Graphic:

Publication Date: 29 Jun 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 29 Jun 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 28 Jun 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

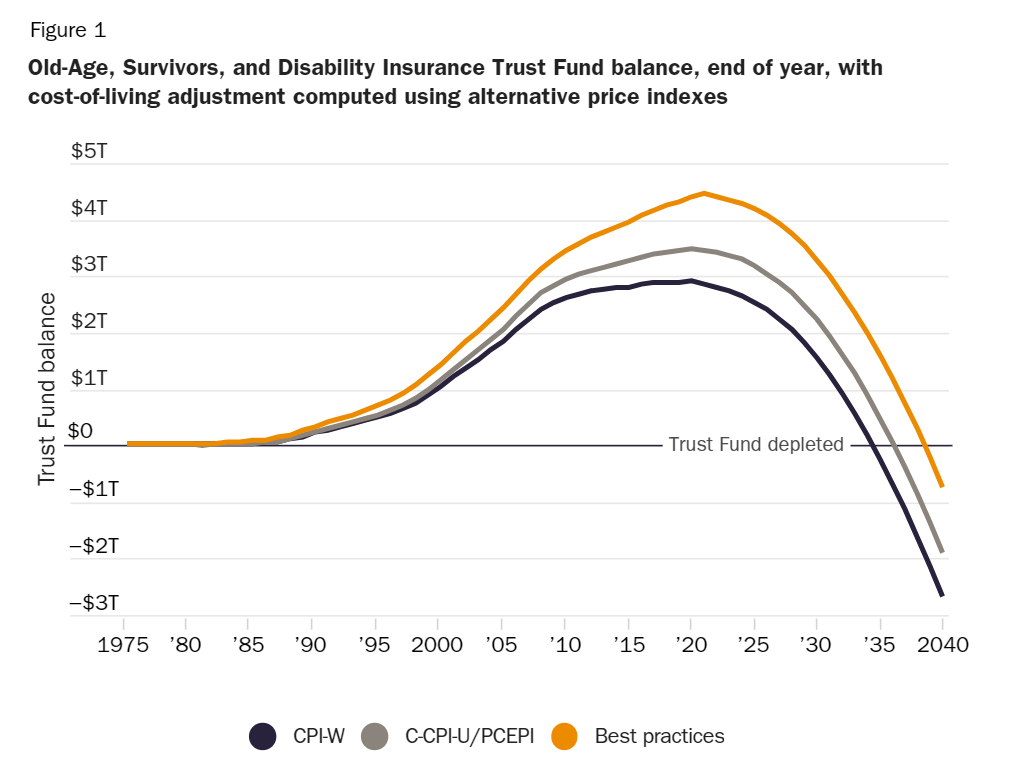

COLAs for Social Security’s OASDI have had an additional significant fiscal effect. Until recently, the payroll taxes paid for Social Security each year have usually exceeded the cost of benefits paid in that year. This balance was transferred to the general fund of the U.S. Treasury, which in turn issued special Treasury bonds to the Social Security Trust Fund to be redeemed later when taxes collected were less than the benefits paid. The fund balance reached $2.9 trillion at the end of 2020. Then in 2021, the Social Security Trust Fund had to redeem $56.3 billion of those bonds to pay OASDI benefits. Social Security actuaries have calculated that increasingly larger withdrawals will continue until the Trust Fund is fully depleted in early 2035.36 Under current law, once the Trust Fund balance is fully depleted, payments to beneficiaries must be reduced to the level supported by current Social Security taxes.

If Social Security COLAs had been calculated using the combination of C‑CPI‑U and PCEPI, then the Trust Fund balance in 2020 would have been $3.5 trillion, and full depletion of the Trust Fund would have been delayed two more years to 2037. If the price indexes had also been improved to minimize new‐item bias (the best‐practices index), the balance in 2020 would have been $4.4 trillion, and full depletion of the fund would have been delayed until 2039 (see Figure 1).

Author(s): John F. Early

Publication Date: 22 Jun 2023

Publication Site: Cato

Graphic:

Publication Date: 26 Jun 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 23 Jun 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 22 Jun 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 16 Jun 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

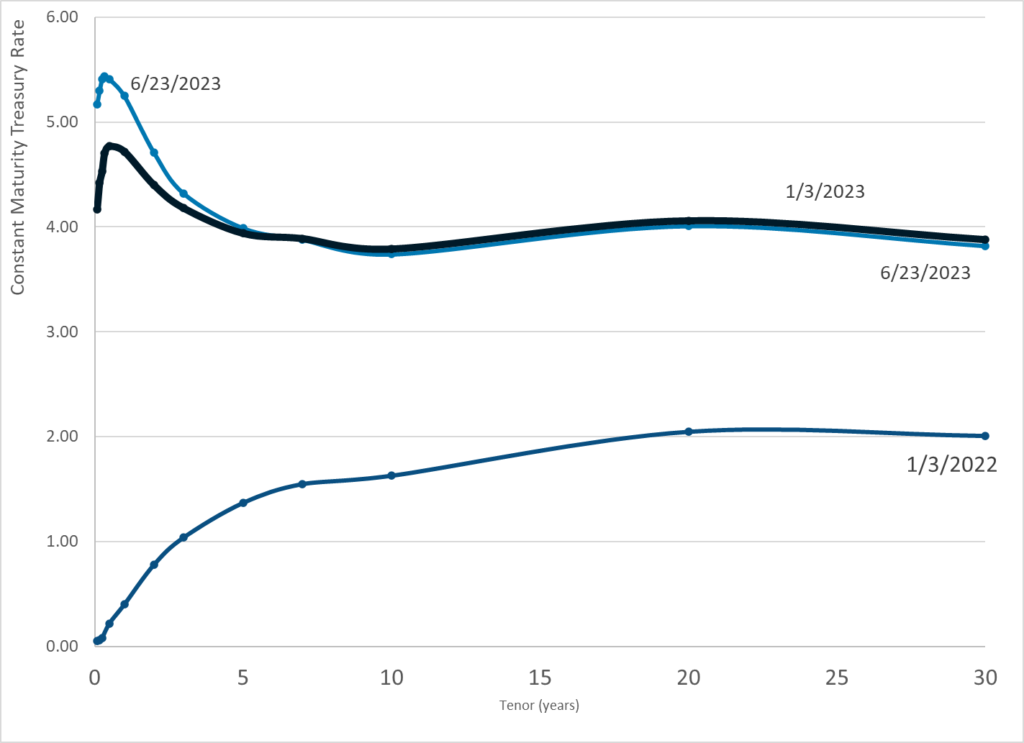

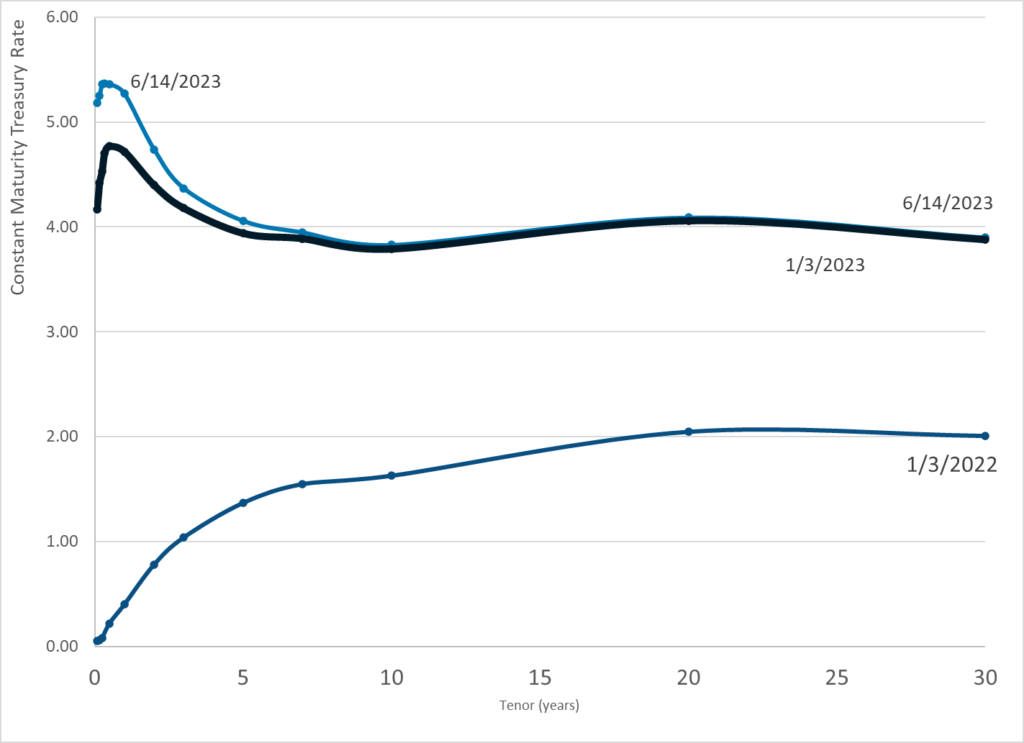

The Fed’s Summary of Economic projections is far more interesting. I highlighted the median economic forecast in pink. Each dot represents the position of someone at the meeting.

Looking ahead to 2025, the Fed is clueless.

Actually, that’s not a bad thing. Someone on the committee is likely to be correct.

Moreover, the results look like one of my favorite sayings: I don’t know and no one else does either, especially the Fed.

Author(s): Mike Shedlock

Publication Date: 14 Jun 2023

Publication Site: Mish Talk

Link: https://www.washingtonpost.com/opinions/interactive/2023/irs-enforcement-costs-congress-funding/

Graphic:

Excerpt:

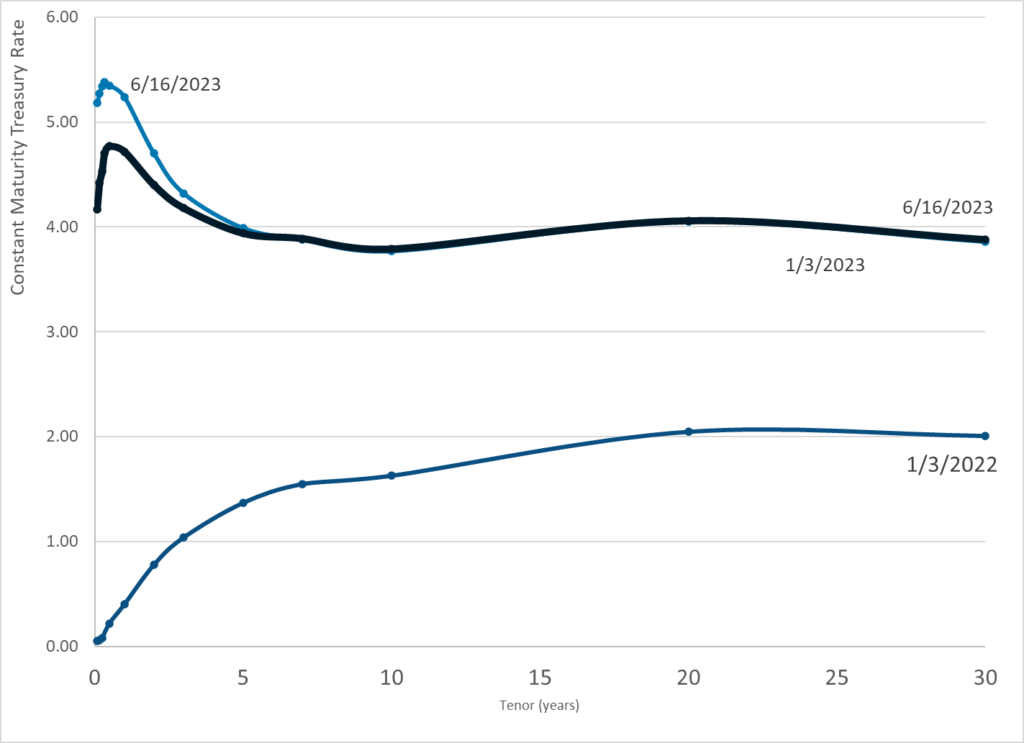

The White House and Congress recently agreed to claw back more than $20 billion earmarked for the Internal Revenue Service. This deal was, ostensibly, part of a grand bargain to reduce budget deficits.

Unfortunately, it’s likely tohave the opposite effect. Every dollar available for auditing taxpayers generates many times that amount for government coffers — and the rate of return is especially astonishing for audits of the wealthiest Americans, according to new research shared exclusively with The Post.

A team of researchers at Harvard University, the University of Sydney and the Treasury Department examined internal IRS data for approximately 710,000 in-person audits from 2010 to 2014. Here’s what they found:

Wealthy people generally have more complex tax returns, so auditing them costs more. Internal government records show that the IRS employees auditing the rich earn higher wages and spend much more time per audit; overhead costs add up, too.

Now here’s the revenue collected per audit, from additional taxes, penalties and interest. The differential for low- vs. high-income taxpayers is even bigger.

This means that while the upfront costs of auditing the wealthy are usually higher — perhaps suggesting these taxpayers aren’t worth going after — the average return on investment is much better.

Author(s):

Opinion by Catherine Rampell and graphics by

Youyou Zhou

Publication Date: 14 Jun 2023

Publication Site: Washington Post

Graphic:

Publication Date: 14 June 2023

Publication Site: Treasury Dept

Link: https://angrybearblog.com/2023/06/107367

pdf report: https://chqpr.org/downloads/Rural_Hospitals_at_Risk_of_Closing.pdf

Graphic:

Excerpt:

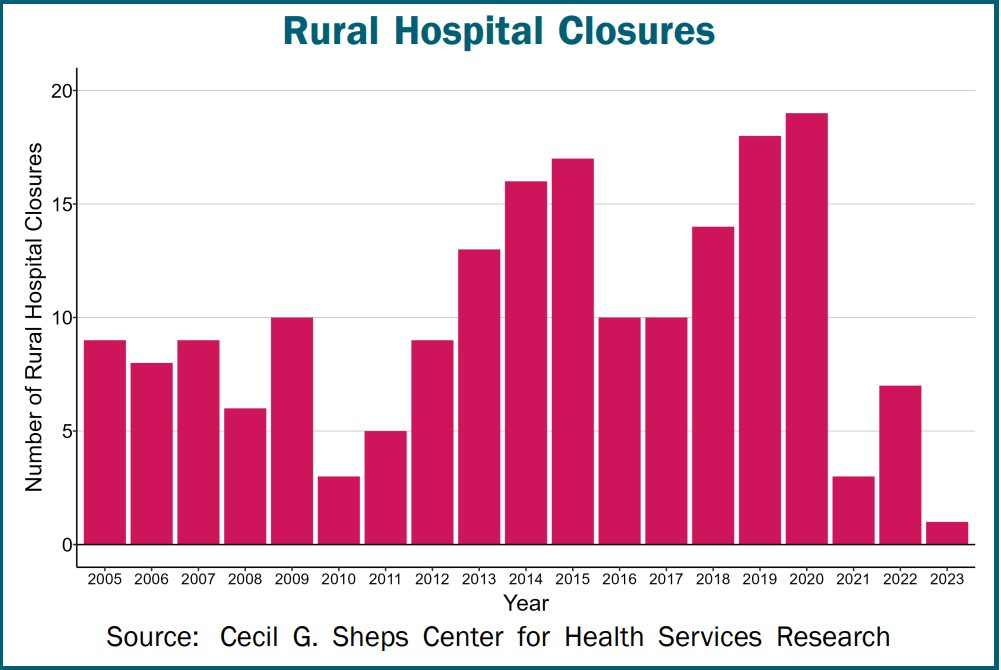

Things are changing more rapidly. Smaller hospitals are under an attack of high costs and less revenue. As a result, many are closing leaving the small town and rural residents without medical care or having to drive long distances in emergencies. As reported by Healthcare Quality and Payment Reform:

Many people across the country could not receive hospital care in their community when the pandemic began. Over 150 rural hospitals closed between 2005 and 2019. An additional 19 rural hospitals closed in 2020, more than any year in the previous decade. The closures are not resulting from the pandemic, but by financial losses in previous years. Ten more rural hospitals closed in 2021 and 2022. The closures decreased in 2019 due to the special financial assistance hospitals received during the pandemic. The pandemic aid has ended and closures are likely to increase.

Six hundred rural hospitals or ~ 30% of all rural hospitals in the country are at risk of closing. At risk because of the serious financial problems, they are experiencing:

Author(s): Center for Healthcare Quality and Payment Reform

Publication Date: 7 Jun 2023 on blog, accessed 14 Jun 2023

Publication Site: Angry Bear Blog

Graphic:

Publication Date: 13 Jun 2023

Publication Site: Treasury Dept