Graphic:

Excerpt:

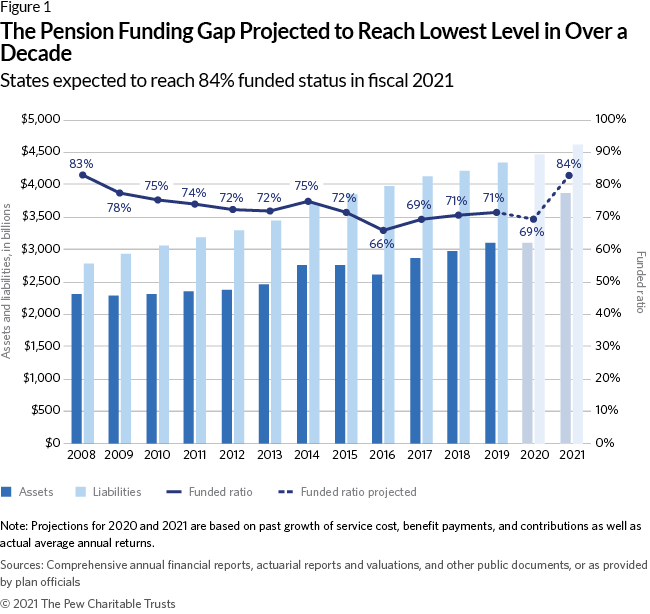

Since the fiscal 2019 reporting period ended, an unprecedented $5 trillion in federal stimulus and other government interventions have buoyed financial markets and strengthened plan balance sheets.2 As a result, state plans earned returns of over 25% in fiscal 2021—a highwater mark not seen since the 1980s. Pew estimates that total unfunded liabilities dropped below $1 trillion by the end of fiscal 2021, which would push state plans to be more than 80% funded for the first time since 2008. (See Figure 1; for more detail, see also Appendix G.) The significant improvement in plans’ fiscal position is due in large part to dramatic increases in employer contributions to state pension funds in the past decade, which boosted assets by more than $200 billion. Since 2010, annual contributions to state pensions have increased by 8% annually, twice the rate of revenue growth. And for the 10 lowest-funded states, the yearly growth in employer contributions averaged 15% over this period. As a result, after decades of underfunding and market losses from risky investment strategies, for the first time this century states are expected to have collectively achieved positive amortization in 2020—meaning that payments into state pension funds were sufficient to pay for current benefits as well as reduce pension debt.

An increase in pension contributions of the size seen over the past decade signals a shift in budget priorities by state policymakers and a recognition that the costs of postponing obligations are untenable if left unaddressed. Although this has improved the outlook for state pension plans, it has also crowded out spending on other important programs and services and left states with less budgetary space to sustain future rises in pension payments.

Author(s): Greg Mennis, David Draine

Publication Date: 14 Sept 2022

Publication Site: Pew Trust