Link: https://committees.parliament.uk/publications/30136/documents/174584/default/

Graphic:

Excerpt:

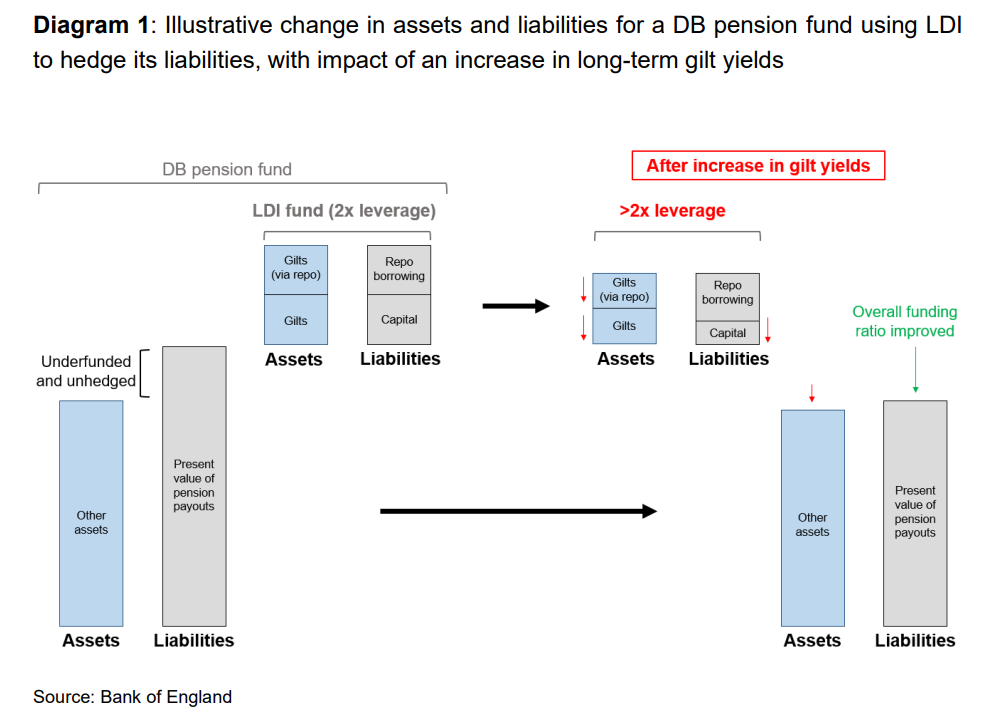

LDI strategies enable DB pension funds to use leverage (i.e. to borrow) to increase their

exposure to long-term gilts, while also holding riskier and higher-yielding assets such as

equities in order to boost their returns. The LDI funds maintain a cushion between the

value of their assets and liabilities, intended to absorb any losses on the gilts. If losses

exceed this cushion, the DB pension fund investor is asked to provide additional funds

to increase it, a process known as rebalancing. This can be a more difficult process for

pooled LDI funds, in part because they manage investment from a large number of small

and medium sized DB pension funds.Diagram 1 gives a stylised example of how the gilt market dynamics last week could

have affected a DB pension fund that was investing in an LDI fund. In this illustrative and simplified example, the left hand side of the diagram shows that the scheme is underfunded (in deficit) before any change in gilt yields, with the value of its assets lower than

the value of its liabilities. More than 20% of UK DB pension funds were in deficit in August

2022 and more than 40% were a year earlier. In this example, the fund is holding growth

assets to boost returns and has also invested in an LDI fund to increase holdings of longterm gilts, funded by repo borrowing at 2 times leverage (i.e. half of the holding of gilts in

the LDI fund is funded by borrowing). The cushion (labelled ‘capital’) is half the size of

the gilt holdings.The right hand side of the diagram shows what would happen should gilt yields rise (and

gilt prices fall). The value of the gilts that are held in the LDI fund falls, in this example by

around 30%. This severely erodes the cushion in the LDI fund. If gilt prices fell further, it

would risk eroding the entire cushion, leaving the LDI fund with zero net asset value and

leading to default on the repo borrowing. This would mean the bank counterparty would

take ownership of the gilts. It should be noted that in this example, the DB pension fund

might be better off overall as a result of the increase in gilt yields. This is because the

market value of its equity and shorter-term bond holdings (‘other assets’) would not fall

by as much as the present value of its pension liabilities, as the latter are more sensitive

to long-term market interest rates. The erosion of the cushion of the LDI fund would lead the LDI fund either to sell gilts to reduce its leverage or to ask the DB pension fund

investors to provide additional funds.

In practice, the move in gilt yields last week threatened to exceed the size of the cushion

for many LDI funds, requiring them to either sell gilts into a falling market or to ask DB

pension plan trustees to raise funds to provide more capital.

Author(s): Sir John Cunliffe, Deputy Governor, Financial Stability

Publication Date: 5 Oct 2022

Publication Site: UK Parliament