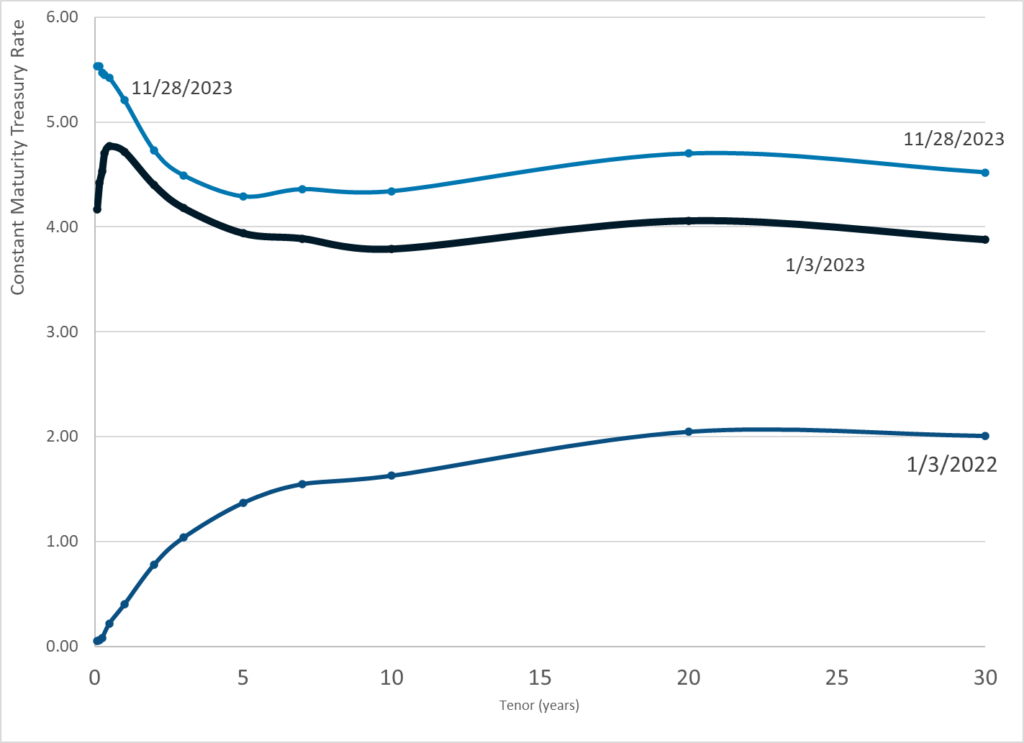

Graphic:

Publication Date: 28 Nov 2023

Publication Site: Treasury Dept

All about risk

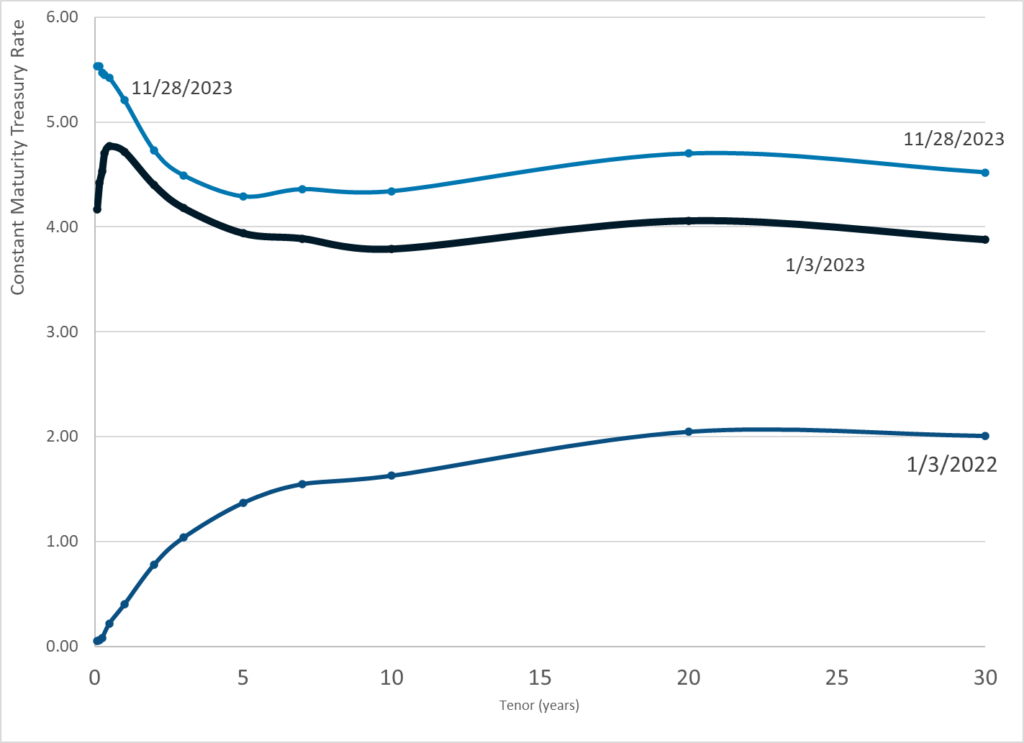

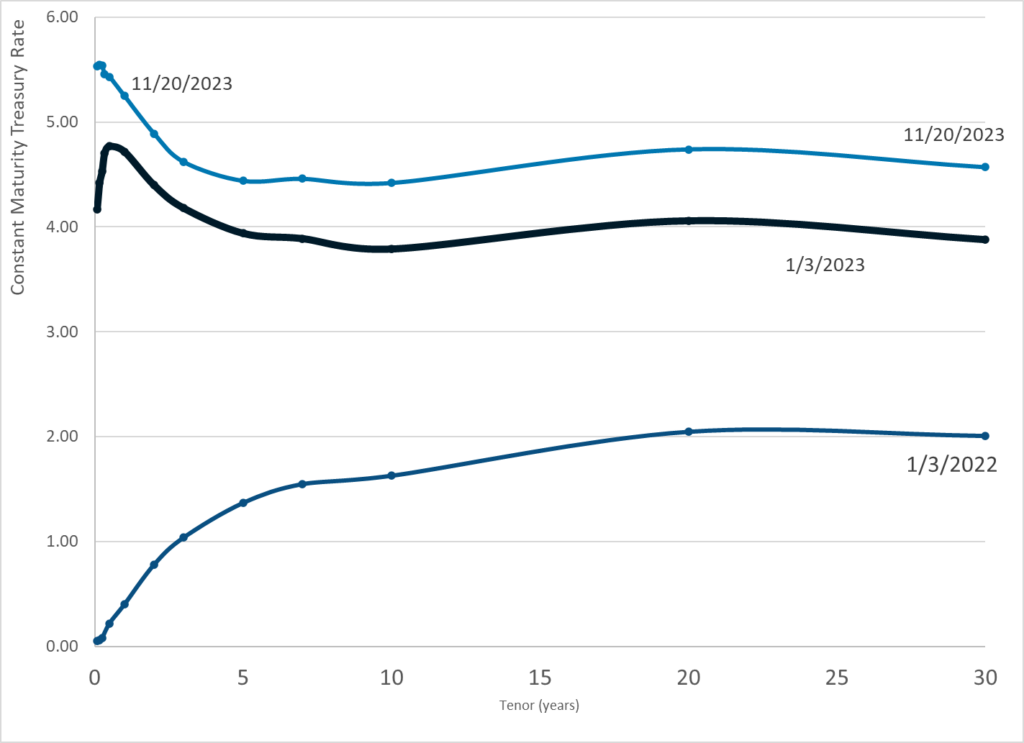

Graphic:

Publication Date: 28 Nov 2023

Publication Site: Treasury Dept

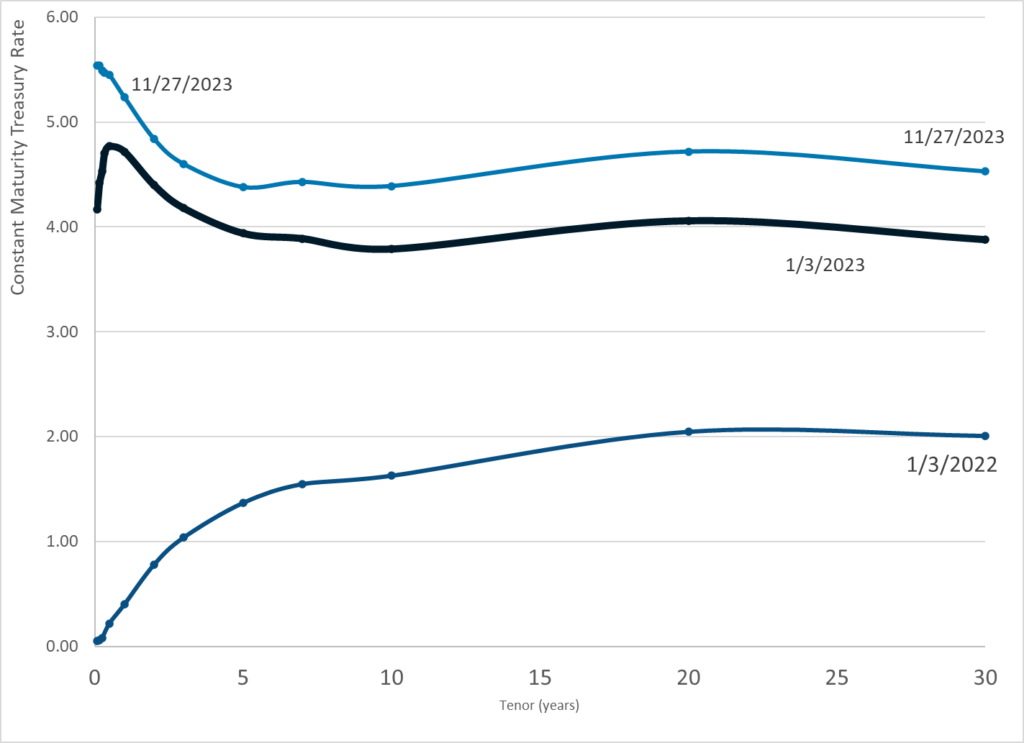

Graphic:

Publication Date: 27 Nov 2023

Publication Site: Treasury Department

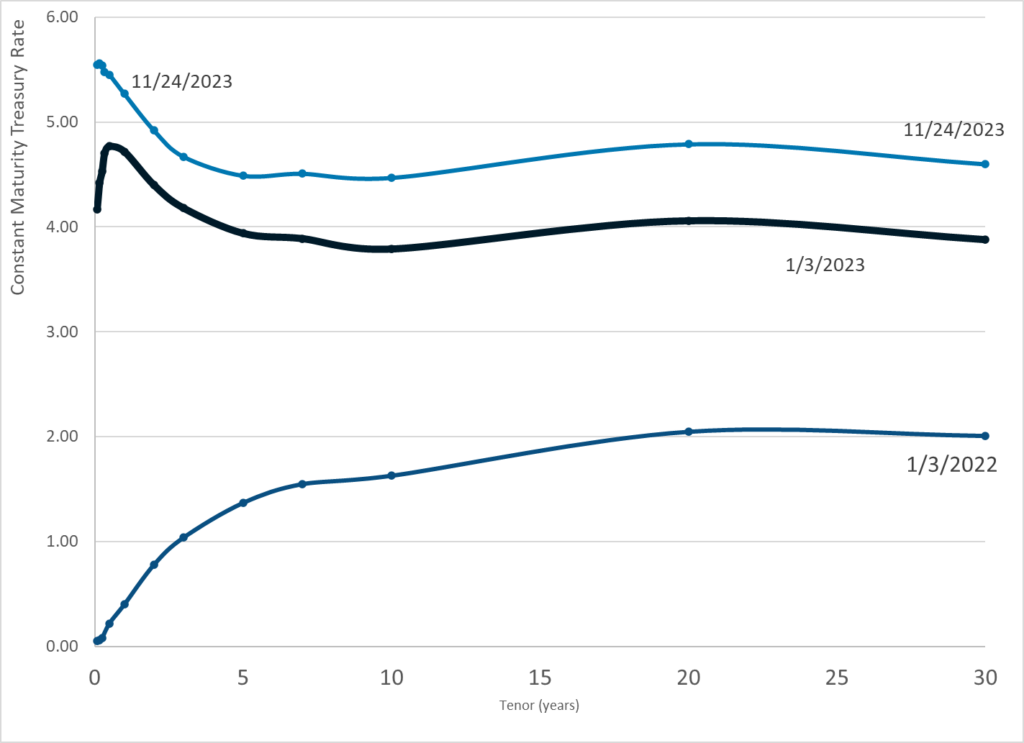

Graphic:

Publication Date: 24 Nov 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 20 Nov 2023

Publication Site: Treasury Dept

Excerpt:

Puerto Rico Electric Power Authority bond parties that oppose the Oversight Board’s proposed debt deal filed suits challenging part of the deal, asked for compensation for Puerto Rico central government’s actions since March 2022 and proposed an alternate bond deal.

The parties filed the suits this weekend in the U.S. District Court for Puerto Rico and filed an informative motion Friday in the bankruptcy telling U.S. District Judge Laura Taylor Swain about their bond deal offer.

GoldenTree Asset Management and Syncora Guarantee sued Puerto Rico’s central government for actions taken since March 2022 to interfere with PREPA’s ability to pay bondholders. The court has yet to appoint a judge in that case.

The bond parties allege the commonwealth government has manipulated PREPA’s fiscal plans and budgets to deprive the bondholders of their claim on the authority’s revenues and depress the value of the bonds.

The board rejected former Oversight Board member Justin Peterson’s suggestion to use commonwealth financial surpluses for PREPA because the commonwealth didn’t owe the authority money.

Author(s): Robert Slavin

Publication Date: 13 Nov 2023

Publication Site: Fidelity Fixed Income/Bond Buyer

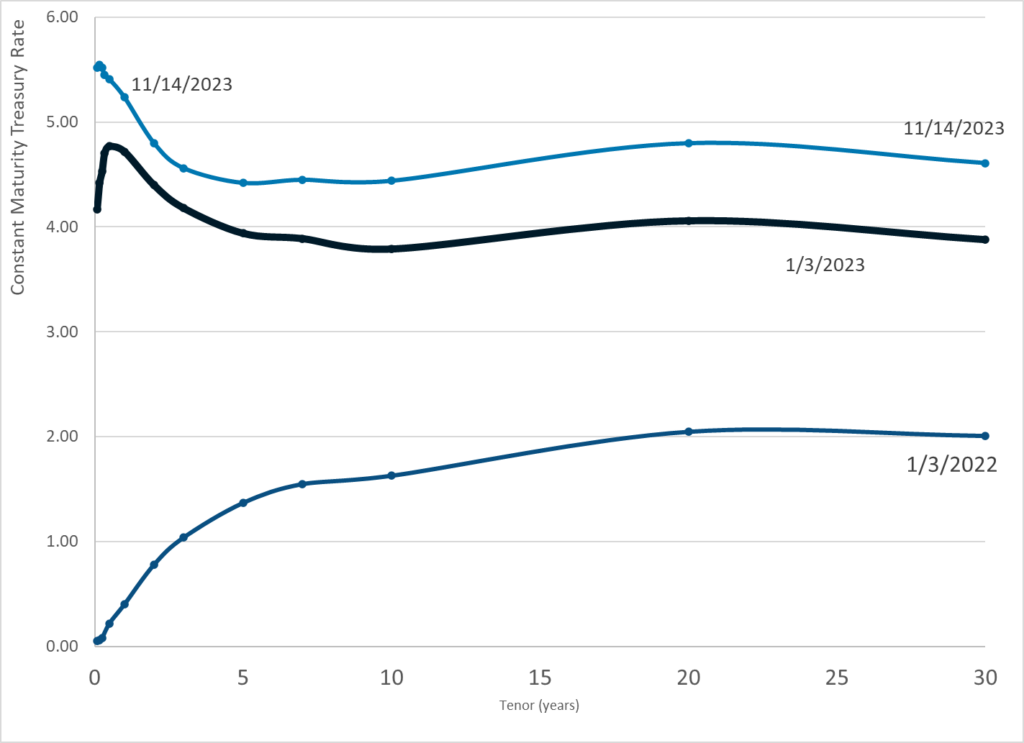

Graphic:

Publication Date: 14 Nov 2023

Publication Site: Treasury Department

Excerpt:

As the timeline for implementing the Financial Data Transparency Act grows shorter, the Securities and Exchange Commission is teaming up with other federal regulators in an attempt to allay fears about implementation.

“There’s no new disclosure requirements, standards or timelines, it’s just about structured data,” said Dave Sanchez, director of the SEC’s Office of Municipal Securities.

The comments came during a panel discussion produced by XBRL US on Thursday. The FDTA was passed last year as a remedy for providing more transparency to the financial markets by introducing machine-readable formats into the Municipal Securities Rulemaking Board’s EMMA system, which tracks the muni market.

The SEC is in charge of developing the standards for how the data will be submitted to the MSRB. The upcoming deadlines include publishing proposed rules by June 2024, which will kick off the public comment period. Determining the standards is set for December 2024, with specific rulemaking to be in place by 2026.

Author(s): Scott Sowers

Publication Date: 10 Nov 2023

Publication Site: Bond Buyer at Fidelity Fixed Income

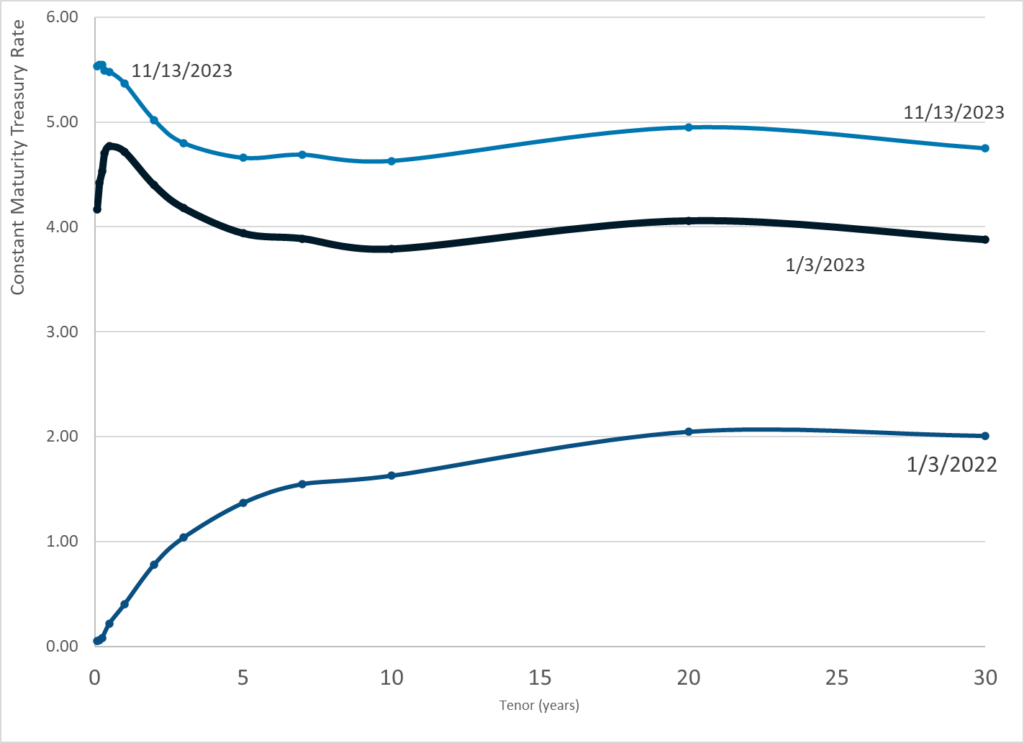

Graphic:

Publication Date: 13 Nov 2023

Publication Site: Treasury Dept

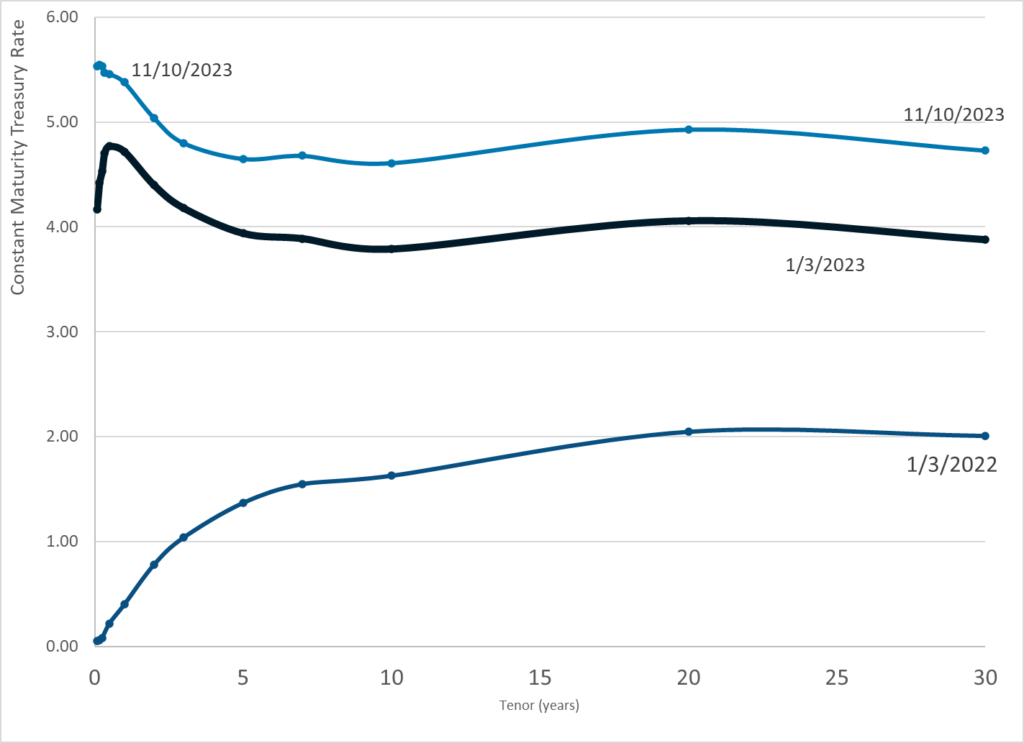

Graphic:

Publication Date: 10 Nov 2023

Publication Site: Treasury Dept

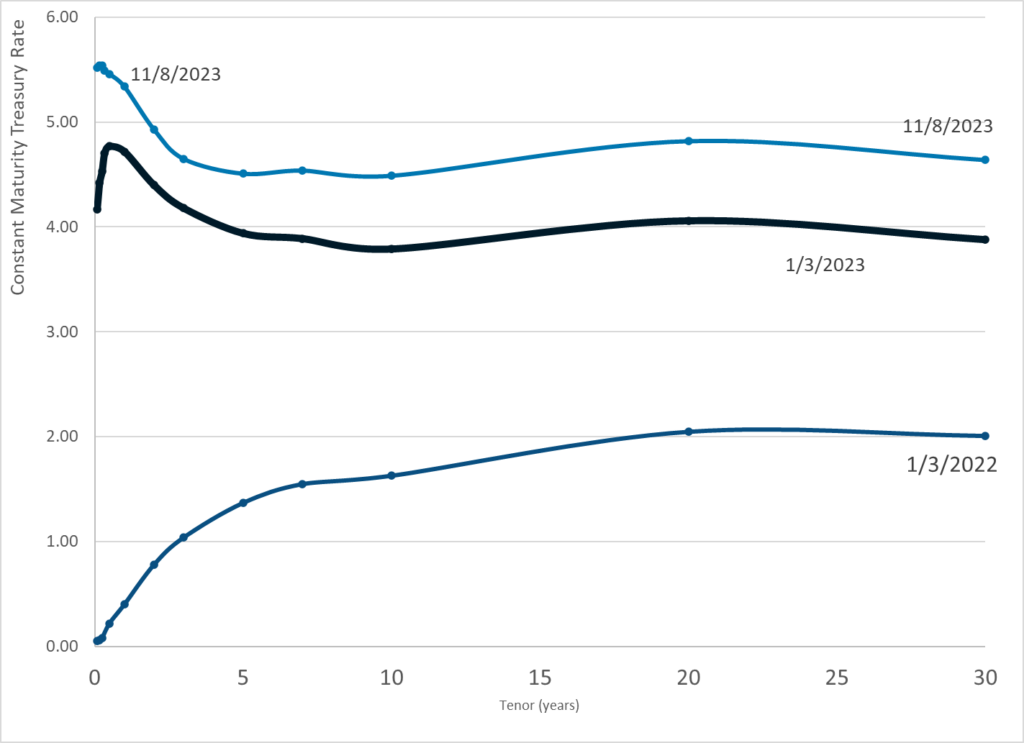

Graphic:

Publication Date: 8 Nov 2023

Publication Site: Treasury Dept

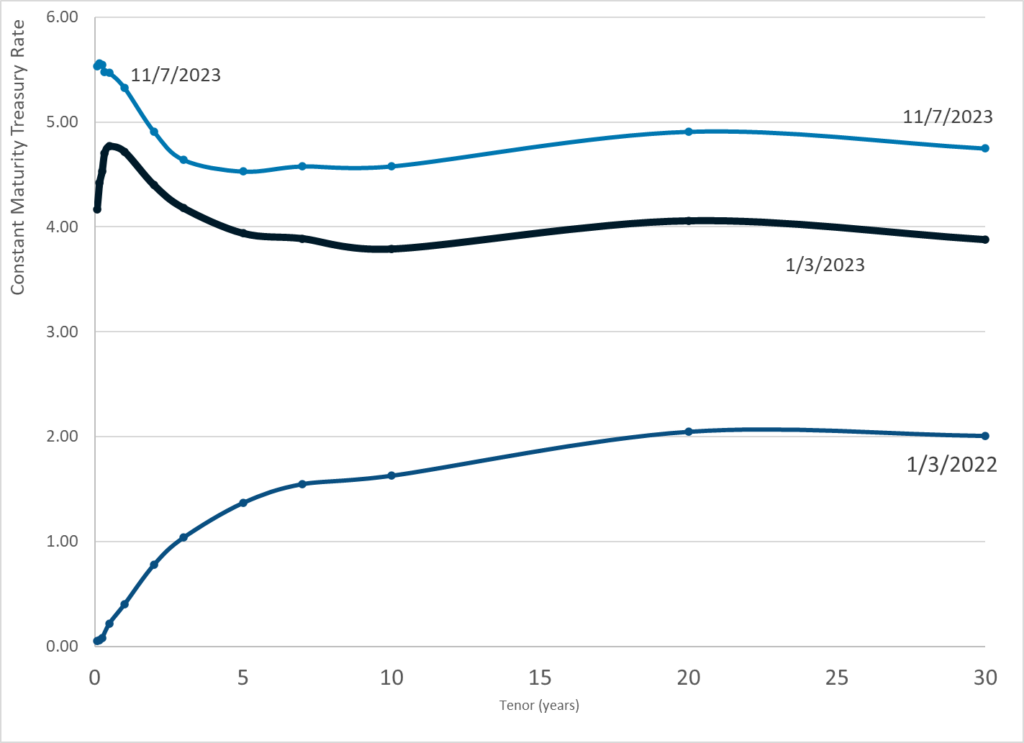

Graphic:

Publication Date: 7 Nov 2023

Publication Site: Treasury Dept

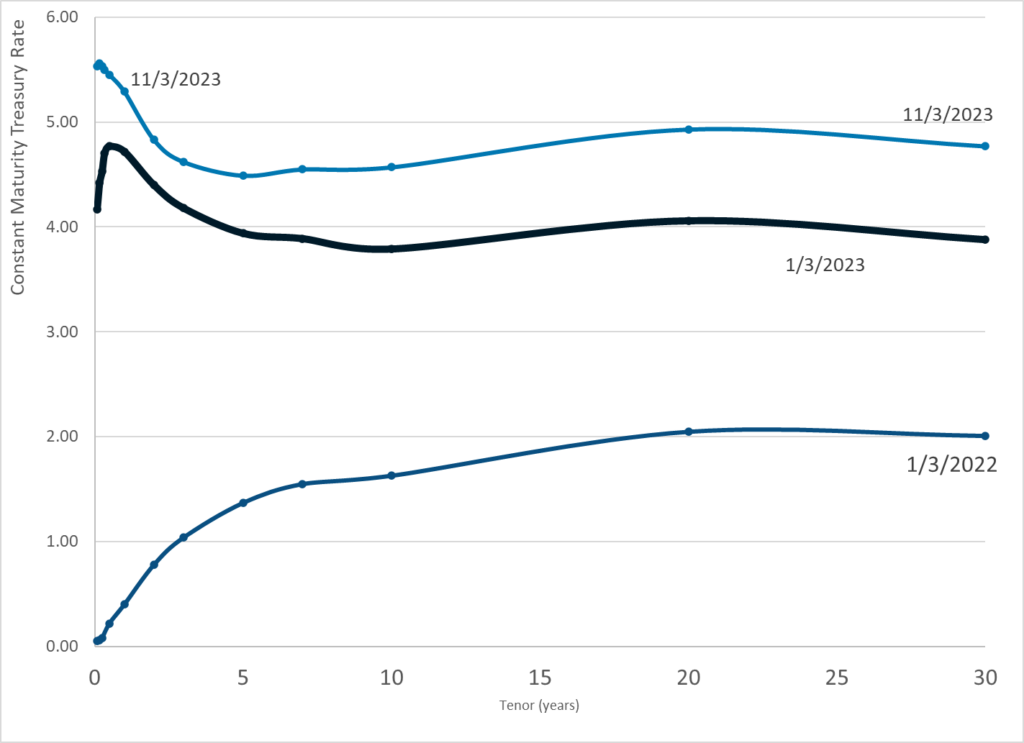

Graphic:

Publication Date: 3 Nov 2023

Publication Site: Treasury Dept