Graphic:

Publication Date: 7 Feb 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 7 Feb 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

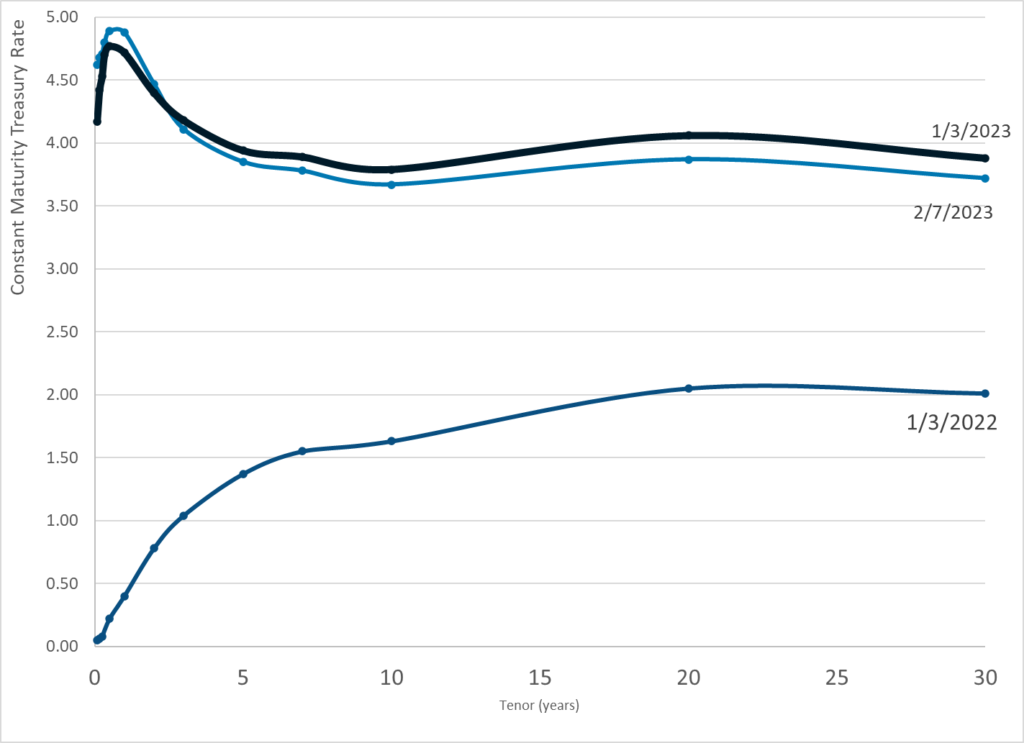

The stress test analysis found that 1,114 U.S. insurers, with a surplus of about $1.2 trillion, held some

amount of CLO tranches modeled. Similar to last year’s stress testing results, we found that the losses on

insurers’ CLO investments that were modeled, even in the stressed scenarios, were highly concentrated.

To understand the impact of potential losses on insurers, principal loss (compare with Table 7) for

scenarios A, B, and C was divided by each insurer’s year-end 2021 total surplus. For each scenario, the

principal loss as a percentage of total surplus for each of the 1,114 insurers was sorted from highest to

lowest. Then the insurer with the largest percentage loss was referenced as “Insurer 1,” the insurer with

the second largest percentage loss was referenced as “Insurer 2,” and so on until the smallest percentage loss, which was referenced as “‘Insurer 1,114” (x-axis). Please note the difference in the scale of the y-axis

in Charts 1, 2, and 3.

Chart 1 shows the distribution of losses as a percentage of surplus for December 2021’s Scenario A.

Although the bulk of insurers show no losses, 49 of the 1,114 insurers experienced losses in this

scenario. Intuitively, the losses were derived primarily from CCC-rated CLO tranches. The largest loss as

a percentage of surplus under Scenario A was 9.72%. Similar to the analysis for year-end 2020, no

insurers experienced double digit losses.

Author(s): Jean-Baptiste Carelus, Eric Kolchinsky, Hankook Lee, Jennifer Johnson, Michele Wong, Azar Abramov

Publication Date: Jan 2023

Publication Site: NAIC Capital Markets Special Reports

Graphic:

Publication Date: 6 Feb 2023

Publication Site: Treasury Dept

Link: https://www.pionline.com/washington/republican-led-house-committee-launches-anti-esg-working-group

Excerpt:

Congressional Republicans on Friday took another step in their quest to dismantle the Biden administration’s environmental, social and governance rule-making initiatives.

The House Financial Services Committee has formed a working group to “combat the threat to our capital markets posed by those on the far-left pushing environmental, social and governance proposals,” the committee’s Chairman Patrick McHenry, R-N.C., announced.

The group will be led by Rep. Bill Huizenga, R-Mich., and include eight other Republican committee members.

Among its priorities, the group will examine ways to “rein in the SEC’s regulatory overreach;” reinforce the materiality “standard as a pillar of the nation’s disclosure regime;” and hold to account market participants who “misuse the proxy process or their outsized influence to impose ideological preferences in ways that circumvent democratic lawmaking,” according to a news release.

“This group will develop a comprehensive approach to ESG that protects the financial interests of everyday investors and ensures our capital markets remain the envy of the world,” Mr. McHenry said in the news release. “Financial Services Committee Republicans as a whole will continue our work to expand capital formation, hold Biden’s rogue regulators accountable, and support American job creators.”

Author(s): Brian Croce

Publication Date: 3 Feb 2023

Publication Site: Pensions & Investments

Graphic:

Publication Date: 3 Feb 2023

Publication Site: Treasury Dept

Link: https://www.thinkadvisor.com/2023/02/01/fight-to-rename-medicare-advantage-gets-new-push/

Excerpt:

Rep. Mark Pocan and two colleagues are reviving a fight to take “Medicare” out of the name of the Medicare Advantage program — and, this time, they have a YouTube that looks like a parody of a Medicare Advantage TV ad.

The Wisconsin Democrat introduced the new version of the Save Medicare Act bill today, together with Reps. Ro Khanna, D-Calif., and Jan Schakowsky, D-Il..

The sponsors are promoting the position that “only Medicare is Medicare,” and that a Medicare Advantage plan may fail to provide the care that an older Medicare enrollee might need.

….

The bill would rename the Medicare Advantage program and prohibit Medicare Advantage plans from using the word “Medicare” in plan titles or ads.

The Pocan-Khanna-Schakowsky bill is a new version of H.R. 9187, a bill that Pocan and Khanna introduced in the 117th Congress. That bill had a total of four co-sponsors, all Democrats.

H.R. 9187 died in the House Energy and Commerce Committee and the House Ways and Means Committee at a time when Democrats controlled the House.

Author(s): Allison Bell

Publication Date: 1 Feb 2023

Publication Site: Think Advisor

Link: https://jacobin.com/2023/01/republicans-debt-ceiling-shock-doctrine-spending-cuts

Excerpt:

The debt ceiling is normally a dull topic, and many have understandably neglected to follow along. To recap, the debt ceiling is the artificial cap Congress places on the amount of money the government can borrow. As Secretary of the Treasury Janet Yellen and others have pointed out, there is little practical reason for the debt ceiling to exist at all. From a technical point of view, it is a formality to authorize the Treasury to pay bills the government has already incurred. Through creative accounting, the Treasury can keep paying for a few more months, and then it will have to stop unless Congress votes to raise the debt ceiling.

All sides agree that the US government deliberately defaulting on debts would be the financial equivalent of an atom bomb, causing immediate painful shocks across the world economy and unpredictable long-term effects. In order to avoid this scenario, voting to raise the debt ceiling is usually a matter of course — though the number of near and actual government shutdowns from Congress playing chicken with the ceiling have increased in recent decades.

But it might be different this time. As Politico reported last week, a number of former government officials who negotiated during previous standoffs over the debt ceiling think there’s much less room for a negotiated settlement this year.

The main reason is that, at least on the surface, House Speaker Kevin McCarthy is in a weak position, effectively held hostage by conditions that were imposed on him by the most extreme members of the House Republican conference during his election to speaker. Those conditions specifically require significant spending cuts in exchange for raising the debt ceiling.

….

Democrats also argue that though Republicans insist on reducing spending, they have refused to make specific demands for what they want cut. Here is where The Shock Doctrine might provide a hint of what’s to come. The idea of privatizing Social Security has been “lying around” since George W. Bush’s presidency. Joe Biden himself has a long, well-documented history of trying to cut Social Security and Medicare, though in public statements since 2020 he has consistently said he would not agree to do so.

Kevin McCarthy and other Republicans have repeatedly floated the idea of cutting the popular programs over the past year. While McCarthy appeared to abruptly back off the idea of cutting Social Security and Medicare as part of the debt ceiling negotiations on Sunday, his ambiguous promise to “strengthen” the programs without specifying what that means leaves plenty of room for privatization.

Author(s): Ben Beckett

Publication Date: 31 Jan 2023

Publication Site: Jacobin

Link: https://www.city-journal.org/fed-goes-underwater

Excerpt:

Before new trillion-dollar federal spending bonanzas became a regular occurrence, the Federal Reserve’s announcement that it lost over $700 billion might have garnered a few headlines. Yet the loss met with silence. Few Americans have noticed the huge increase in both the scale and the scope of the central bank or the dangers that it poses to the American economy. As Fed-driven inflation becomes the Number One political issue in America, that will change.

The Fed’s losses owe to a shift in the way it does business. Before the 2008 financial meltdown, the central bank tried to control interest rates by buying and selling U.S. bonds. A few billion in purchases or sales could move the whole economy, and this meant that the Fed, which operates much like a normal bank, could keep a relatively small balance sheet of under $1 trillion.

Since the financial crisis, the Federal Reserve, like other developed-world central banks, has used a different playbook. It provides enough funds to satiate the entire banking world, and it seeks to adjust the economy by paying banks more or less interest to hold those funds. These payments keep private-sector interest rates from dropping too low. When it first undertook this “floor” experiment, the Fed’s balance sheet exploded to more than $4 trillion. After the Covid pandemic, it approached $9 trillion.

A larger balance sheet means greater risks. And the Fed has added to that risk by purchasing longer-duration assets. Pre–financial crisis, the Fed bought mainly short-term federal debt. Only about 10 percent of all the U.S. bonds owned by the central bank lasted longer than ten years. Now, that figure has risen to 25 percent.

Author(s): Judge Glock

Publication Date: Winter 2023

Publication Site: City Journal

Graphic:

Publication Date: 1 Feb 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 31 Jan 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 30 Jan 2023

Publication Site: Treasury Dept

Link: https://mishtalk.com/economics/one-and-done-for-fed-rate-hikes-in-2023

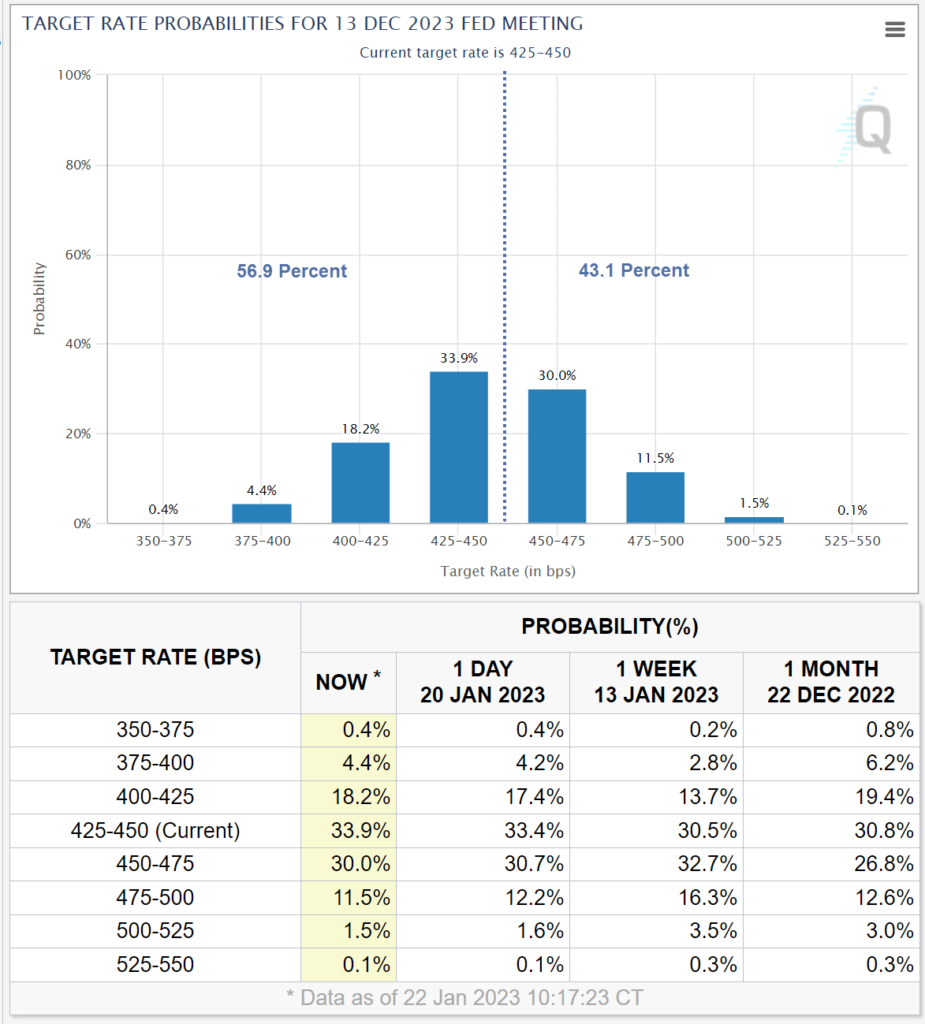

Graphic:

Excerpt:

The market says it’s odd-on for the Fed to cut rates later this year.

So is it one and done then one cut? Not quite.

The market believes there is a 90.1 percent chance the Fed gets in at least one more hike in 2023.

There’s a 36.4 percent chance of 2 or more quarter-point hikes through June.

Author(s): Mike Shedlock

Publication Date: 22 Jan 2023

Publication Site: Mish Talk