Link: https://lotsmoore.co.uk/why-do-pension-schemes-use-liability-driven-investment/

Excerpt:

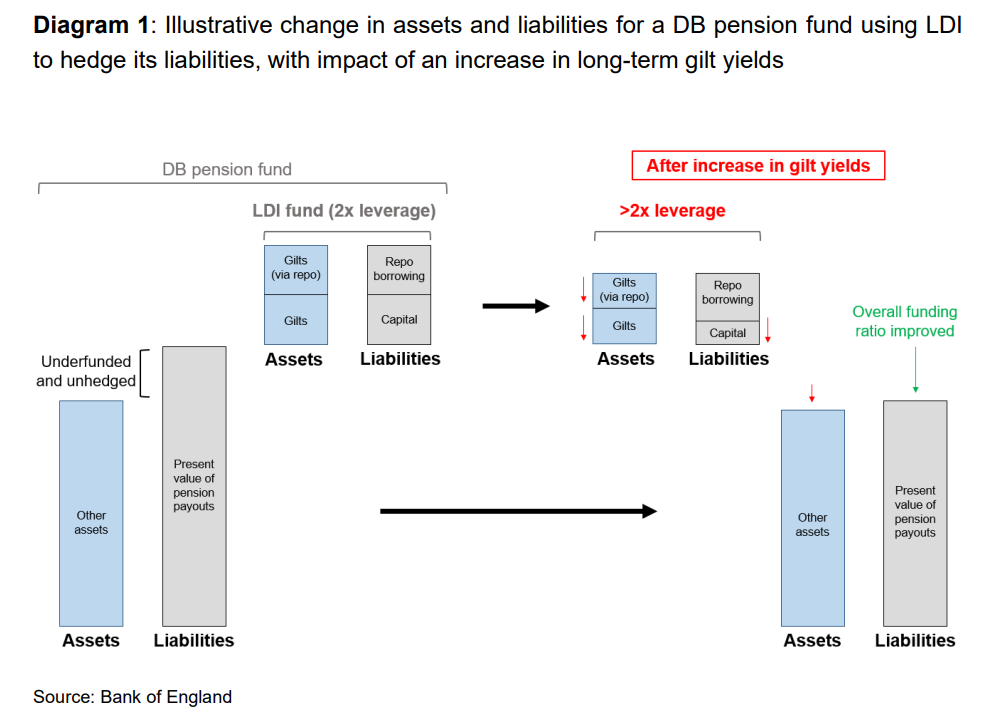

Liability-driven investment allows schemes to invest in the growth assets they need to close the funding gap while reducing the impact of interest rates on the liabilities. This is achieved by assigning a portion of a portfolio to an LDI fund. Rather than this fund just holding gilts, it holds a mixture of gilts and gilt repos.

A gilt repo is re-purchase agreement. The LDI manager sells a gilt to a counterparty bank while arranging to buy back that gilt at a later date for an agreed price. This gilt repurchase agreement provides cash to the pension scheme which it can then use to invest in other assets.

This mixture of gilts and gilt repos in an LDI fund uses leverage to provide capital to the pension fund. It is akin to using a mortgage to buy a house. Different levels of leverage were available in the funds – the more leverage, the greater the ratio of gilt repos to gilts in a fund.

The more leverage in a fund, the less capital a pension scheme had to lock up in government debt and the more it could use to invest in assets which could help to close its funding gap. This was helpful when interest rates were low but became problematic when gilt yields rose.

Author(s): Charlotte Moore

Publication Date: 17 Oct 2022

Publication Site: Lots Moore