Link: https://www.genre.com/knowledge/publications/2023/april/ri23-1-en

Graphic:

Excerpt:

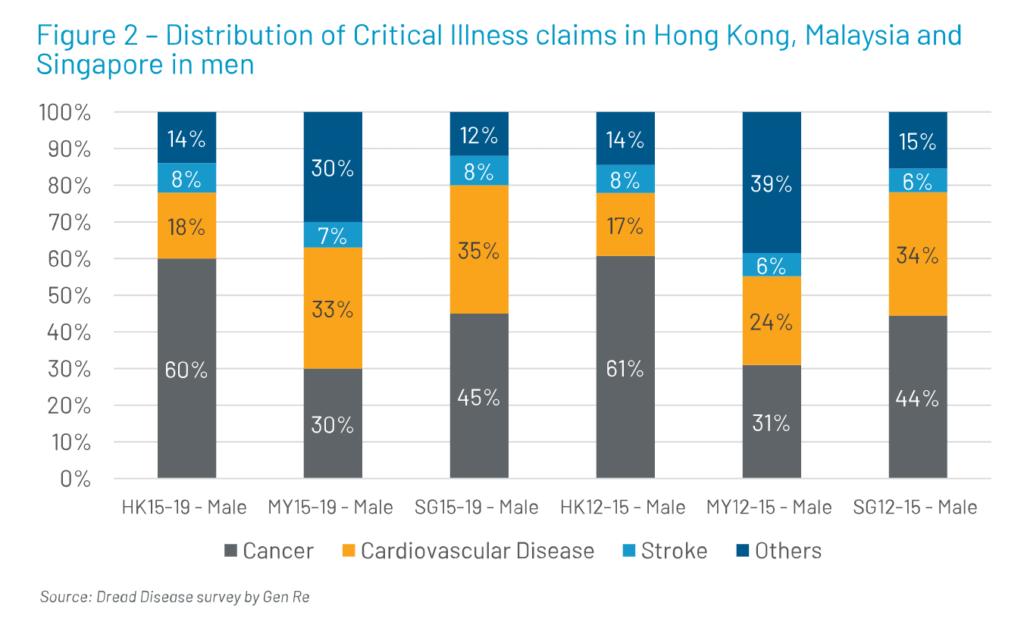

Figure 2 shows the incidence of cardiovascular disease and stroke in the male population.

This was derived from Gen Re’s Dread Disease experience study covering the period 2012–2015 and 2015–2019 for Hong Kong, Singapore and Malaysia. As per the analysis from the leading insurance companies of the respective market, 43% of men in Singapore, 40% of men in Malaysia and 26% of men in Hong Kong had critical illness claims due to cardiovascular disease and stroke between 2015 and 2019. When compared with the 2012–2015 analysis, it was noted that there is an increase in claims by 3% in Singapore, 10% in Malaysia and 1% points in Hong Kong, which may be associated with overweight and obesity or simply an older portfolio.

Due to increases in body weight and medical complications, insurance companies may be confronted with increasing claims which will impact their profitability. To mitigate this cost, insurance companies may have to increase the premium so as to commensurate with this rising claim cost. This increase in price will impact on the healthy population.

Health insurance premium has doubled in the past 10 years, but it is unclear how much of this premium is sufficient to cover the financial burden of the obesity pandemic. The evaluation of existing and developing new health coverages related to obesity-related conditions is an important consideration for the profitability of the health insurance providers.14

Author(s): Bharath UP

Publication Date: 12 April 2023

Publication Site: Gen Re