Graphic:

Excerpt:

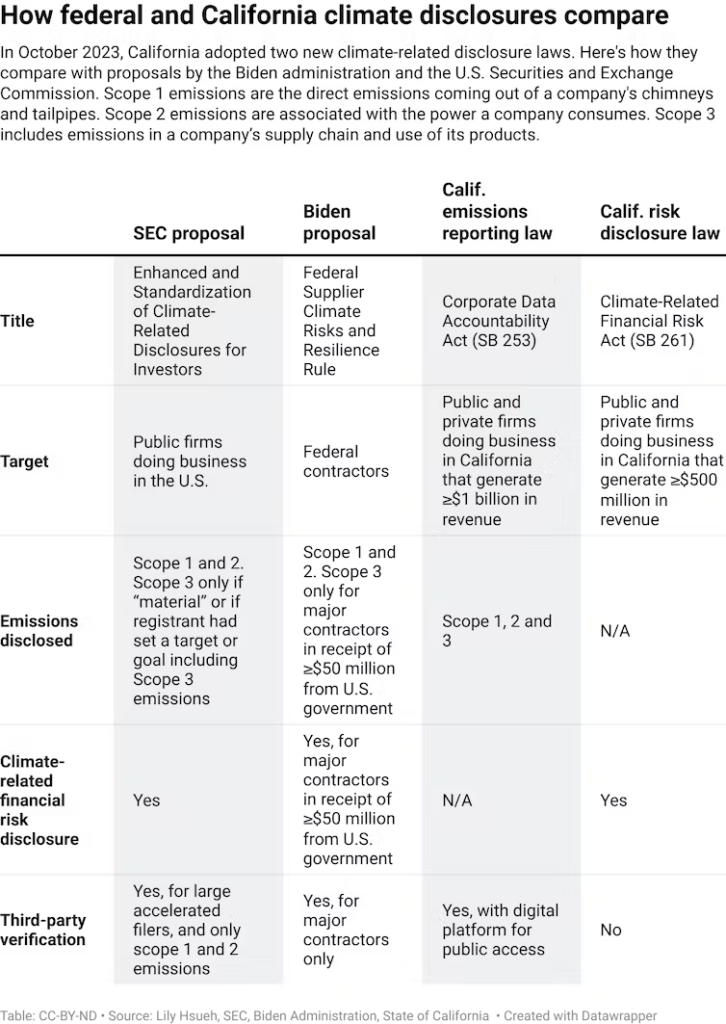

Many of the world’s largest public and private companies will soon be required to track and report almost all of their greenhouse gas emissions if they do business in California – including emissions from their supply chains, business travel, employees’ commutes and the way customers use their products.

That means oil and gas companies like Chevron will likely have to account for emissions from vehicles that use their gasoline, and Apple will have to account for materials that go into iPhones.

It’s a huge leap from current federal and state reporting requirements, which require reporting of only certain emissions from companies’ direct operations. And it will have global ramifications.

California Gov. Gavin Newsom signed two new rules into law on Oct. 7, 2023. Under the new Climate Corporate Data Accountability Act, U.S.- companies with annual revenues of US$1 billion or more will have to report both their direct and indirect greenhouse gas emissions starting in 2026 and 2027. The California Chamber of Commerce opposed the regulation, arguing it would increase companies’ costs. But more than a dozen major corporations endorsed the rule, including Microsoft, Apple, Salesforce and Patagonia.

Author(s): Lily Hsueh

Publication Date: 10 Oct 2023

Publication Site: The Conversation