Graphic:

Excerpt:

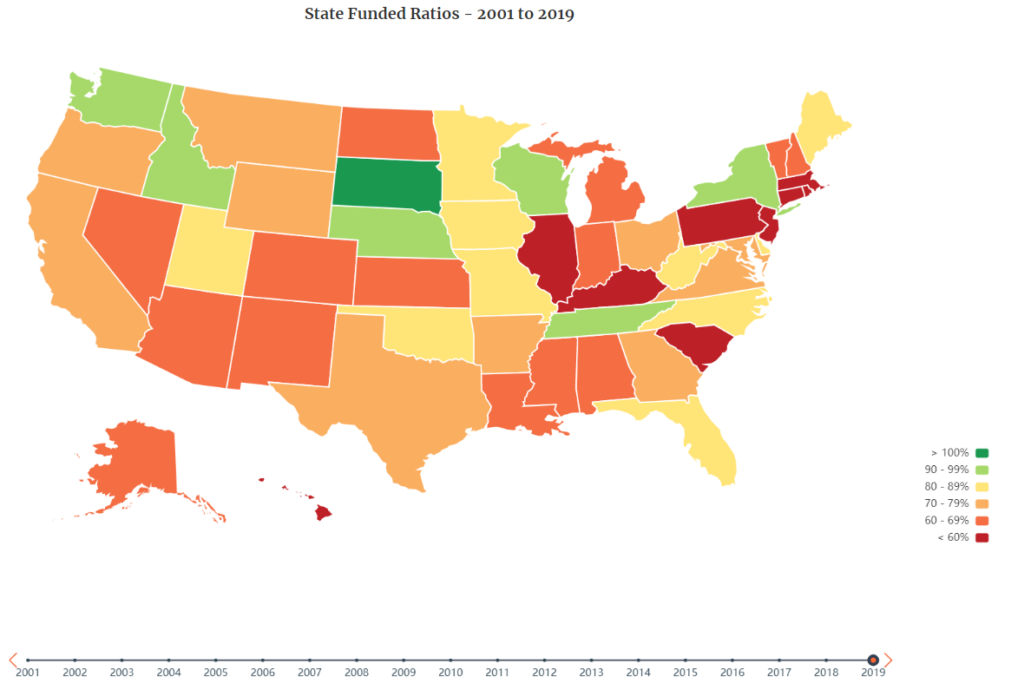

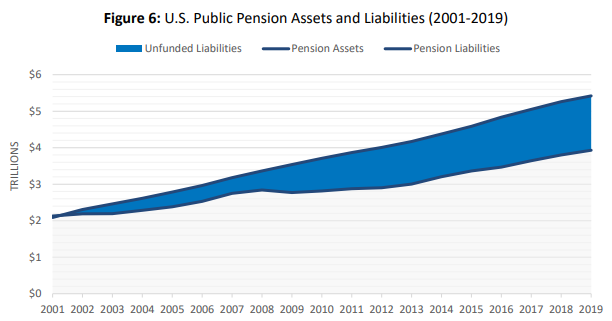

This Report addresses the widespread underfunding of the retirement systems in the nation’s state and local governments. It begins by summarizing some past, current, and probable future trends of unfunded pension liability at the state and local levels. It describes the scope of unfunded pension debt in various state and local jurisdictions and calculates both their aggregate debt and per capita debt, based on states’ self-assessments; it then incorporates a variety of other measurements of unfunded liability. Results from many of those other measures suggest that the magnitude of unfunded pension liability may be considerably larger than previously indicated.

This Report then describes and analyzes the inherent dynamics of government retirement systems that have produced this underfunding, finding that there are a variety of pressures and processes within these retirement systems that can operate to the disadvantage of employees, beneficiaries, and the public generally. It then summarizes attempts to reform pension systems in several states. Some of those states now have relatively sound retirement systems; others less so. It then contrasts the requirements that govern most private-sector pensions to the relatively relaxed regulatory regimes of state and local government pensions, concluding that adoption of rules similar to those governing private sector requirements would likely have positive consequences if implemented for state and local government pension plans and their beneficiaries.The nation’s experience with unfunded pension liability at the state and local government levels may provide some lessons for policymakers; this Report concludes with several recommendations in this area.

Author(s): Daniel Greenberg: Senior Policy Advisor in the Veterans’ Employment and Training Service; Jay Sirot: Special Assistant in the Office of the Assistant Secretary for Policy

Publication Date: 15 January 2021

Publication Site: Benefits Link