Graphic:

Excerpt:

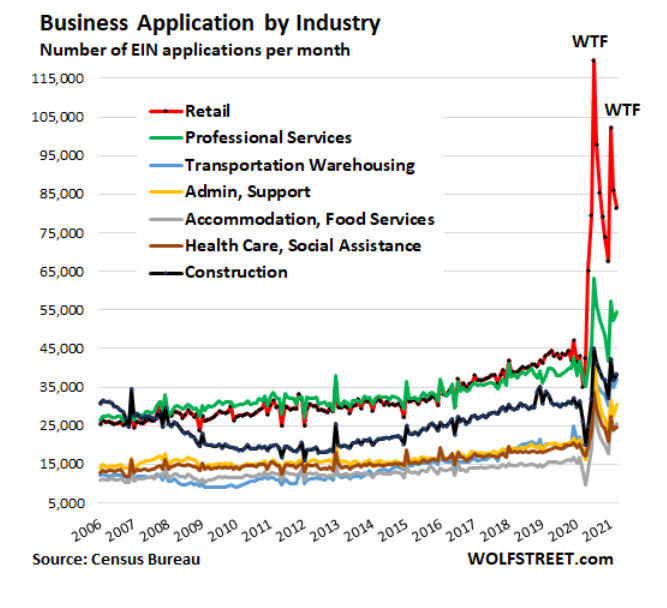

I don’t remember anything that has ever drawn so much fraud to itself, like an industrial magnet attracting ferrous scrap metal, as the federal government programs to support the unemployed and struggling businesses.

When it comes to this twin-spike in business applications, the forgivable Payroll Protection Program (PPP) loans and Economic Injury Disaster loans come to mind immediately – especially since the spike into July, and then the renewed spike this year, are timed with the two PPP generations.

Businesses that applied for the PPP loans had to submit documentation of wages paid over specified periods. The first-generation PPP program ended on August 8, 2020. The second-generation PPP program started this year and remains open.

The dates were structured so that it would be impossible by honest people to create a business entity after the announcement, pay wages for long enough to qualify for a PPP loan, and then apply for a PPP loan. Applicants had to submit historical wage documentation to the lenders whose job it was to check all this out.

Author(s): Wolf Richter

Publication Date: 16 April 2021

Publication Site: Wolf Street