Link: https://astralcodexten.substack.com/p/when-will-the-fda-approve-paxlovid

Graphic:

Excerpt:

For context: a recent study by Pfizer, the pharma company backing the drug, found Paxlovid decreased hospitalizations and deaths from COVID by a factor of ten, with no detectable side effects. It was so good that Pfizer, “in consultation with” the FDA, stopped the trial early because it would be unethical to continue denying Paxlovid to the control group. And on November 16, Pfizer officially submitted an approval request to the FDA, which the FDA is still considering.

As many people including Zvi, Alex, and Kelsey have noted, it’s pretty weird that the FDA agrees Paxlovid is so great that it’s unethical to study it further because it would be unconscionable to design a study with a no-Paxlovid control group – but also, the FDA has not approved Paxlovid, it remains illegal, and nobody is allowed to use it.

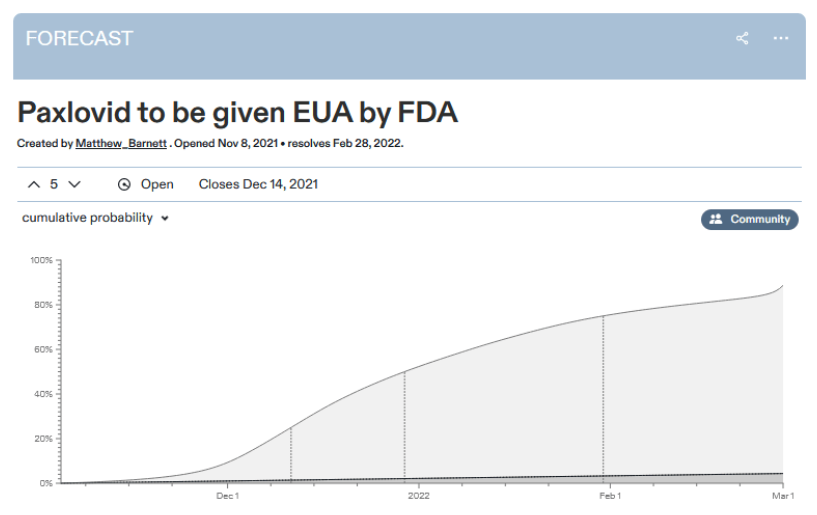

One would hope this is because the FDA plans to approve Paxlovid immediately. But the prediction market expects it to take six weeks – during which time we expect about 50,000 more Americans to die of COVID.

Perhaps there’s not enough evidence for the FDA to be sure Paxlovid works yet? But then why did they agree to stop the trial that was gathering the evidence? Or perhaps there’s enough evidence, but it takes a long time to process it? But then how come the prediction markets are already 90% sure what decision they’ll make?

Author(s): Scott Alexander

Publication Date: 22 Nov 2021

Publication Site: Astral Codex Ten