Graphic:

Excerpt:

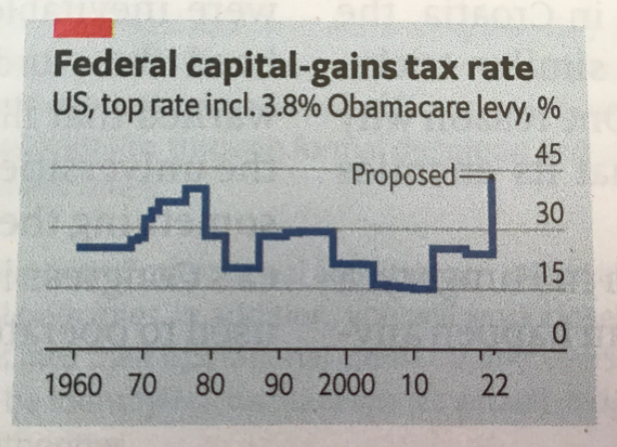

A lawmaker who helps shape federal tax legislation has indicated that he wants to keep wealthy families from using private placement life insurance to replace any federal tax loopholes that Congress closes.

Sen. Ron Wyden, D-Ore., the chair of the Senate Finance Committee, today announced that he has written to Prudential Financial, Zurich Insurance Group and the American Council of Life Insurers to get more information about the PPLI market, and the possibility that many PPLI policies may serve only to reduce the income taxes of families that rank in the wealthiest 1% of American families, not to provide genuine insurance.

“Is investment in PPLI products marketed to new or existing clients as a means to minimize or eliminate ordinary income, capital gains or estate taxes?” Wyden asks in the letters to Prudential and Zurich. “If so, please explain the legal basis for why these products help minimize or eliminate taxes.”

Author(s): Allison Bell

Publication Date: 21 Sept 2022

Publication Site: Think Advisor