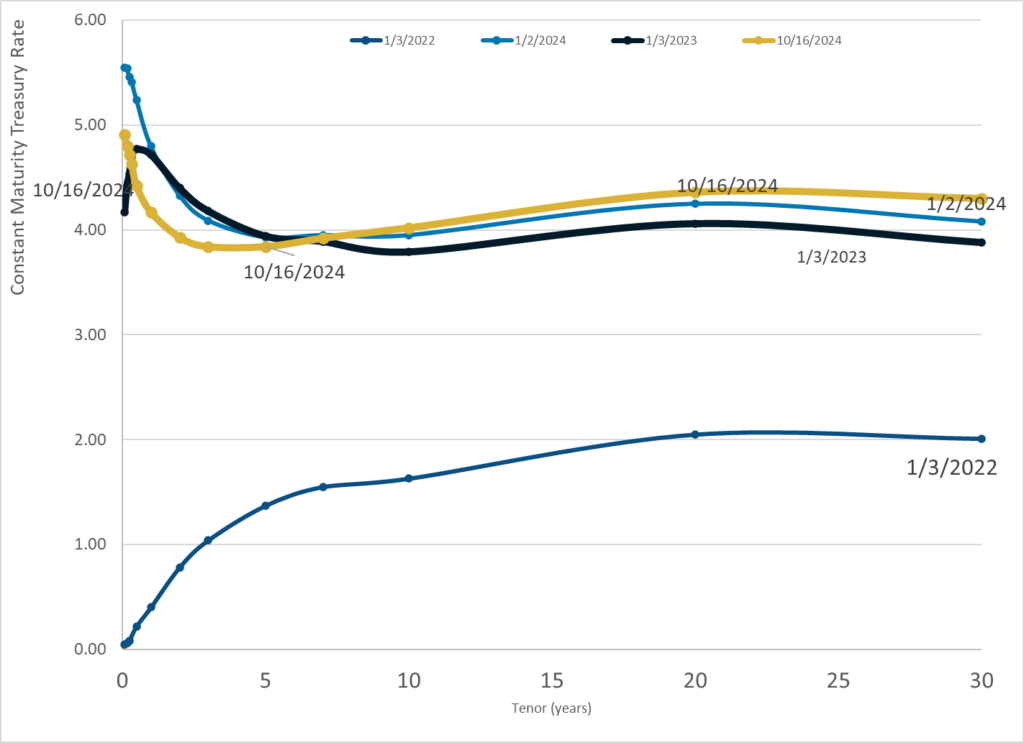

Graphic:

Publication Date: 16 Oct 2024

Publication Site: Treasury Dept

All about risk

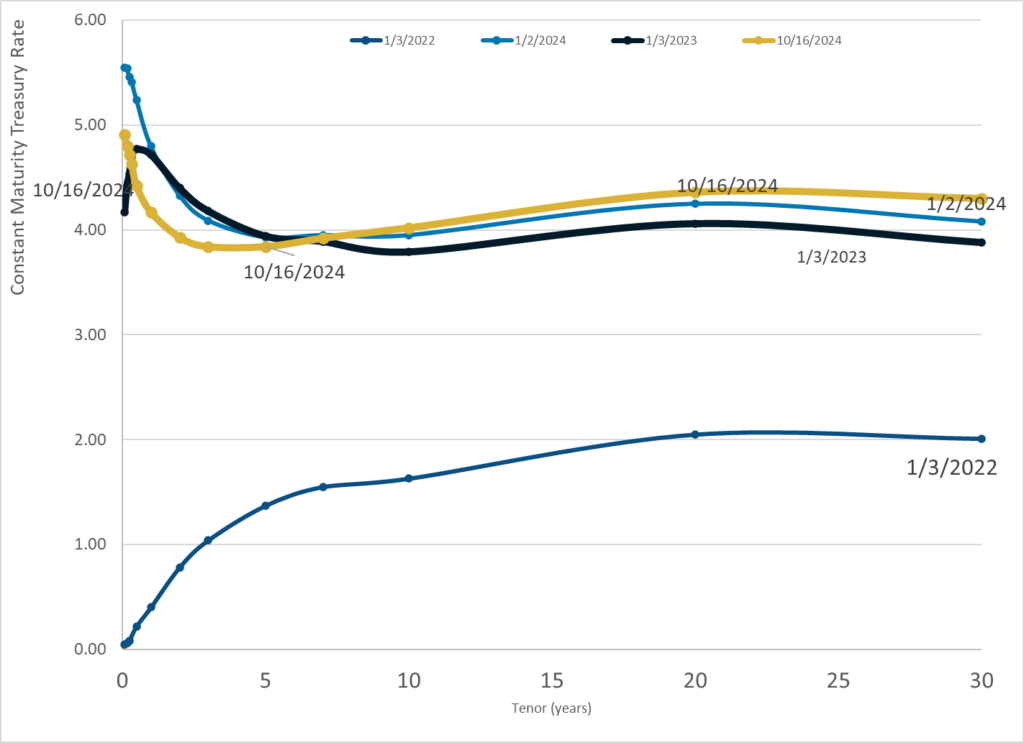

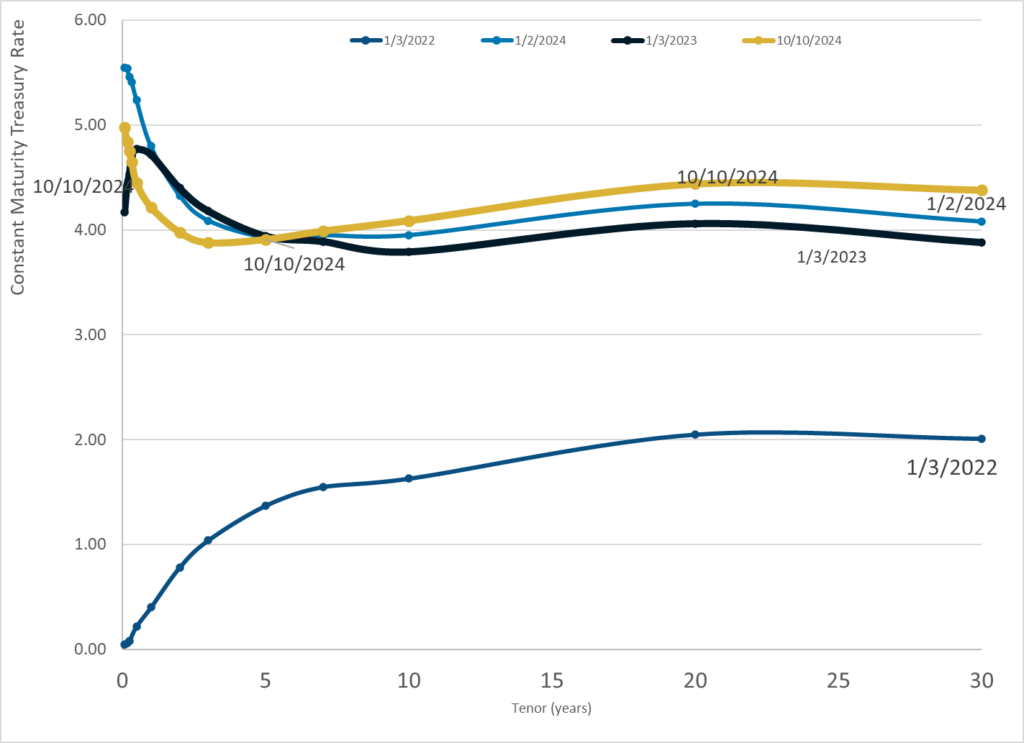

Graphic:

Publication Date: 16 Oct 2024

Publication Site: Treasury Dept

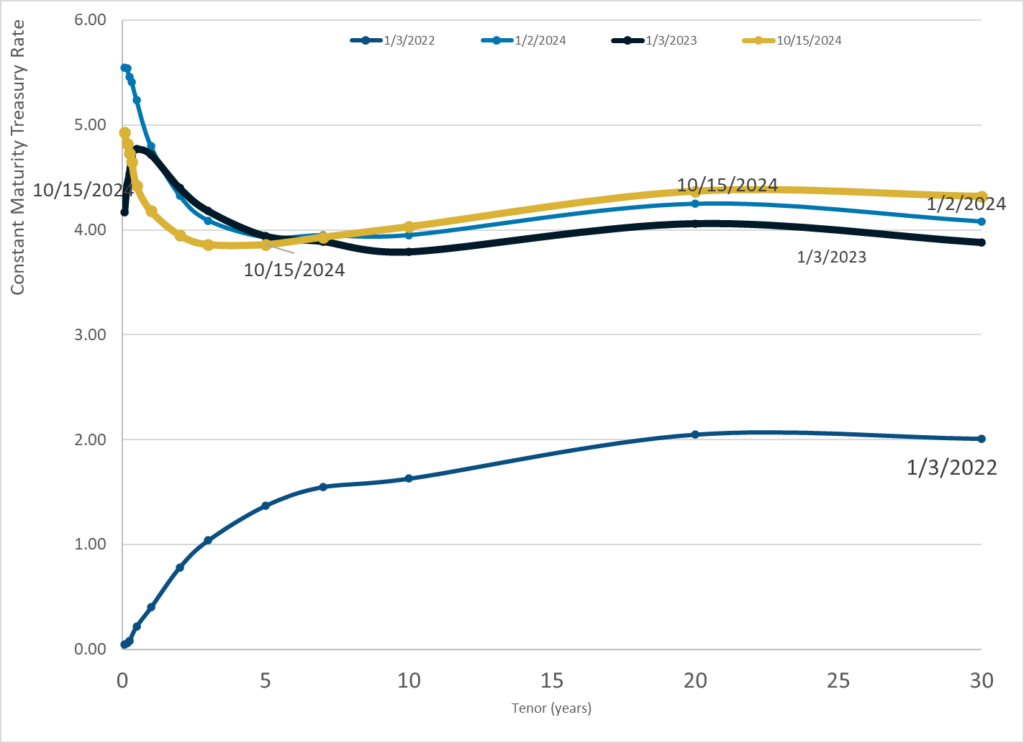

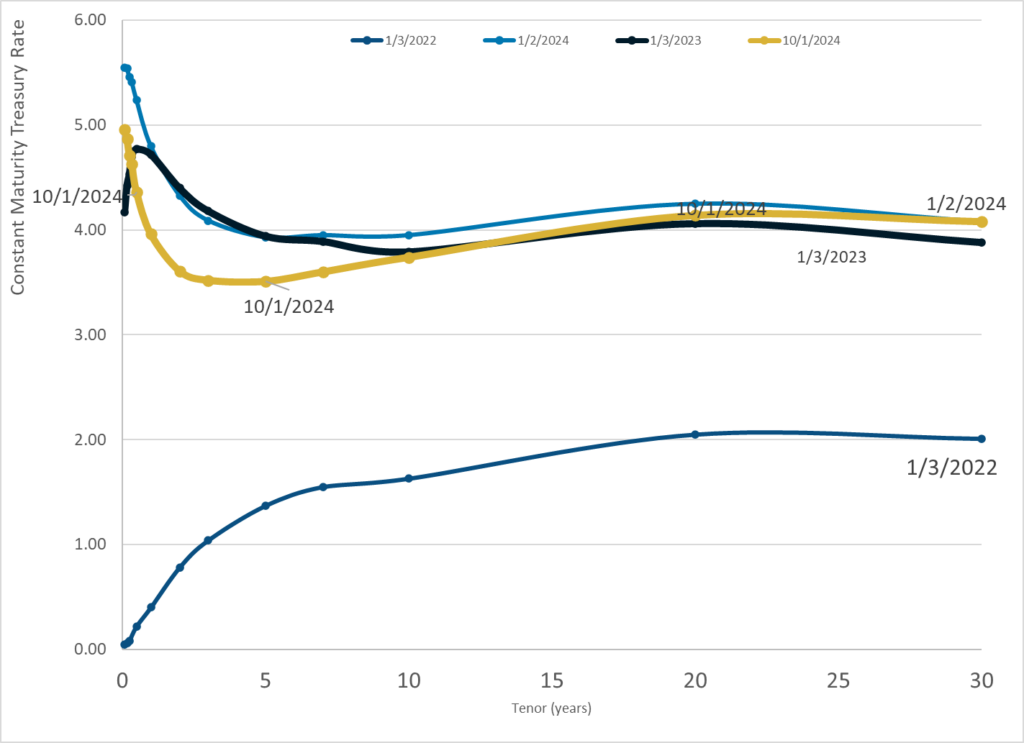

Graphic:

Publication Date: 15 Oct 2024

Publication Site: Treasury Dept

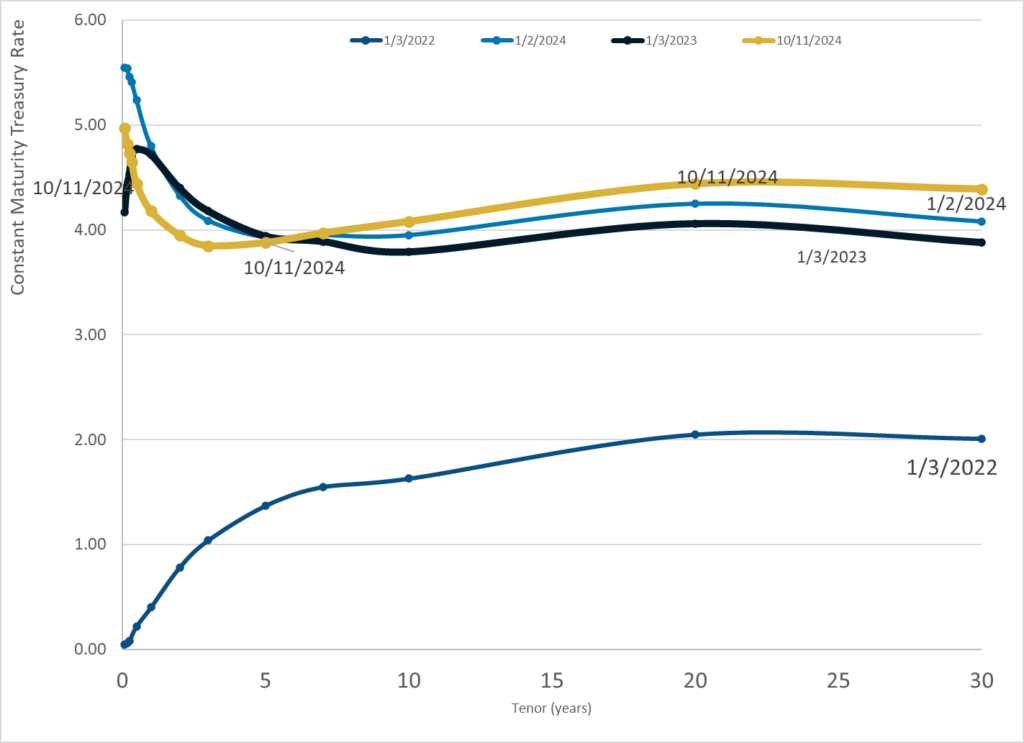

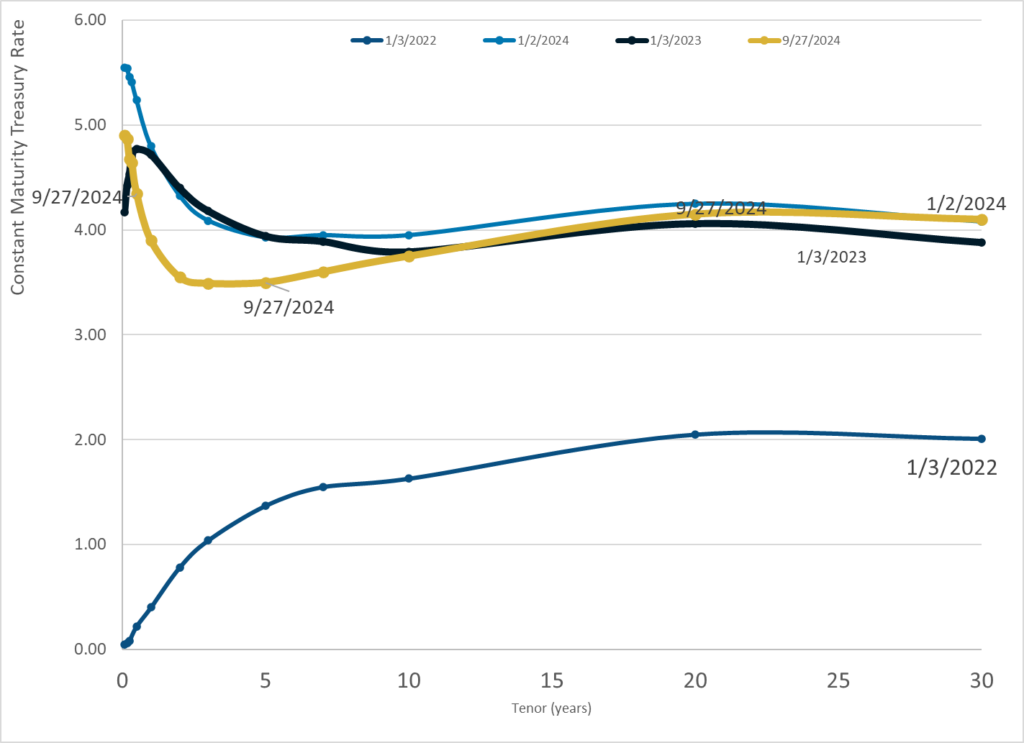

Graphic:

Publication Date: 11 Oct 2024

Publication Site: Treasury Dept

Link: https://www.bloomberg.com/opinion/articles/2024-10-14/td-was-convenient-for-criminals?srnd=undefined

Excerpt:

But TD Bank’s problem — which led to the largest AML-failures penalty ever — was not just about ignoring red flags. The more fundamental problem is that TD Bank tried to do its anti-money-laundering compliance on the cheap, and the prosecutors and regulators hate that. The Justice Department says:

[The TD Bank Global Anti-Money Laundering (GAML) group]’s budget was a primary driver of its decisions about projects, hiring, staffing, and technology enhancements throughout the relevant period. GAML executives strove to maintain what TD Bank Group referred to as a “flat cost paradigm” or “zero expense growth paradigm,” meaning that each department’s budget, including GAML’s, was expected to remain flat year-over-year, despite consistent growth in TD Bank Group’s revenue over the relevant period. This budgetary pressure originated with senior bank executives and was achieved within GAML and US-AML by [its chief AML officer] and [its Bank Secrecy Act officer], both of whom touted their abilities to operate within the “flat cost paradigm without compromising risk appetite” in their self-assessments. GAML’s base and project expenditures on USAML were less in fiscal year 2021 than they were in fiscal year 2018 and were not sufficient to address AML deficiencies including substantial backlogs of alerts across multiple workstreams, despite TDBNA’s profits increasing approximately 26% during the same period. In 2019, [the chief AML officer] referred to the Bank’s “historical underspend” on compliance in an email to the Group senior executive responsible for the enterprise AML budget, yet the US-AML budget essentially stayed flat. GAML and US-AML employees explained to the Offices that budgetary restrictions led to systemic deficiencies in the Bank’s transaction monitoring program and exposed the Bank to potential legal and regulatory consequences.

That, I think, is why the fine was so big. The message that this case is meant to send to banks is “if your compliance team wants more money to build a better AML program, you’d better give it to them, because otherwise we will fine you orders of magnitude more money than you would have spent.” The attorney general said:

TD Bank chose profits over compliance, in order to keep its costs down.

That decision is now costing the bank billions of dollars in criminal and civil penalties.

The deputy attorney general added:

We are putting down a clear marker on what we expect from financial institutions — and the consequences for failure.

When it comes to compliance, there are really only two options: invest now – or face severe consequences later.

As I’ve said before, a corporate strategy that pursues profits at the expense of compliance isn’t a path to riches; it’s a path to federal prosecution.

One job of a bank is to stop crime, which means that banks employ thousands of people who essentially work for the US Department of Justice. But the Department of Justice has no direct control over how many of those people there are, how much they get paid or what resources they have. Law enforcement agencies cannot directly set the banks’ budgets for anti-money-laundering programs, even though those budgets really are part of law enforcement. It is, perhaps, a frustrating situation: The Justice Department would like banks to spend more money catching criminals, and it can’t quite make them.

Except obviously it can. The Justice Department can’t directly set banks’ AML budgets, but it can do it indirectly, and it just did. If you are a bank compliance officer and you want to hire 2,000 people and get some shiny new computers, you can go to your regulators and say “do we need to spend this money on AML,” and they will say “that would be better,” and you will go to your chief executive officer with a transcript of the TD Bank press conference, and you will get whatever you want.

Author(s): Matt Levine

Publication Date: 14 Oct 2024

Publication Site: Bloomberg

Graphic:

Publication Date: 10 Oct 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 1 Oct 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 27 Sept 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 24 Sept 2024

Publication Site: Treasury Dept

Graphic:

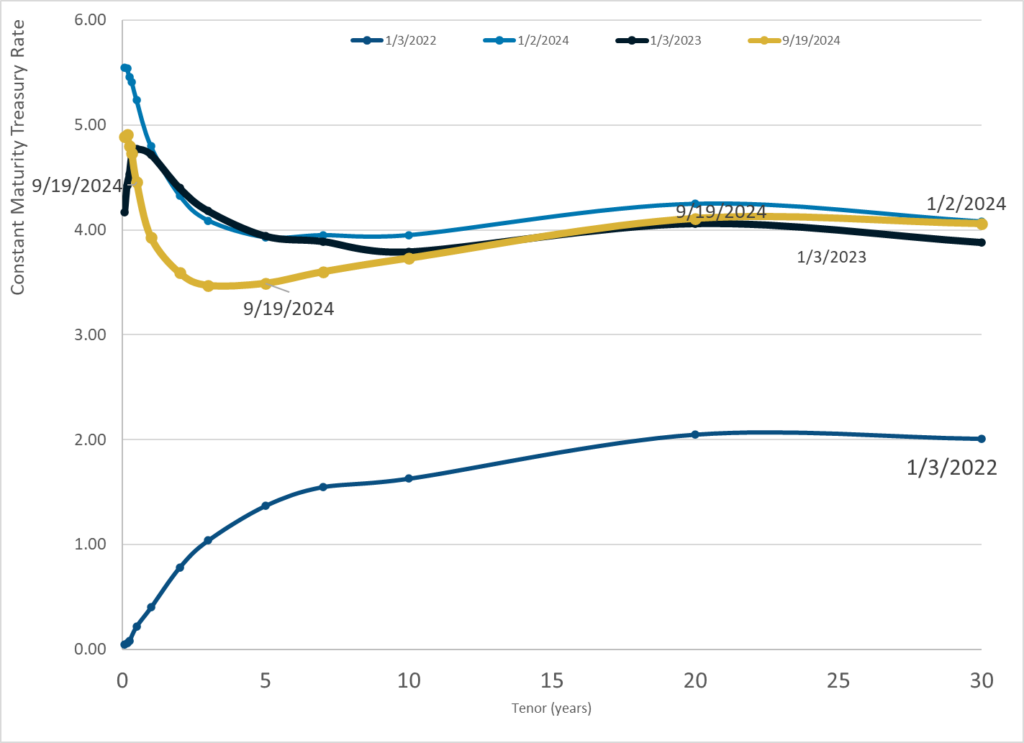

Publication Date: 19 Sept 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 18 Sept 2024

Publication Site: Treasury Dept

Link: https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

Graphic:

Excerpt:

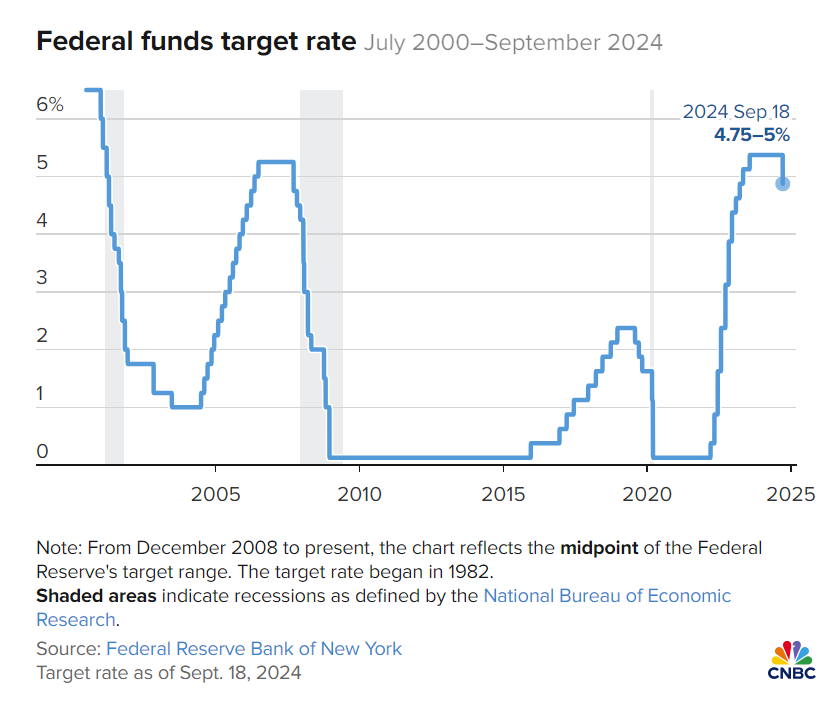

WASHINGTON – The Federal Reserve on Wednesday enacted its first interest rate cut since the early days of the Covid pandemic, slicing half a percentage point off benchmark rates in an effort to head off a slowdown in the labor market.

With both the jobs picture and inflation softening, the central bank’s Federal Open Market Committee chose to lower its key overnight borrowing rate by a half percentage point, or 50 basis points, affirming market expectations that had recently shifted from an outlook for a cut half that size.

Outside of the emergency rate reductions during Covid, the last time the FOMC cut by half a point was in 2008 during the global financial crisis.

The decision lowers the federal funds rate to a range between 4.75%-5%. While the rate sets short-term borrowing costs for banks, it spills over into multiple consumer products such as mortgages, auto loans and credit cards.

In addition to this reduction, the committee indicated through its “dot plot” the equivalent of 50 more basis points of cuts by the end of the year, close to market pricing. The matrix of individual officials’ expectations pointed to another full percentage point in cuts by the end of 2025 and a half point in 2026. In all, the dot plot shows the benchmark rate coming down about 2 percentage points beyond Wednesday’s move.

Author(s): Jeff Cox

Publication Date: 18 Sept 2024

Publication Site: CNBC

Graphic:

Excerpt:

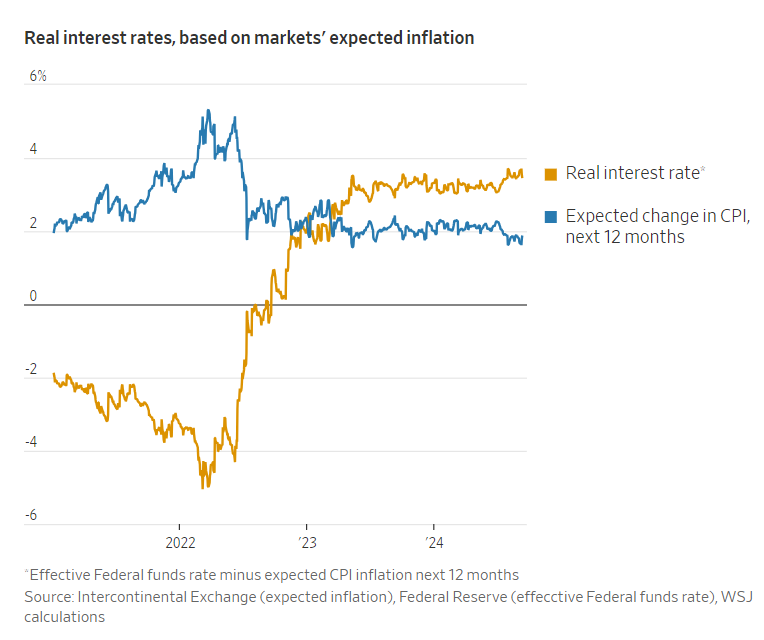

A year ago inflation as measured by the consumer-price index was 3.2%. In August, it was 2.5%. In that time, core inflation, which excludes food and energy, has fallen from 4.2% to an estimated 2.7%, using the Fed’s preferred gauge, the price index of personal-consumption expenditures, or PCE.

The gap between 2.7% and the Fed’s 2% target largely reflects the lagged effects of higher housing, auto and other prices from a few years ago. Some alternative indexes attempt to exclude such idiosyncratic factors. Harvard University economist Jason Furman averages several over different time horizons to yield a single, PCE-equivalent underlying inflation rate. It was 2.2% in August, the lowest since early 2021.

Inflation is likely to keep falling. Oil has plunged from $83 a barrel in early July to below $70 on Friday. This will directly lower headline inflation and, indirectly, core inflation because oil is an input into almost every business. A study by Robert Minton, now at the Fed, and Brian Wheaton at the University of California, Los Angeles, found oil can explain 16% of fluctuations in core inflation, and it takes two years for 80% of the effect to show up.

Author(s): Greg Ip

Publication Date: 15 Sept 2024

Publication Site: WSJ