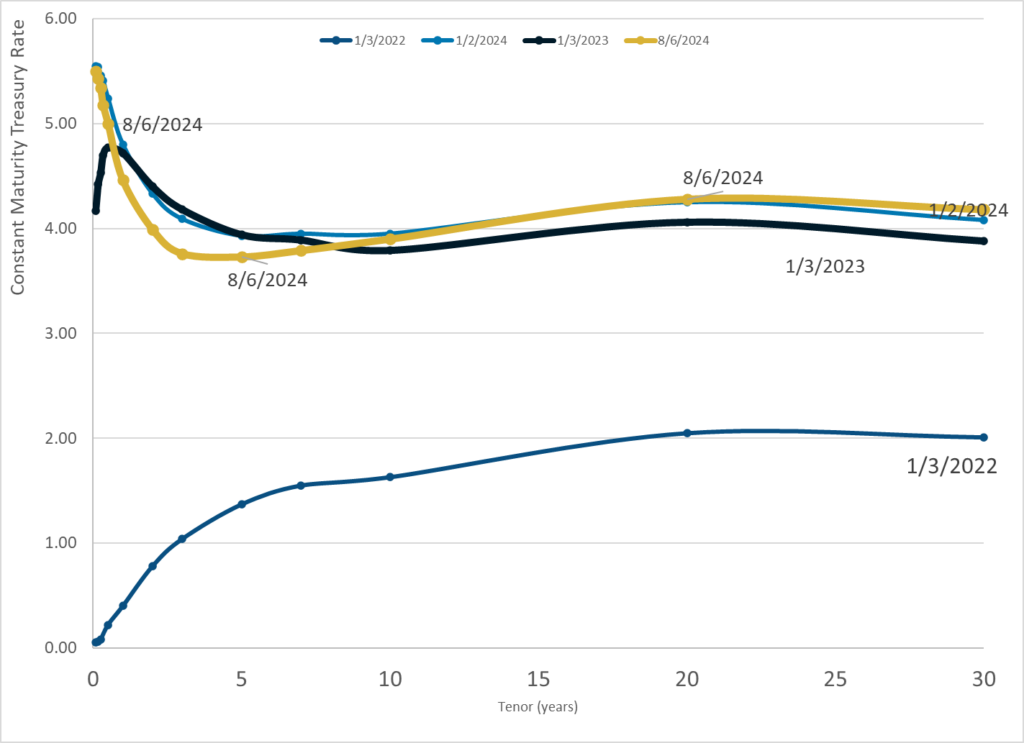

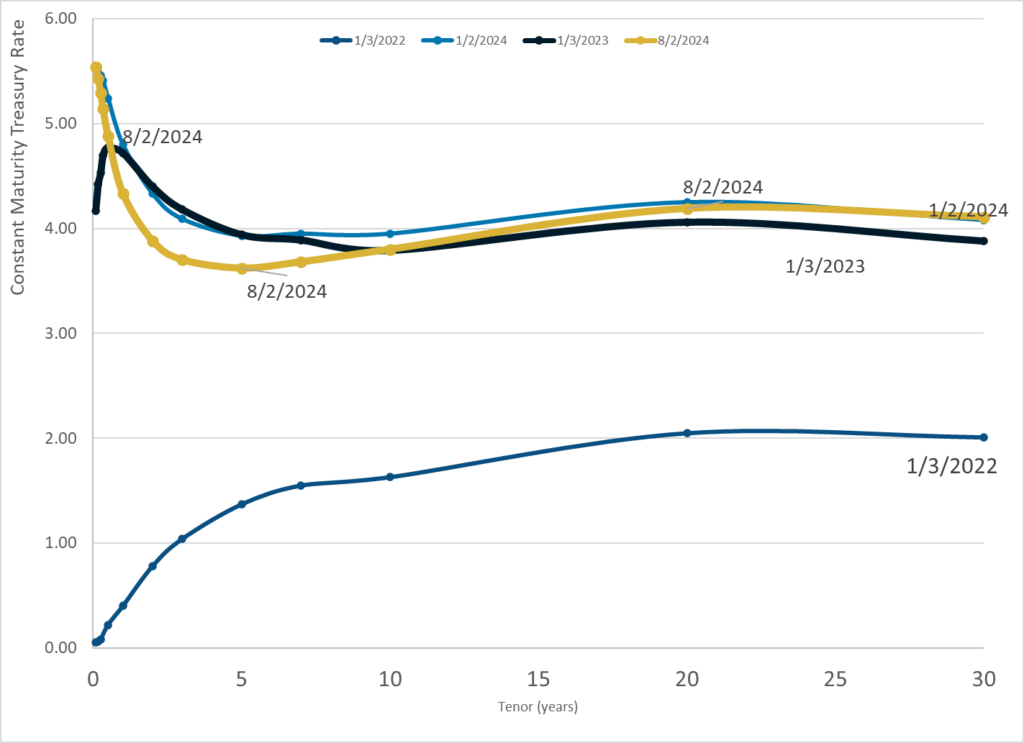

Graphic:

Publication Date: 6 Aug 2024

Publication Site: Treasury Dept

All about risk

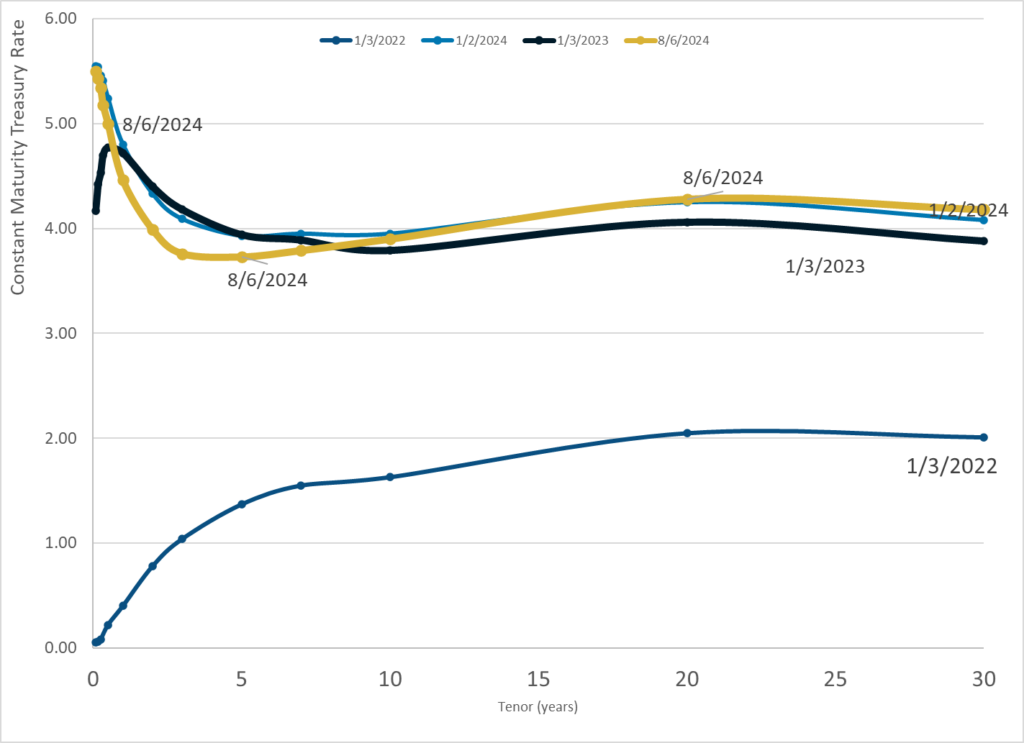

Graphic:

Publication Date: 6 Aug 2024

Publication Site: Treasury Dept

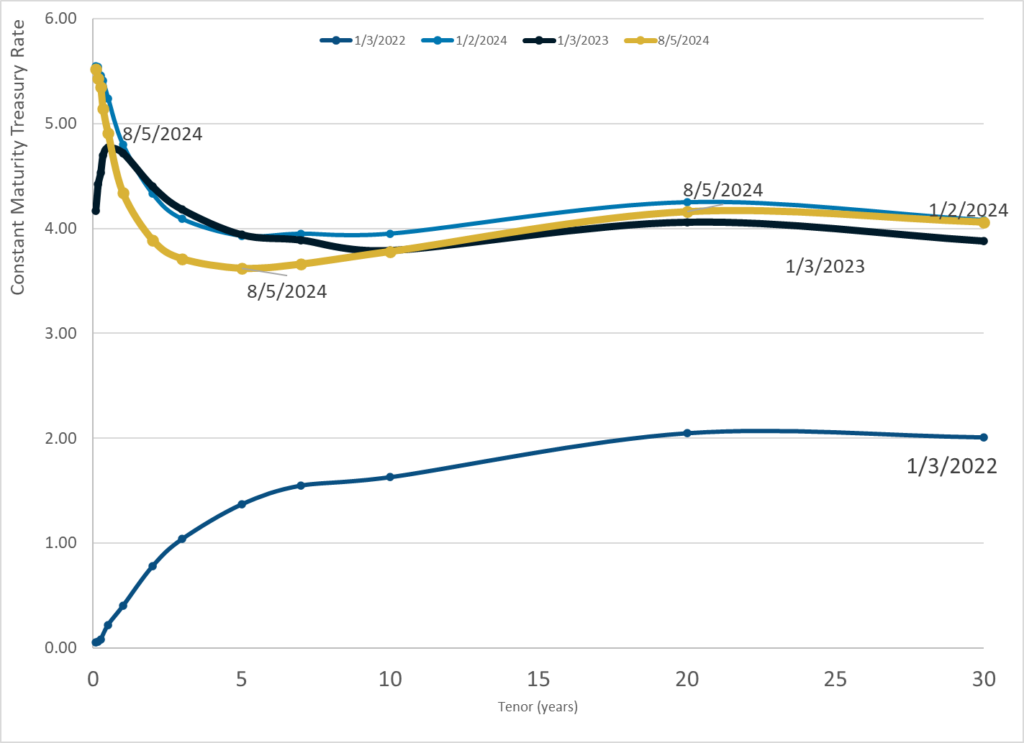

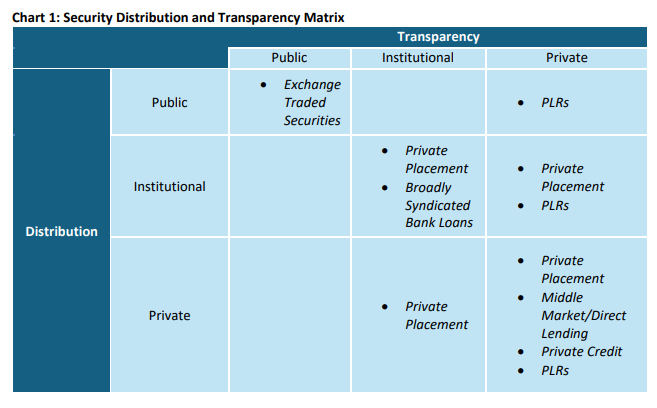

Graphic:

Publication Date: 5 Aug 2024

Publication Site: Treasury Dept

Link: https://mishtalk.com/economics/big-changes-in-fed-interest-rate-cut-expectations-this-year-and-next/

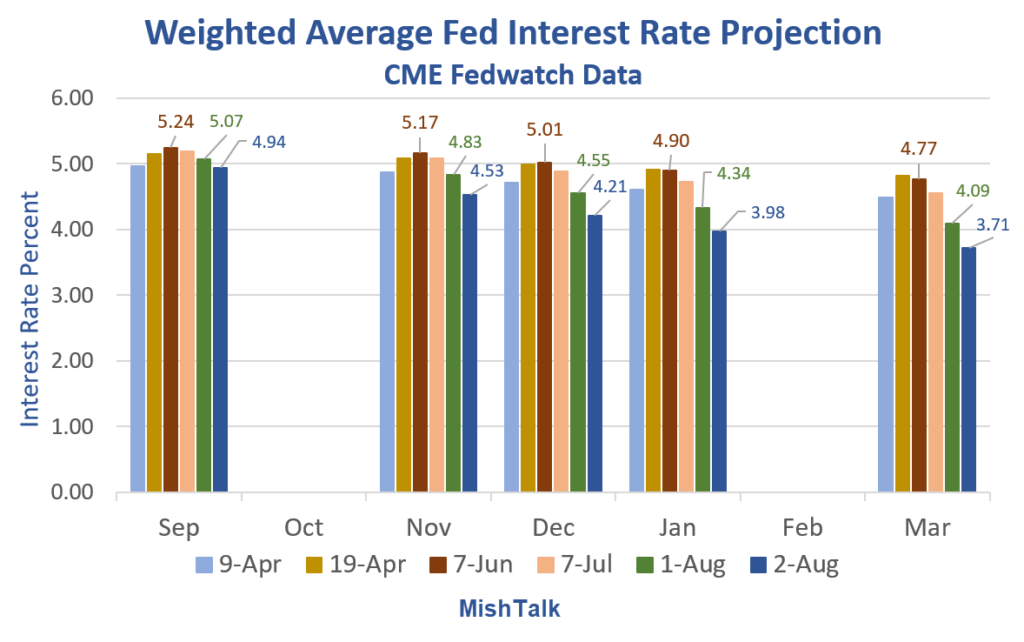

Graphic:

Excerpt:

I captured rate cut expectations before and after the Friday jobs reports. Let’s take a look.

The current rate is 5.25%-5.50% effectively 5.37%.

Those odds were smack in the middle of volatility.

The CME website now shows data as of August 1 (no change on Friday), so they have something messed up.

The chart above reflects the huge volatility we saw in bond yields on Friday.

….

Are too many cuts priced in or not enough?

That’s the question. I expect two cuts in September. Looking out to next year, I think too many cuts are priced in.

Author(s): Mike Shedlock

Publication Date: 3 Aug 2024

Publication Site: Mish Talk

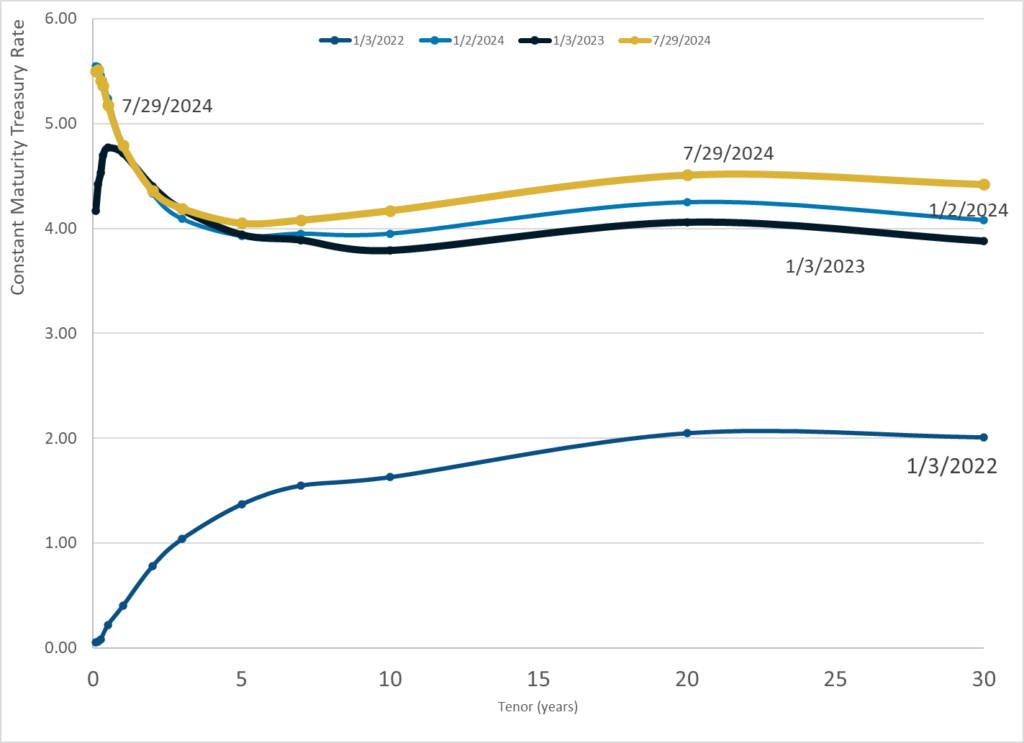

Graphic:

Publication Date: 2 Aug 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 31 July 2024

Publication Site: Treasury Dept

Link: https://content.naic.org/sites/default/files/capital-markets-market-buzz-private-credit-plr.pdf

Graphic:

Excerpt:

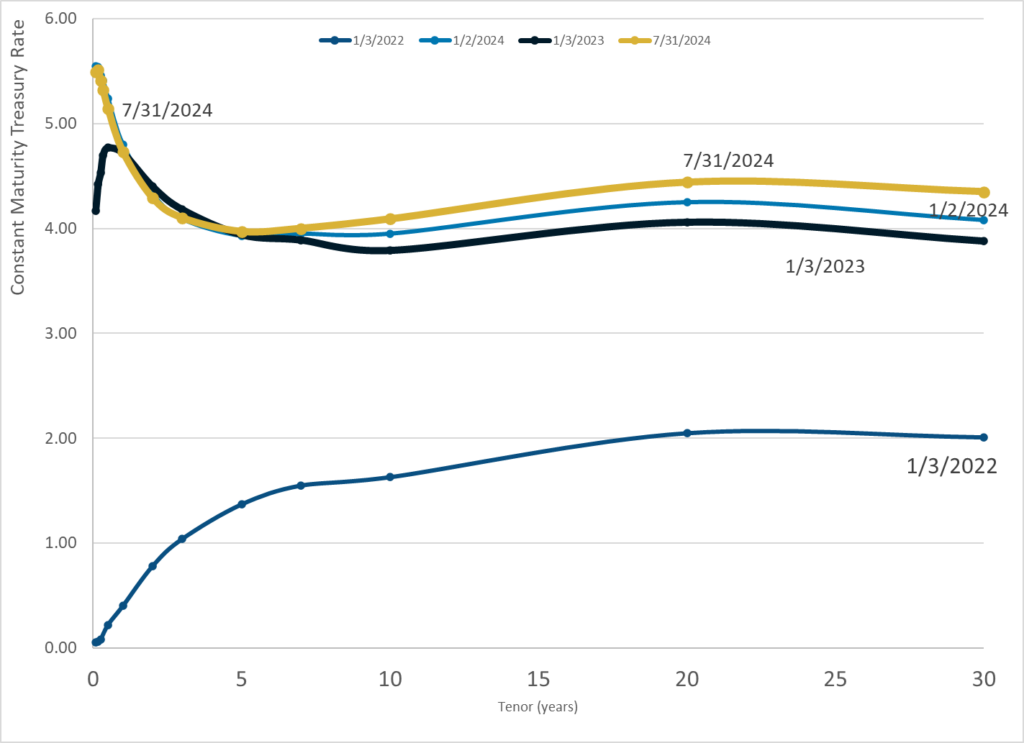

The terms private credit and private letter ratings (PLRs) have unintentionally elicited some confusion

about their respective meanings. While there is no standardized definition, and the term may be used

differently by market participants, private credit generally refers to debt, or debt-like, securities that are

not publicly issued or traded. On the other hand, PLRs refer to credit opinions that are assigned to

privately rated securities by credit rating providers and are only communicated to the issuer and a

specified group of investors.

To bring some clarity, at least with respect to how the NAIC views them, these terms can be characterized

in two dimensions: 1) distribution; and 2) transparency.

Publication Date: 30 July 2024

Publication Site: NAIC Capital Markets Bureau Market Buzz

Graphic:

Publication Date: 29 July 2024

Publication Site: Treasury Dept

Link:

https://content.naic.org/sites/default/files/capital-markets-special-reports-bank-loans-ye2023_0.pdf

Graphic:

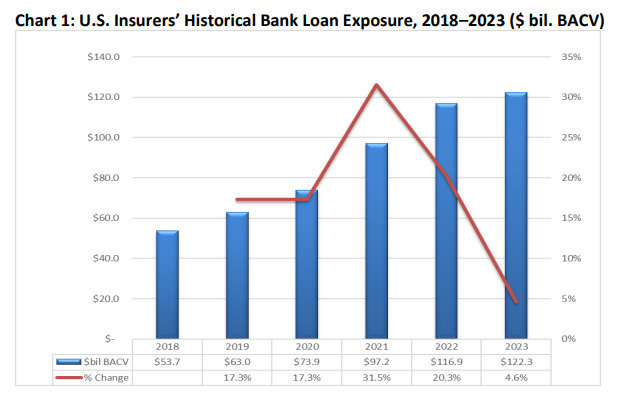

Executive Summary:

Bank loan investments increased to about $122 billion in book/adjusted carrying value (BACV)

at year-end 2023 from $117 billion at year-end 2022.Despite the 4.6% growth, bank loansremained at 1.4% of U.S. insurers’ total cash and invested

assets at year-end 2023—the same as year-end 2022.Approximately 70% of U.S. insurers’ bank loan investments were acquired, and 85% were held

by life companies.In particular, large life companies, or those with more than $10 billion in assets under

management, accounted for 82% of U.S. insurers’ bank loan exposure, up from nearly 80% in

2022.The top 25 insurance companies accounted for 75% of U.S. insurers’ total bank loan

investments at year-end 2023; the top 10 accounted for about 60%.Improvement in credit quality for U.S. insurer-bank loans continued, evidenced by a fourpercentage-point increase in those carrying NAIC 1 and NAIC 2 designations and a

corresponding four-percentage-point decrease in bank loans carrying NAIC 3 and NAIC 4

designations.

Author(s): Jennifer Johnson

Publication Date: 16 July 2024

Publication Site: NAIC Capital Markets Special Report

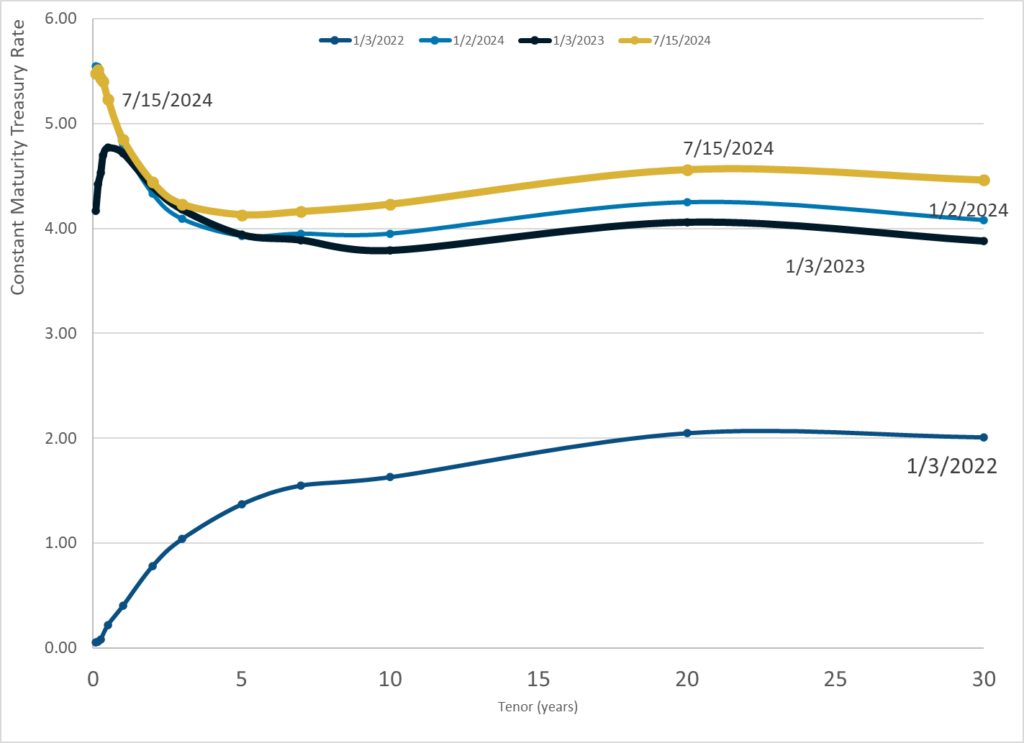

Graphic:

Publication Date: 15 July 2024

Publication Site: Treasury Dept

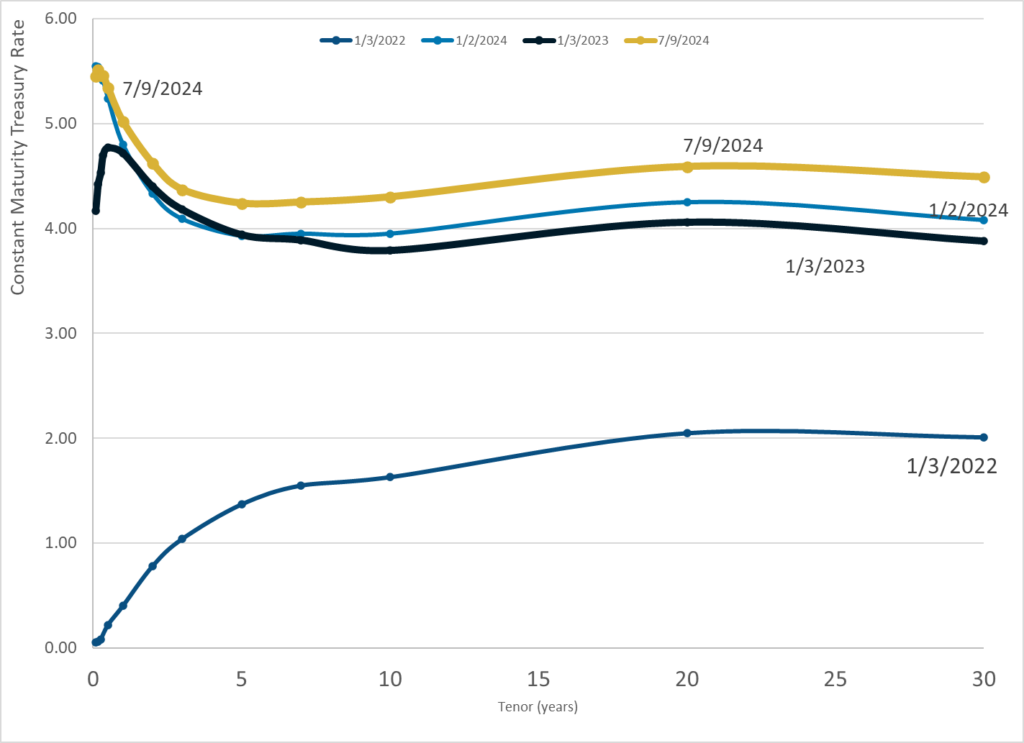

Graphic:

Publication Date: 9 July 2024

Publication Site: Treasury Department

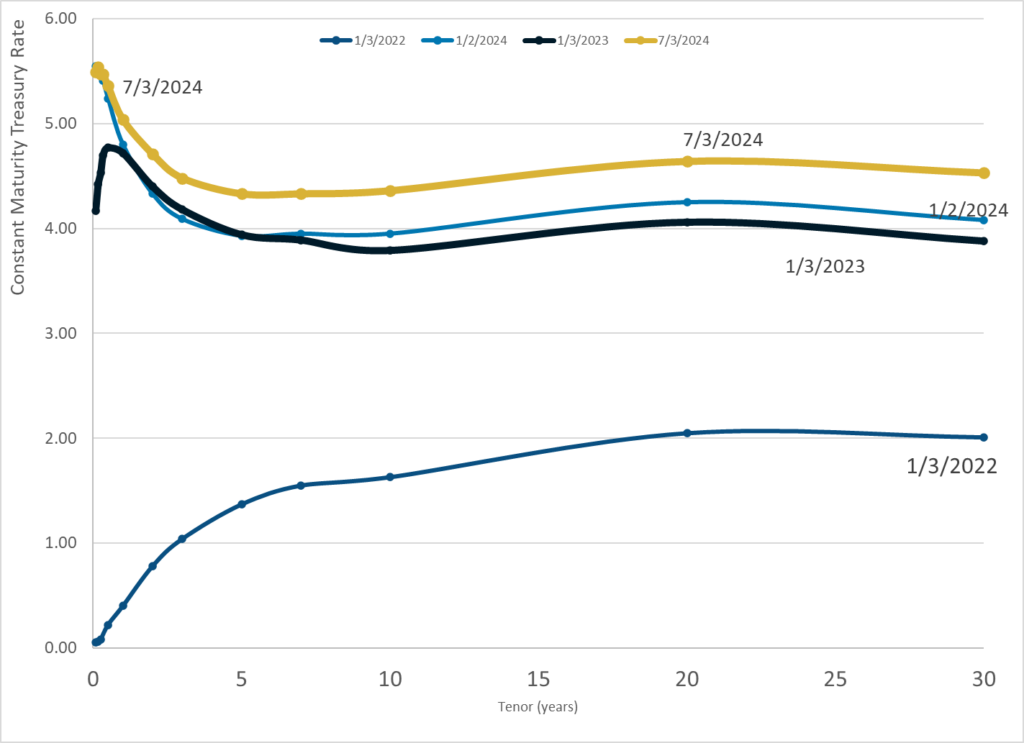

Graphic:

Publication Date: 3 July 2024

Publication Site: Treasury Dept

Graphic:

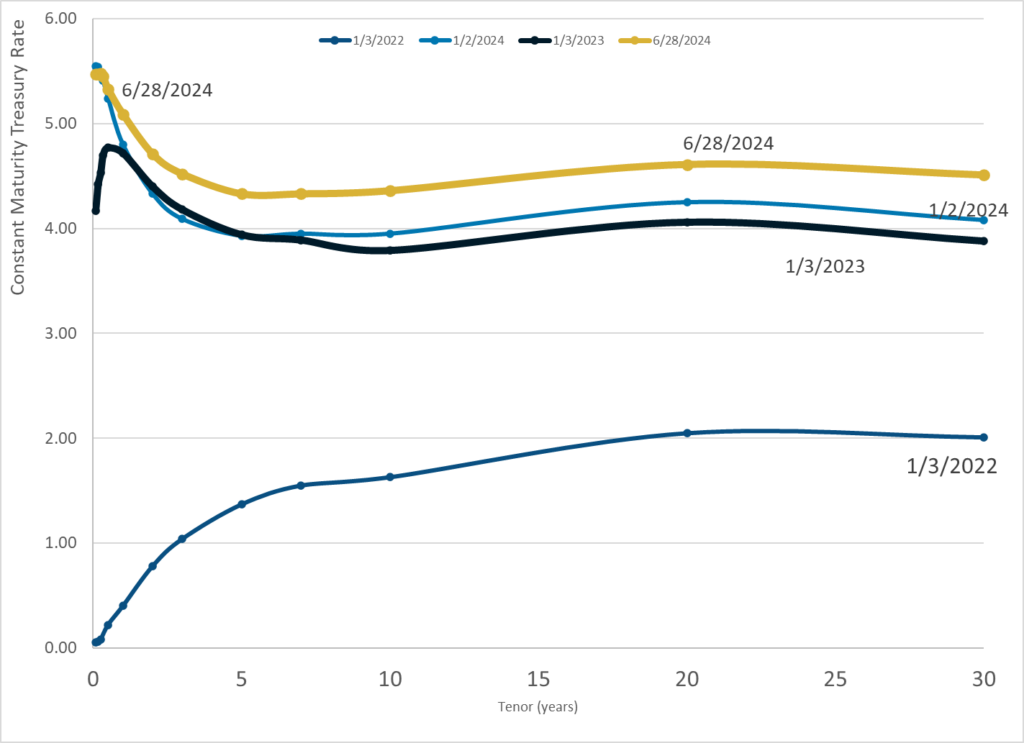

Publication Date: 28 June 2024

Publication Site: Treasury Department