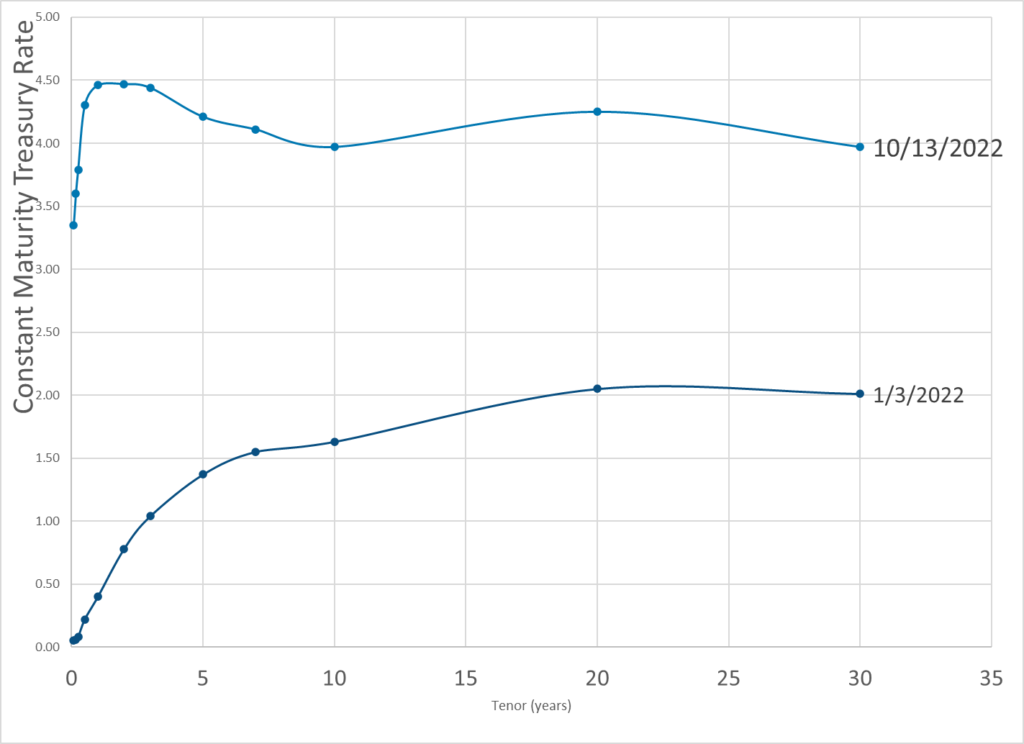

Graphic:

Publication Date: 13 Oct 2022

Publication Site: Dept of Treasury

All about risk

Graphic:

Publication Date: 13 Oct 2022

Publication Site: Dept of Treasury

Excerpt:

Louisiana Treasurer John Schroder is divesting $794 million worth of state funds from BlackRock because the world’s largest asset manager’s “blatantly anti-fossil fuel policies would destroy Louisiana’s economy.”

The divestment is in response to BlackRock’s sustainable investing philosophy, and for the firm calling on other companies to embrace net zero investment strategies that would harm the fossil fuel industry, which Schroder notes is a “vital part” of Louisiana’s economy.

“This divestment is necessary to protect Louisiana from actions and policies that would actively seek to hamstring our fossil fuel sector,” Schroder said in a letter to BlackRock CEO Larry Fink. “I refuse to invest a penny of our state’s funds with a company that would take food off tables, money out of pockets and jobs away from hardworking Louisianans.”

When asked to comment, a BlackRock spokesperson said the firm’s view is captured by a line in its Sept. 7 response to a letter it received from a group of 19 Republican state attorneys general saying environmental, social, and governance investments weaken America’s national security.

Author(s): Michael Katz

Publication Date: 10 Oct 2022

Publication Site: ai-CIO

Link: https://www.thinkadvisor.com/2022/10/11/cathie-woods-open-letter-to-fed-draws-snark/

Graphic:

Excerpt:

Ark Invest founder and CEO Cathie Wood is drawing snarky comments on and off Twitter after posting an open letter to the Federal Reserve challenging the central bank’s aggressive interest-rate hikes.

Wood published the letter on her firm’s website Monday as her ARK Innovation ETF (ARKK) sustained more blows in a year that has seen its returns slide more than 60%. Bloomberg reported Tuesday that the fund, which has fallen more than double the S&P 500′s decline, was down about 11% over three days.

Wood voiced concern the Fed is making a policy error that will lead to deflation and said it seemed to be basing its decisions on two lagging indicators: employment and headline inflation from official reports such as the Consumer Price Index. These variables “have been sending conflicting signals and should be calling into question the Fed’s unanimous call for higher interest rates,” she wrote.

Author(s): Dinah Wisenberg Brin

Publication Date: 11 Oct 2022

Publication Site: Think Advisor

Link: https://www.ai-cio.com/news/pbgc-provides-financial-assistance-to-struggling-metal-workers-pension/

Excerpt:

The Pension Benefit Guaranty Corporation approved a Special Financial Assistance program from a Metal Sheet Workers local pension plan in Massillon, Ohio, on Wednesday.

The plan covered 1,649 participants in the sheet metal trade. About 850 of them saw their benefits cut an average of 24% in May 2020 under the terms of the Multiemployer Pension Reforms Act of 2014. SFA will pay $28.8 million to make up the shortfall.

The MPRA allowed trustees of multiemployer plans to submit an application to the Treasury Department to reduce pension payouts if such a reduction is necessary to prevent the fund from running out of money.

Author(s): Paul Mulholland

Publication Date: 7 Oct 2022

Publication Site: ai-CIO

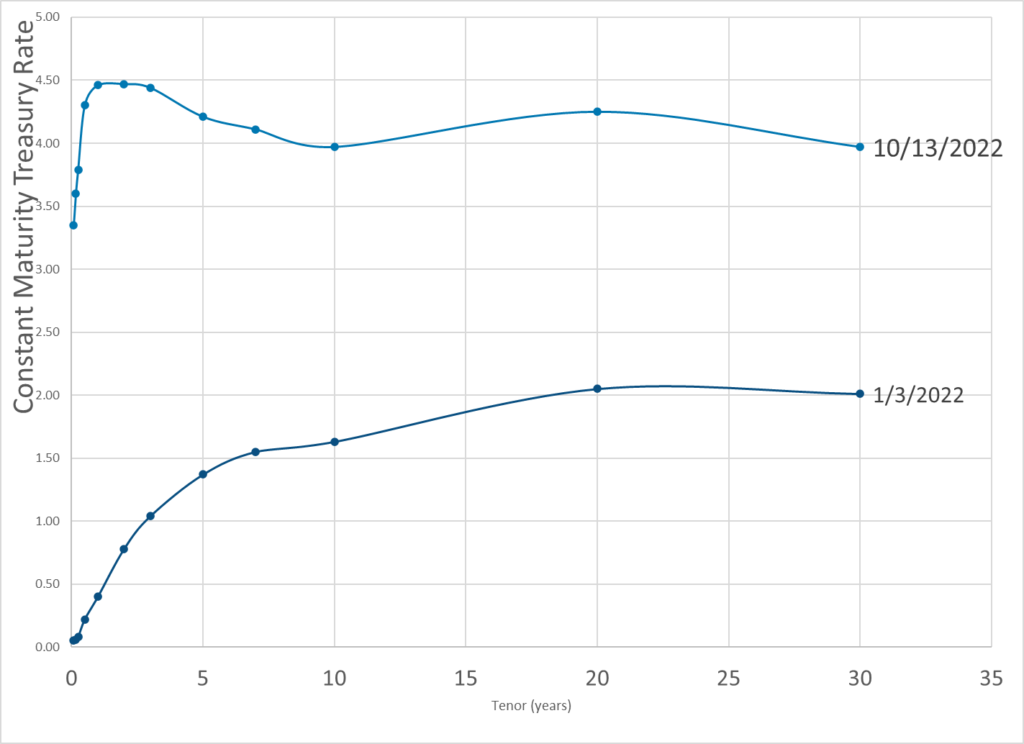

Link: https://www.soa.org/resources/research-reports/2022/decentralized-ins-alt/

Graphic:

Excerpt:

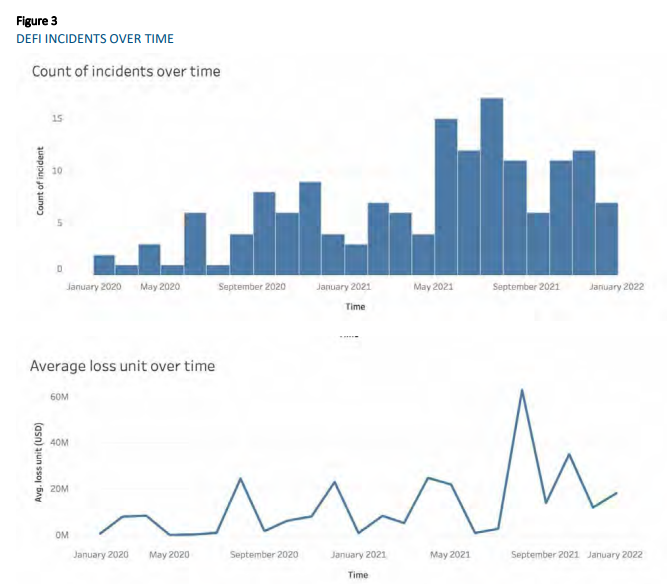

The DeFi ecosystem has been expanding rapidly in the past few years, growing from less than USD $1 billion in 2020 to USD $61.6 billion as of June 2022 as measured by Total Value Locked (TVL), the amount of crypto asset deposited in the DeFi protocols.

With continuous innovation in product design and delivery, the potential of DeFi adoption is massive. However, the rise of DeFi is marred by security issues. Nearly 200 blockchain hacking incidents have taken place in 2021 with approximately USD $7 billion in stolen funds (Cointelegraph, 2021). These hacking events have a wide range of causes including, but not limited to, the following:

Author(s):

Alvin Kwock

OneDegree

Erik Lie, FSA, CERA

Hailstone Labs

Gwen Weng, FSA, CERA, FCIA

Hailstone Labs

Rex Zhang, ASA

OneDegree

Publication Date: Sept 2022

Publication Site: Society of Actuaries

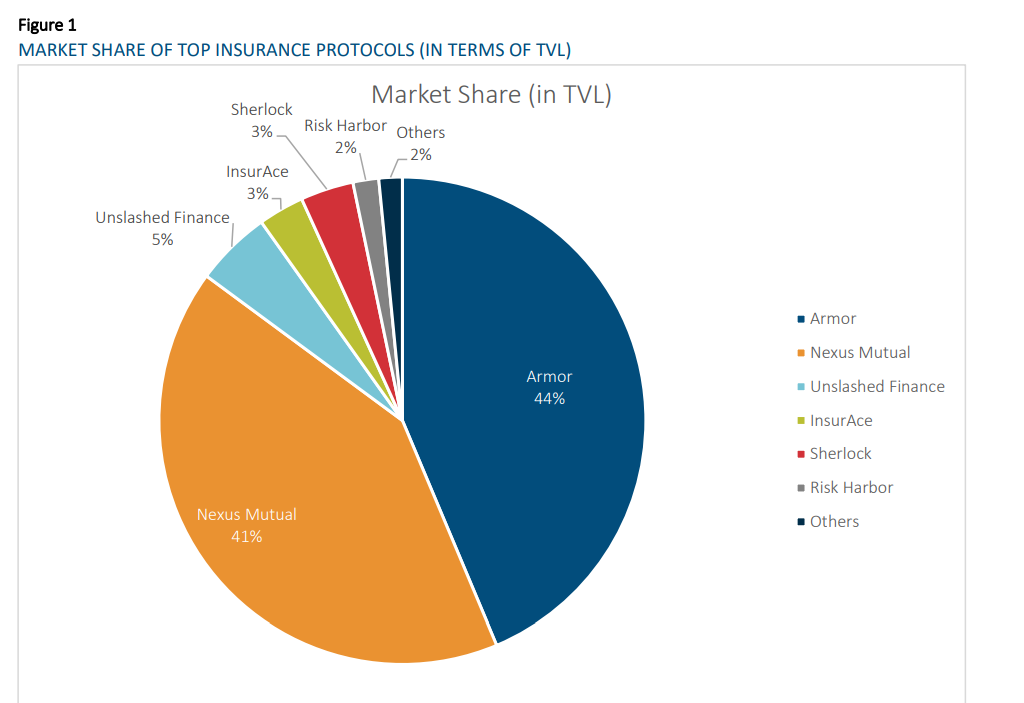

Graphic:

Publication Date: 11 Oct 2022

Publication Site: Dept of Treasury

Link: https://committees.parliament.uk/publications/30136/documents/174584/default/

Graphic:

Excerpt:

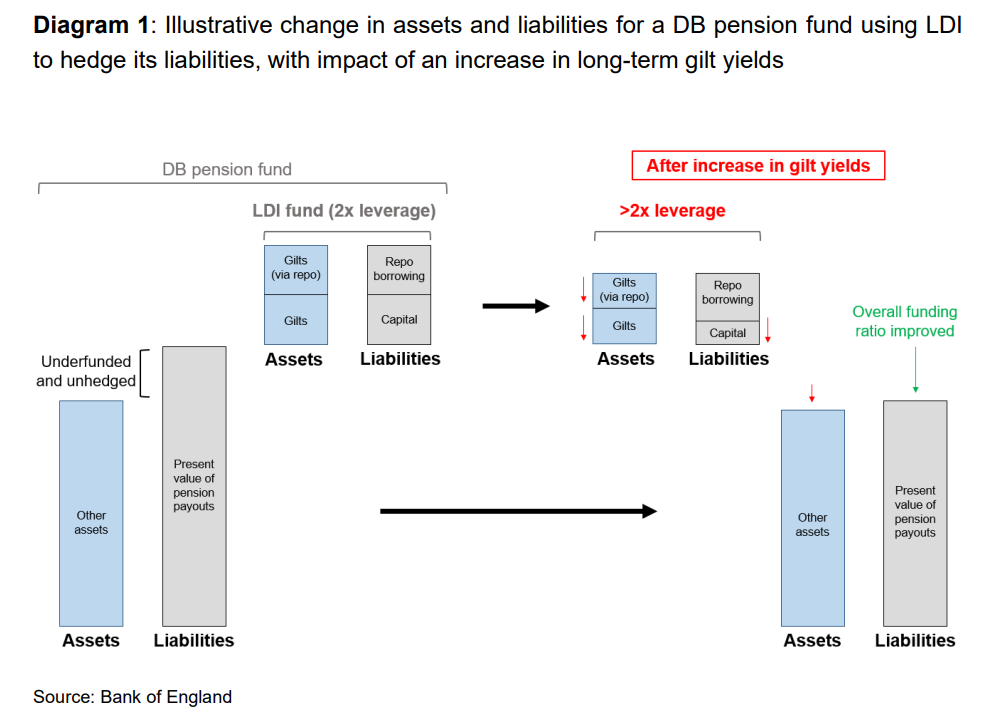

LDI strategies enable DB pension funds to use leverage (i.e. to borrow) to increase their

exposure to long-term gilts, while also holding riskier and higher-yielding assets such as

equities in order to boost their returns. The LDI funds maintain a cushion between the

value of their assets and liabilities, intended to absorb any losses on the gilts. If losses

exceed this cushion, the DB pension fund investor is asked to provide additional funds

to increase it, a process known as rebalancing. This can be a more difficult process for

pooled LDI funds, in part because they manage investment from a large number of small

and medium sized DB pension funds.Diagram 1 gives a stylised example of how the gilt market dynamics last week could

have affected a DB pension fund that was investing in an LDI fund. In this illustrative and simplified example, the left hand side of the diagram shows that the scheme is underfunded (in deficit) before any change in gilt yields, with the value of its assets lower than

the value of its liabilities. More than 20% of UK DB pension funds were in deficit in August

2022 and more than 40% were a year earlier. In this example, the fund is holding growth

assets to boost returns and has also invested in an LDI fund to increase holdings of longterm gilts, funded by repo borrowing at 2 times leverage (i.e. half of the holding of gilts in

the LDI fund is funded by borrowing). The cushion (labelled ‘capital’) is half the size of

the gilt holdings.The right hand side of the diagram shows what would happen should gilt yields rise (and

gilt prices fall). The value of the gilts that are held in the LDI fund falls, in this example by

around 30%. This severely erodes the cushion in the LDI fund. If gilt prices fell further, it

would risk eroding the entire cushion, leaving the LDI fund with zero net asset value and

leading to default on the repo borrowing. This would mean the bank counterparty would

take ownership of the gilts. It should be noted that in this example, the DB pension fund

might be better off overall as a result of the increase in gilt yields. This is because the

market value of its equity and shorter-term bond holdings (‘other assets’) would not fall

by as much as the present value of its pension liabilities, as the latter are more sensitive

to long-term market interest rates. The erosion of the cushion of the LDI fund would lead the LDI fund either to sell gilts to reduce its leverage or to ask the DB pension fund

investors to provide additional funds.

In practice, the move in gilt yields last week threatened to exceed the size of the cushion

for many LDI funds, requiring them to either sell gilts into a falling market or to ask DB

pension plan trustees to raise funds to provide more capital.

Author(s): Sir John Cunliffe, Deputy Governor, Financial Stability

Publication Date: 5 Oct 2022

Publication Site: UK Parliament

Excerpt:

The latest excessive fee suit targets “wildly excessive compensation,” an allegedly imprudent stable value offering, and the unmonitored use of “float” income.

More specifically, the participant-plaintiffs of Miami, Florida-based Lennar Corp. are raising issues with the recordkeeping/administrative fees (“wildly excessive compensation”) paid by the plan, the prudence of retaining Prudential’s stable value fund, and the use of float income by Prudential (the plan’s recordkeeper).

The lawsuit, filed in the U.S. District Court for the Southern District of Florida (Catenac v. Lennar Corp., S.D. Fla., No. 1:22-cv-23232, complaint 10/5/22), is directed at a plan with approximately $1.2 billion in assets and nearly 13,000 participants. The participant-plaintiffs are represented here by Morgan & Morgan PA.

Author(s): Nevin E. Adams, JD

Publication Date: 6 Oct 2022

Publication Site: NAPA-net

Link: https://www.toledoblade.com/opinion/editorials/2022/10/08/no-crypto-in-401-k-s/stories/20221004017

Excerpt:

Meanwhile, in Congress the Retirement Savings Modernization Act was just introduced to allow cryptocurrency and just about anything short of lottery tickets into America’s 401(k) accounts. The alternative asset industry — private equity, hedge funds, venture capital, real estate, and more — has been trying for years to offer their speculative products — and reap huge fees in the process — through personal retirement accounts as they are already able to do in some public pensions, such as Ohio’s.

There has been no legal barrier to these investments, and the Trump administration’s Department of Labor went so far as to specify that alternative investments could be part of 401(k)s, a decision affirmed by the Biden Administration. But companies administering 401(k) accounts are fiduciaries, and they’ve avoided alternative investments in fear of getting sued for breach of fiduciary duty for offering them to workers. For decades, prudence has prevailed and 401(k) retirement accounts have not allowed high-fee, illiquid funds as a 401(k) option.

The proposed bill simply states that alternative investments, despite the higher fees associated with them, are “covered” investments that do not establish fiduciary breach by their presence in a 401(k) plan. The cloak of congressionally created cover for alternative investments is needed because the current commonsense assumption is that the mere presence of these investments is strong evidence fiduciary duty has been breached.

Author(s): Blade Editorial Board

Publication Date: 8 Oct 2022

Publication Site: Toledo Blade

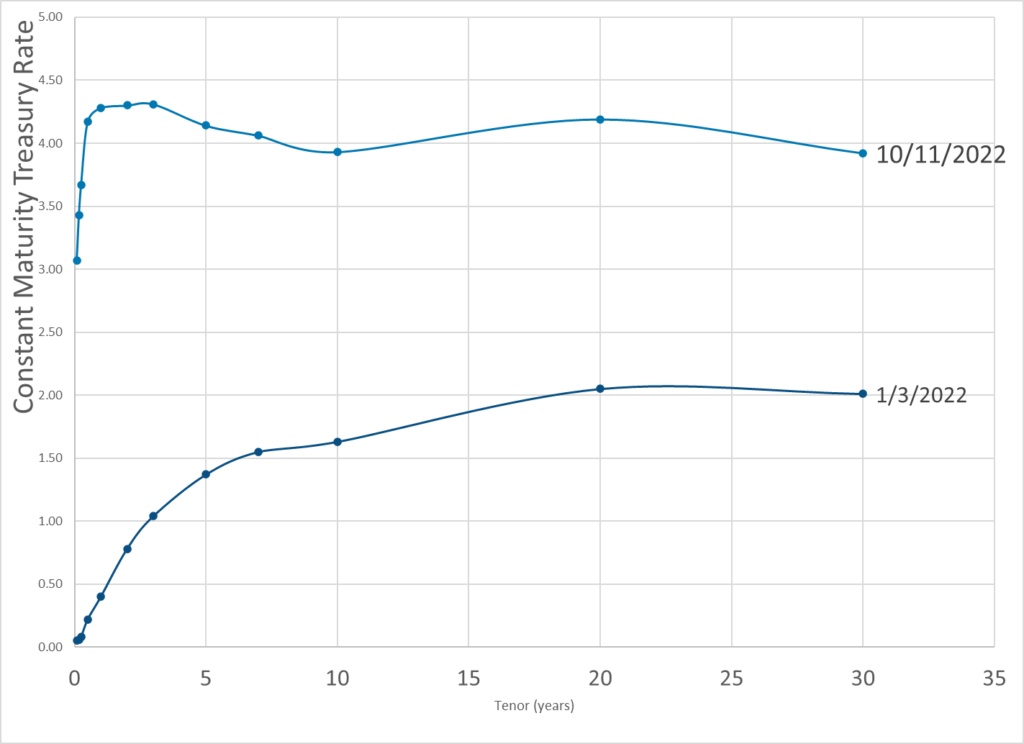

Link: https://www.soa.org/resources/research-reports/2022/decentralized-finance-protocols/

Graphic:

Excerpt:

Decentralized finance (DeFi) is an emerging and rapidly growing financial ecosystem with the defining feature that it is powered by blockchain technology. The focus of this paper is on risks for DeFi protocols that could lead to economic losses that could be insurable. This framework was designed around the risks associated with the existing and emerging DeFi protocols.

Author(s):

Tara Chang

OneDegree

Joe Ho

Hailstone Labs

Zachary Tirrell, FSA, FIAA

Gwen Weng, FSA, CERA, FCIA

Hailstone Labs

Jo You

OneDegree

Publication Date: October 2022

Publication Site: Society of Actuaries

Graphic:

Publication Date: 7 Oct 2022

Publication Site: Dept of Treasury

Excerpt:

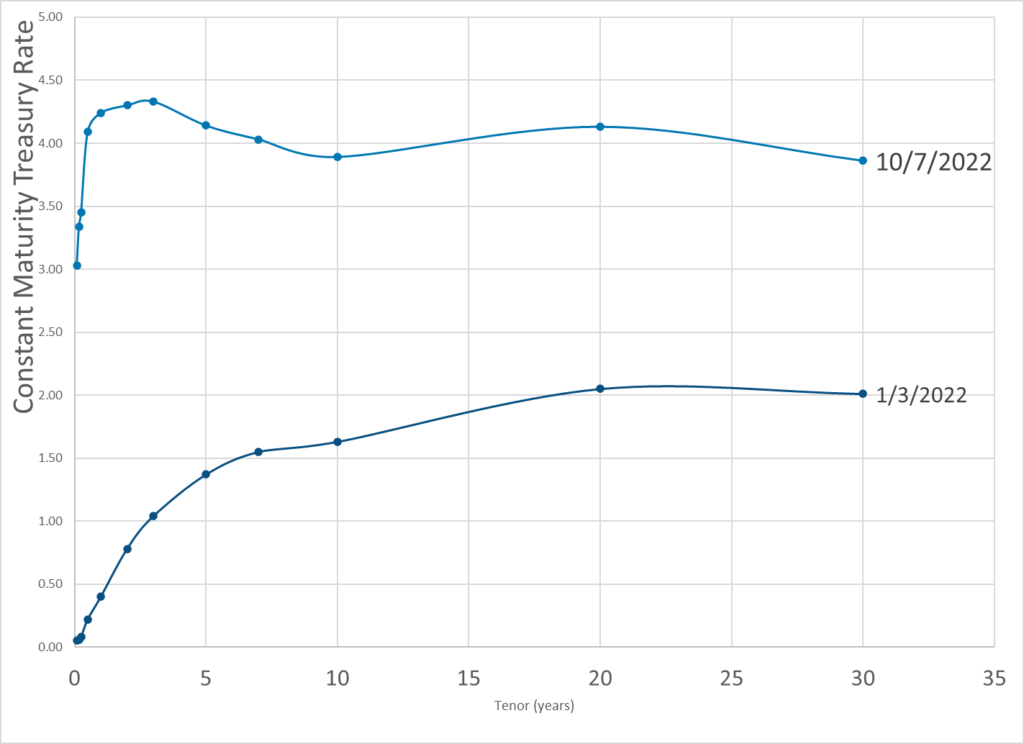

The Bank of England told lawmakers that a number of pension funds were hours from collapse when it decided to intervene in the U.K. long-dated bond market last week.

The central bank’s Financial Policy Committee stepped in after a massive sell-off of U.K. government bonds — known as “gilts” — following the new government’s fiscal policy announcements on Sept. 23.

The emergency measures included a two-week purchase program for long-dated bonds and the delay of the bank’s planned gilt sales, part of its unwinding of Covid pandemic-era stimulus.

The plunge in bond values caused panic in particular for Britain’s £1.5 trillion ($1.69 trillion) in so-called liability-driven investment funds (LDIs). Long-dated gilts account for around two-thirds of LDI holdings.

…..

The 30-year gilt yield fell more than 100 basis points after the bank announced its emergency package on Wednesday Sept. 28, offering markets a much-needed reprieve.

Cunliffe noted that the scale of the moves in gilt yields during this period was “unprecedented,” with two daily increases of more than 35 basis points in 30-year yields.

“Measured over a four day period, the increase in 30 year gilt yields was more than twice as large as the largest move since 2000, which occurred during the ‘dash for cash’ in 2020,” he said.

Author(s): Elliot Smith

Publication Date: 6 Oct 2022

Publication Site: CNBC