Link: https://www.city-journal.org/inflation-return-of-a-plague

Excerpt:

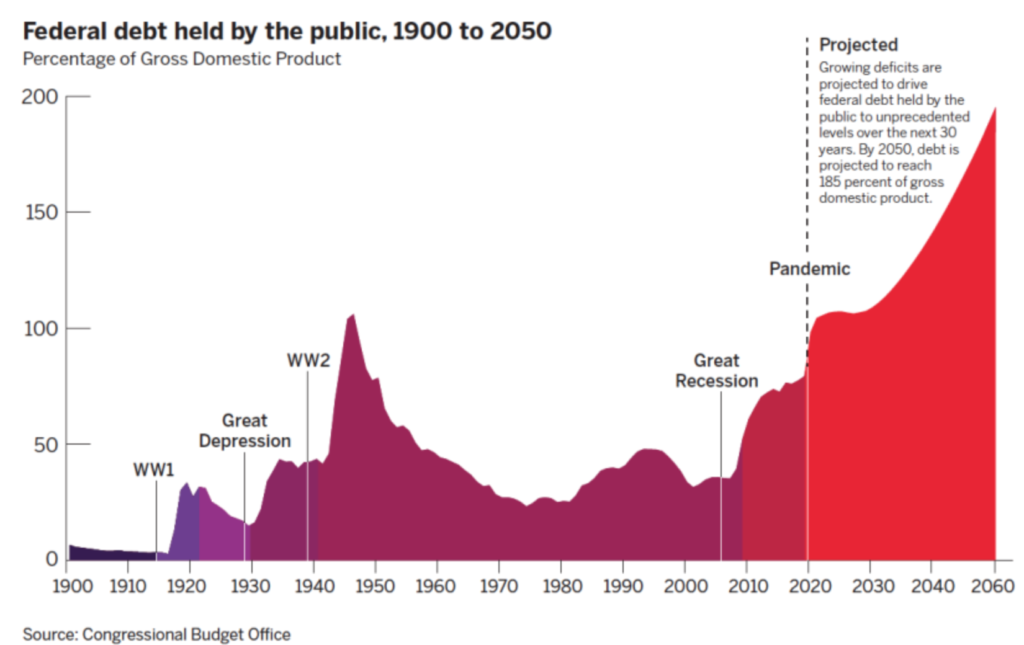

Experience has once again verified Friedman’s and Lucas’s theories, reducing to nothing the naïve propositions of Modern Monetary Theory, a recent delusion of the American Left. According to this unscientific, ahistorical theory, legislatures can control the production of money and distribute it in a way that satisfies all needs, with no destructive consequences from expanding the money supply. The question of reimbursing a gigantic public debt is not supposed to arise, because no one can force the government to pay what it owes. But this magical solution, adopted in part by Joe Biden, ignores the fact that public debt produces inflation and that a debt that is not repaid, as in the case of Argentina, eventually ruins the currency. All this was well known, at least by economists, so it is surprising that governments in America and Europe had not taken it into account of late. They have short memories. From the 1980s until recently, inflation had been constrained thanks to public policies inspired by Friedman—but policymakers had forgotten its threatening presence, as if it belonged only to the past. We can liken inflation with pathogens: smallpox has disappeared, but vaccination is what made it disappear; stop vaccinating, and the evil can return. In the 1980s, central banks helmed by Friedman’s disciples, such as Paul Volcker in the United States or Jean-Claude Trichet in Europe, raised interest rates and defeated inflation by reducing the money supply. Today, economic policymakers will need to apply the same remedy as in 1980. Central banks are working on this, but their conversion comes late; they have waited for inflation to establish itself before responding, a delay that will make the remedy more painful.

Author(s): Guy Sorman

Publication Date: 14 Jun 2022

Publication Site: City Journal