manhattan Institute, I set upper-income tax rates at their revenue-maximizing level, while paring back tax loopholes and fighting tax evasion. As background, the Congressional Budget Office projects that our budget deficits—which currently exceed 7% of gross domestic project—will surpass 10% of GDP over the next three decades. My research shows that the “tax the rich” model would raise at most 2% of GDP in additional revenue over the long term.

Author(s): Brian Riedl

Publication Date: 22 Jan 2024

Publication Site: WSJ, op-ed

Graphic:

Publication Date: 22 Feb 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 21 Feb 2024

Publication Site: Treasury Dept

Excerpt:

The New York State Common Retirement Fund (Fund) will restrict its investments in eight integrated oil and gas companies, including Exxon Mobil Corp., after a review of the companies’ readiness to transition to a low-carbon economy, State Comptroller Thomas P. DiNapoli, trustee of the Fund, announced today.

The evaluation of the Fund’s integrated oil and gas holdings is part of DiNapoli’s broader review of the transition readiness of energy sector investments that face significant climate risk. With today’s announcement, the Fund will be divesting its corporate bonds and actively managed public equity holdings in eight integrated oil and gas companies that it has determined are not transition-ready. In addition to Exxon, the companies to be divested and restricted in the coming months are Guanghui Energy Company Ltd., Echo Energy PLC, IOG PLC, Oil and Natural Gas Corporation Ltd, Delek Group Ltd., Dana Gas Co and Unit Corp. The value of these holdings is approximately $26.8 million as of Dec. 31, 2023.

DiNapoli also announced the Fund has met its initial goal of committing $20 billion to the Sustainable Investments and Climate Solutions program, and has set a new goal of investing $40 billion in that program by 2035. With the program, the Fund invests in sustainable investments including clean energy generation, energy storage, resource efficiency, and green infrastructure across all asset classes. As part of the expansion of this program, DiNapoli also announced the Fund would increase its climate index investments by 50% to over $10 billion over the next two years, with the longer-term goal of doubling it by 2035.

Publication Date: 15 Feb 2024

Publication Site: Office of the Comptroller of NY State

Excerpt:

Activists credit the support of Beck, Maine Rep. Maggie O’Neil and state Sen. Chloe Maxmin for making Maine the first state to require fossil fuel divestment by law.

Passed and signed by Maine’s governor in 2021, LD99 calls for the state’s permanent funds and its pension system, MainePERS, to divest from fossil fuel investments by 2026 and not reinvest going forward.

It prohibits both specific lists of publicly traded companies as well as any whose “core business” is in fossil fuel exploration, extraction, refining, processing or infrastructure. (A separate 2021 law also requires Maine to divest from private prisons.)

Other pension systems, including New York state’s, have made promises to divest from companies whose primary business drives planet-warming emissions, but are not required to by legislation. In 2015, California passed a law to remove public investments in thermal coal, but a move to extend that to all fossil fuel companies died in the Legislature this session.

MainePERS’ assets — about $18 billion at the end of the last fiscal year — are small in comparison to New York and California, but how they manage their legislative mandate will be closely watched as other states face calls for fossil fuel divestment and wider questions of dealing with climate risk in investing.

Leaders at the pension system stressed a key phrase in the legislation, that any MainePERS divestment decision will be made “in accordance with sound investment criteria and consistent with fiduciary obligations” — crucial to a state constitutional requirement to its pension members.

….

MainePERS Chief Investment Officer James Bennett estimates about $1.2 billion of the system’s total holdings are in fossil fuel investments, split evenly between publicly traded companies and private investments.

Liquidating private investments will be more complicated, he says. Many of the limited partnerships MainePERS is invested in include fossil fuel assets alongside other infrastructure investments and cannot be separated. They’d need to sell the whole thing, if it indeed is within the financial interest of members to do so.

Author(s): Taylor K Brown

Publication Date: 13 July 2022

Publication Site: Governing