Link: https://www.governforcalifornia.org/news/2023/12/1/our-most-expensive-failure

Graphic:

Excerpt:

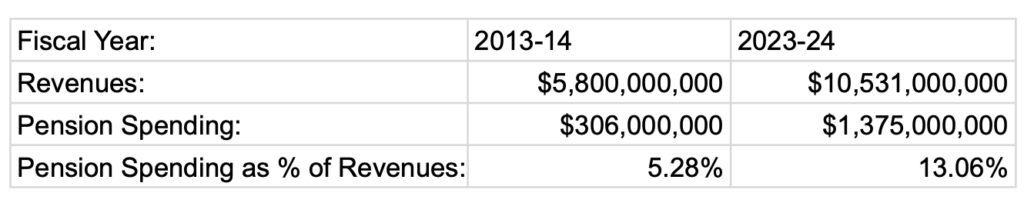

When launching GFC in 2011 it was my hope that we would see meaningful pension reform by 2020, but we have failed to achieve that objective and the negative consequences for public services and taxpayers have been enormous. As evidence, just look at the four-fold explosion in annual pension spending by the Los Angeles Unified School District this year compared to ten years ago:

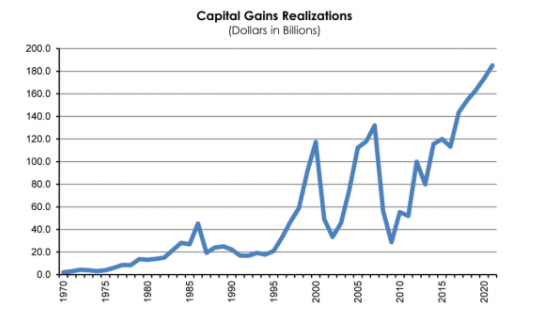

Pension spending will keep exploding. That’s because California’s public pension funds still have inadequate ratios of assets to liabilities despite more than $200 billion of pension contributions and a doubling of the stock market since 2013-14.

Pension reform is not the only thing I got wrong. I thought it would be even easier to terminate California’s unnecessary spending on other post-employment benefits (OPEB), especially after the creation of Obamacare and that program’s generous federal healthcare subsidies, but LAUSD alone is spending $365 million on OPEB this school year. Together, pensions and OPEB consume one of every six LAUSD dollars, leaving that much less for classrooms and salaries.

Author(s): David Crane

Publication Date: 1 Dec 2023

Publication Site: Govern for California