Excerpt:

The Ohio State Teachers’ Retirement System cannot invest its way to a permanent COLA, Brian Grinnell, former chief actuary of the $97.3 billion pension fund, told Pensions & Investments.

Grinnell left the pension fund in May after more than 10 years as its chief actuary. In a Sept. 27 interview, he said his responsibilities were primarily to help STRS staff and the board understand the risks the pension fund has faced and help develop a forward-looking plan to make decisions with long-term outcomes in mind.

In his interview, he said, “I was not comfortable with the direction the plan was headed, and I didn’t feel like my continued participation would be positive.”

….

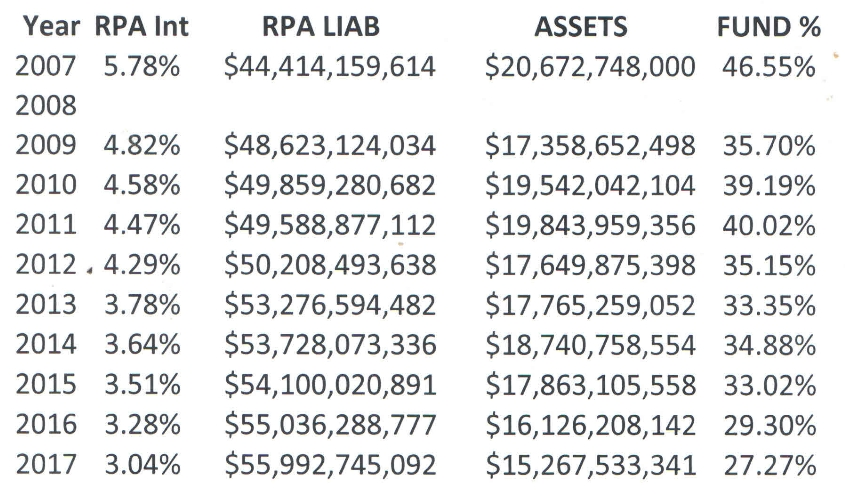

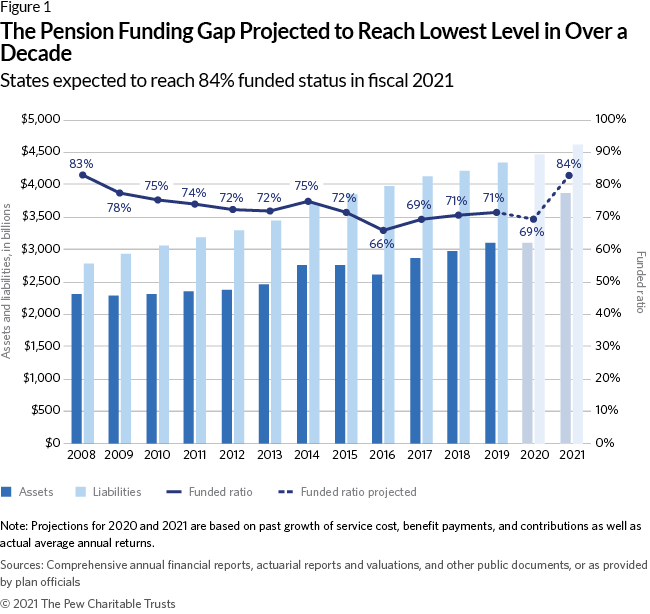

The pension reform law, SB342, was one of five laws that addressed funding issues at all five of Ohio’s state retirement systems and was drafted as a result of severe stock market declines that came from the Great Recession in 2008 and 2009. Among all the state systems, STRS was the worst off in 2012 with a funding ratio of 57.6% as of June 30 of that year. Additionally, the amortization period for the retirement system’s unfunded pension liabilities under the STRS defined benefit plan had become infinite — meaning that it would never become fully funded.

Grinnell said STRS has had to contend with the challenge of being an extremely mature pension fund: Essentially, there is more money being sent out to retirees receiving benefits now relative to the future contributions the pension fund can expect from current and future teachers.

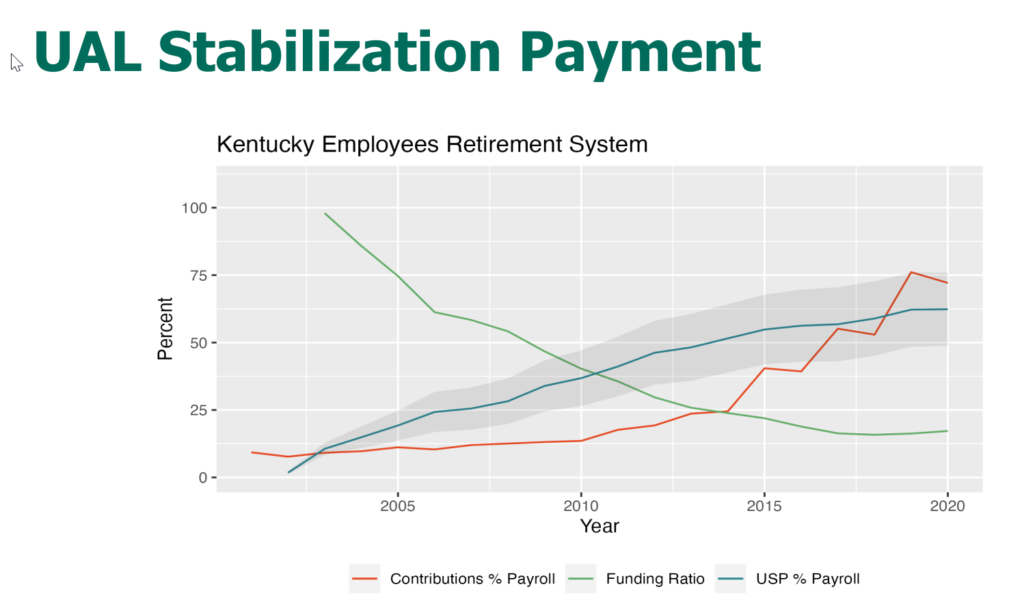

“Here’s where STRS is a little bit of an unusual situation because it is a fixed-rate plan,” Grinnell said, “so both the benefits and the contributions are essentially fixed by statute. So most plans, if they have a bad year in terms of investment performance, the contribution rate goes up the following year to fill that hole. That doesn’t happen at STRS.”

Grinnell said when a pension fund is both a mature plan and has that fixed-rate contribution and fixed benefits, it’s very difficult to recover from any kinds of market downturns. He noted that all five of Ohio’s state retirement systems have that fixed-rate structure.

“Most other public pensions do not have that kind of structure,” he said, “and I think that tends to work all right for an immature plan, a plan that’s growing and not paying out a lot of benefits relative to the contributions.”

Author(s): Rob Kozlowski

Publication Date: 2 October 2024

Publication Site: Pensions & Investments